Retailer Report: What to Expect This Cyber Monday

For retailers, Cyber Monday marks the start of the peak shopping season and a welcome sales boost.

But holiday sales this year will be impacted by worsening economic conditions involving a looming recession, dampened consumer demand, and continued bottlenecks in the supply chain. Early trends and new Q4 predictions can help shed some light on what we should expect in the aftermath of Cyber Week.

Supply-side recession concerns

Cyber Monday discounts always lead to an increase in shopping activity, but consumer demand will likely soften as the Federal Reserve attempts to slow the economy.

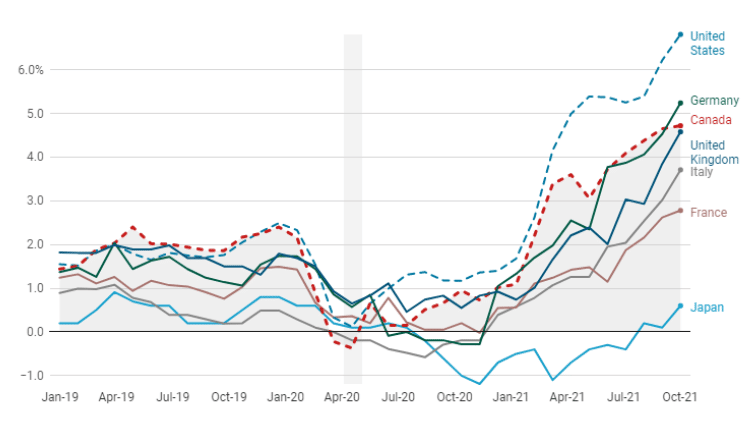

Inflation continues to stay hot, even with aggressive rate hikes meant to restrict the supply of money and reduce price hikes. The consumer price index, a traditional inflation measure, rose 0.4 percent month-to-month and a whopping 8.2 percent over the last twelve months, far above the Fed’s target inflation rate of 2 percent.

| Source - Inflation Data |

And inflation continues to hit consumers where it hurts through core commodities and household goods. Interest rates are also expected to reach highs of 4.6 percent.

Consumers will feel the squeeze this holiday season.

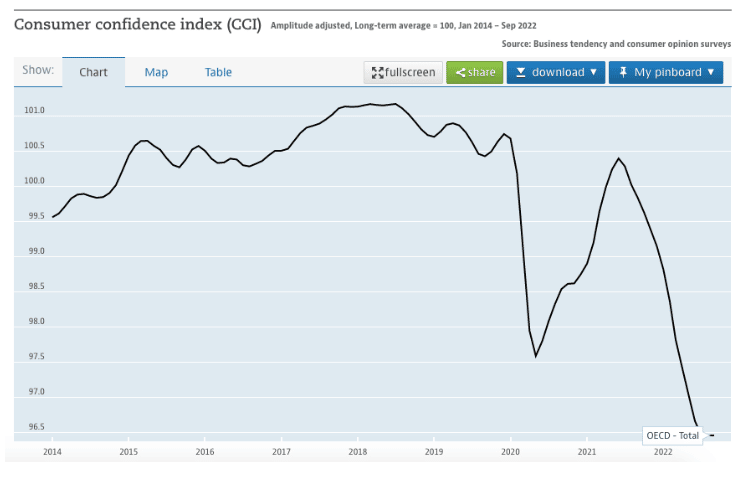

For now, many are leaning on credit card debt as a solution (total U.S. credit increased in August by $32 billion). Demand should fall as the Fed interest rate hikes exert downward pressure, but extended reliance on credit cards could lead to an increase in friendly fraud chargebacks. Instances of friendly fraud due to buyer’s remorse and intentional misuse, so-called liar-buyers, are likely to jump as recession fears build and disposable income shrinks. Consumer confidence has plummeted with what looks like an inevitable recession, and as the 2008 financial crisis and the Covid downturn show, that can lead to spikes in false claims and less-than-honest consumer disputes.

| Source |

Fulfillment and supply chain issues

While the Federal Reserve attempts to quell inflation from a demand-side perspective, it is a mere band-aid to supply-side woes. Until fiscal policy can help sort out lingering logistics problems associated with pandemic disruptions, failed delivery of goods and shipment bottlenecks will plague merchants this holiday season.

At one point in early 2022, nearly 20% of all global container vessels sat in congested ports. And while domestic transportation appears to have improved, it has not returned to pre-pandemic levels. Complications now prevent supply and demand from equalizing. New labor strikes in Felixstowe, U.K., among other port locations, have affected deliveries of goods to mega-retailers. Ship service cancellations have increased as ocean carriers cite port congestion, labor disruptions, and inflation as chief concerns. Container wait times are unpredictable as cargo delays lead to a lack of available containers.

Other world events continue to contribute to a fragile ecosystem. A war in the Ukraine, zero-Covid policies in China, and a trucker shortage, all lead to increased supply chain complications.

As a result, chargebacks related to “merchandise not received” may increase this holiday season. False claims associated with undelivered goods may also spike with the holiday season as consumers take advantage of a stop-go fulfillment environment. And the longer delivery and supply chain networks remain clogged, the more strain placed on consumer-to-business relations, ultimately impacting chargeback fraud related to customer dissatisfaction.

The silver lining? The aggressive monetary tightening of the Fed will soften demand, and that will help supply chain issues. It might spark a hard landing into a recession this Christmas, but that should help reduce chargebacks related to shipping issues.

Risk exposure and online discounts

The holidays bring a ready and welcome boost to retail sales, but the overall forecast is less than rosy. Adobe Analytics projected a minimal growth rate of 2.5% in online sales over November and December, the smallest figure since the report's inception in 2015 and a far cry from last year's increase of 10%.

Such headwinds are closely related to current economics as retailers attempt to reduce expenses and offload inventory before a recession. Everyone wants to protect their margins and maintain flexibility in response to a possible downturn. But that is leading to a reduction in marketing spend coupled with an early and lengthy season of sales discounts (Adobe predicts record high discounts upwards of 32 percent for bargain deals this season). Good price deals may entice buyers, but inflation-adjusted prices will still curb sale enthusiasm. Discount-fatigued consumers, faltering demand, and inflation-boosted prices feel like the perfect storm designed to lower Cyber Monday sales volume growth.

Cost-efficiency solutions can provide relief as profits tighten due to the cost of inflation. Automation can help control rising input costs. Digital solutions that expedite the movement of goods (e.g. smaller haulers) will help with supply-side inventory. Chargeback mitigation solutions like Justt can handle the chargeback lifecycle with fewer costs.

With low growth figures, those who can leverage solutions to cut costs and expand margins will find themselves in a better position once Q4 ends.

Managing the holiday sales (chargeback) frenzy

Even with muted digital sales, experts still predict remarkable resiliency for Cyber Monday. The biggest shopping day of the year is estimated to drive a record $11.2 billion in spending at a 5.1% growth rate year-over-year. Expectations are low yet positive, especially considering consumers have already spent at an 8.9% growth rate through 2022.

Of course, a strong Cyber Monday means we can expect a similar number of chargebacks this year compared with last. A reduction in shipping-related chargebacks should be counterbalanced by overall growth in friendly fraud as more and more consumers became familiar with misusing the chargeback mechanism to get their money back while often keeping the merchandise.

Merchants should also expect a post-holiday increase in customer disputes. In past years, over 40 percent of annual chargebacks occurred in Q1, a hangover effect from Q4 peak holiday season purchase activity. The frenzy over last-minute sales can often result in buyer’s remorse and other intentional chargeback fraud. And the sudden increase in card-not-present sales offers the perfect background for fraudsters to enact payment fraud. Even the influx of holiday orders can lead to merchant error or failed fulfillment, all of which lead to rising chargeback numbers.

Merchants should take steps to manage the rise in chargeback volume before the post-holiday surge overwhelms.

The bottom line

Cyber Monday will continue to provide robust sales for retailers, even as existing supply-side recession worries, high inflation, and softened consumer demand temper sales expectations for the overall holiday season. In the aftermath of the holiday season, expect a high Q1 chargeback volume. Supply chain worries may exacerbate shipment-related chargebacks, while consumers may resort to friendly fraud as consumer debt increases and prices rise. Retailers should invest in cost-efficiency solutions to limit risk exposure, especially as year-over-year growth rates remain muted throughout the downturn.

Need support navigating the current economic climate? Talk to Justt to discuss our success-based fees and how we can help you recover revenues lost to chargeback fraud.