What is an acquirer?

An acquirer, also known as an acquiring bank, is a financial institution that processes credit and debit card payments for merchants. It processes transactions, settles funds, and serves as an intermediary between merchants, card networks, and issuing banks. Acquirers provide the necessary infrastructure and services for businesses to securely handle electronic payments, playing a vital role in the payment processing ecosystem. The acquirer usually charges fees for these services, typically including a percentage of the transaction amount and a fixed fee per transaction.

What merchants need to know about acquirers:

- Acquirers enable merchants to accept various payment methods, including credit and debit cards, across different channels (e.g., in-store, online, mobile).

- In addition to payments, they will often provide secure payment gateways, fraud detection tools, and ensure compliance with industry standards like PCI DSS, which is crucial for protecting sensitive financial data.

- Acquirer fees can significantly impact a merchant’s bottom line. These typically include a percentage of each transaction and a fixed per-transaction fee, varying among providers.

- The speed at which acquirers settle funds affects a merchant’s cash flow. Settlement times can vary from 1-3 business days, depending on the acquirer.

- Some acquirers specialize in certain industries (e.g., e-commerce, travel, gaming) and offer tailored solutions, reporting tools, and support services to meet specific sector needs.

Understanding Acquirers and Their Role in the Online Payments Ecosystem

How do Acquirers work?

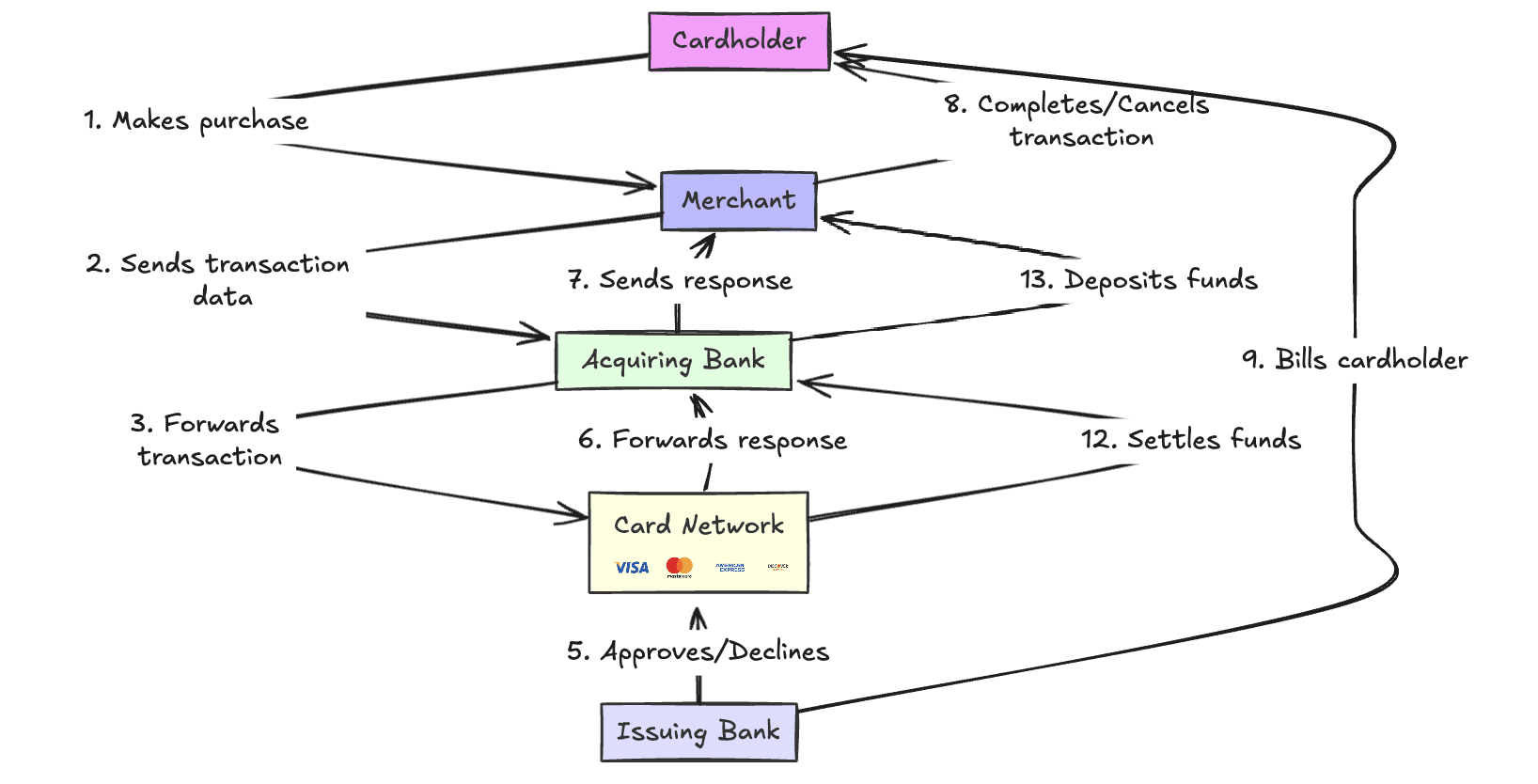

An acquirer forms a relationship with a merchant, providing them with the necessary tools and services to accept card payments. Here’s a simplified overview of how acquirers facilitate transactions between online sellers and buyers:

- Transaction initiation: When a customer makes a purchase, the transaction details are sent from the point of sale (whether physical or online) to the acquirer.

- Authorization request: The acquirer forwards the transaction details to the appropriate card network (e.g., Visa, Mastercard).

- Issuing bank verification: The card network routes the request to the customer’s issuing bank, which checks for sufficient funds and approves or declines the transaction.

- Response relay: The approval or decline message is sent back through the same chain to the merchant.

- Settlement: At the end of each business day, the acquirer batches all approved transactions and initiates the process to transfer funds from the issuing banks to the merchant’s account.

- Fund deposit: The acquirer deposits the funds into the merchant’s account, usually within 1-3 business days, minus any applicable fees.

Throughout this process, acquirers also monitor for fraudulent activity and ensure compliance with industry standards and regulations.

Why are acquirers needed? Why are they needed?

Acquirers perform several crucial functions in the payment processing ecosystem:

1. Payment processing: They handle the technical aspects of transmitting and authorizing card transactions.

2.Merchant onboarding: Acquirers evaluate and set up new merchants to accept card payments.

3.Risk management: They assess and monitor merchant risk profiles to prevent fraud and minimize financial exposure.

4.Compliance oversight: Acquirers ensure merchants adhere to card network rules and regulations, including PCI DSS standards.

5.Fund settlement: They manage the process of transferring funds from card issuers to merchant accounts.

6.Chargeback handling: Acquirers manage the chargeback process, acting as an intermediary between merchants and issuers.

7.Technology provision: Many acquirers offer point-of-sale systems, payment gateways, and other necessary hardware or software.

8.Reporting and analytics: They provide merchants with transaction data and insights to help manage their businesses.

9.Customer support: Acquirers offer technical and operational support to their merchant clients.

10.Value-added services: Many acquirers provide additional services such as loyalty programs, currency conversion, and fraud prevention tools.

Overall, acquirers have an integral role in enabling businesses to accept and process card payments efficiently and securely.

Examples of Acquirers, Globally

North America:

- Chase Merchant Services

- Bank of America Merchant Services

- Fiserv (formerly First Data)

- Global Payments

- Elavon

- Square

- Stripe

- PayPal (through Braintree)

- Worldpay (now part of FIS)

- Adyen (Dutch company with significant US presence)

Europe, Middle East, and Africa (EMEA):

- Barclaycard

- Worldline

- Nets Group

- Adyen

- Wirecard (Note: faced significant issues in 2020)

- SIX Payment Services

- Elavon Europe

- Checkout.com

- PPRO

- Credorax

It’s worth noting that many of these acquirers operate globally, and the payments landscape is continually evolving through mergers, acquisitions, and new entrants to the market. Some of these companies may offer both acquiring and other payment services.

Acquirers vs. Payment-Service Providers (PSPs) vs. Payment Facilitators

Acquirers, Payment Service Providers (PSPs), and Payment Facilitators (PayFacs) are important yet distinct entities in the payment processing ecosystem. As mentioned previously, acquirers, or acquiring banks, handle credit and debit card transactions for merchants, manage risk, and settle funds through direct relationships with card networks.

PSPs serve as intermediaries between merchants and multiple acquirers, offering a single integration point for accessing various payment methods. They streamline payment processing by managing relationships and providing services like fraud prevention.

PayFacs, a type of PSP, onboard sub-merchants under a master merchant account, allowing quick payment setup. They assume more risk by being responsible for sub-merchants’ compliance.

Though these roles differ, there can be overlap. Some large PSPs may also function as acquirers, and vice versa. The choice among them depends on a merchant’s specific needs, industry, and size.

Acquirer vs. Issuer

An acquirer and an issuer (or issuing bank) each have differing roles in the payment ecosystem.

In contrast to the acquirer, the issuer is the bank or financial institution that provides credit or debit cards to consumers. For example, JPMorgan Chase & Co. in the United States and Barclays in the United Kingdom. Issuing banks hold the consumer’s account and are responsible for authorizing transactions, billing the cardholder, and ultimately collecting payment from them. The issuer bears the risk of the cardholder defaulting on payments and works with the acquirer to settle transactions.

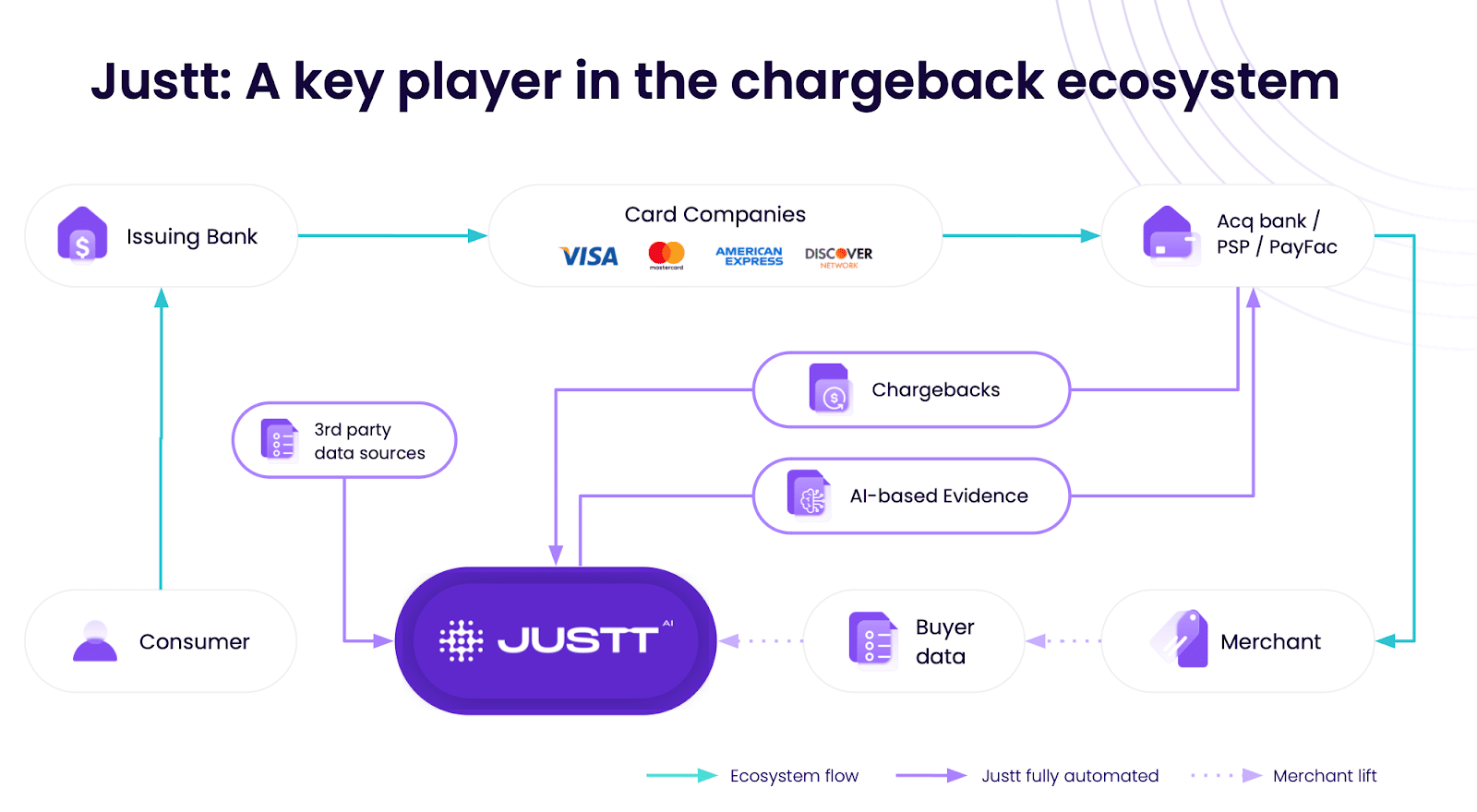

How does Justt work with Acquirers?

When chargebacks are routed through the card networks to a merchant’s acquiring bank, the relevant information is transmitted to their dispute management system by the PSP or appears in their payment processor’s backend. At the same time, we retrieve this information into our platform and pull in the chargeback data, then submit evidence back into the acquiring network on their behalf, particularly for fraud-related cases. This process happens as soon as we receive the chargeback information.

When it comes to managing chargebacks, Justt offers a robust solution that seamlessly integrates with many types of acquirers. Justt automates the chargeback dispute process, helping merchants efficiently handle disputes, minimize revenue loss, and maintain focus on growing their business.

Whether you’re in retail, e-commerce, or any other industry, choosing an acquirer that aligns with your specific needs, combined with Justt’s chargeback management, can be a critical factor in your success. Speak with us today to start securing your hard-earned revenue.