What is an ACH Dispute?

An ACH dispute occurs when a party involved in an Automated Clearing House (ACH) transfer challenges the legitimacy of the transaction. These disputes are usually initiated when account holders contact their bank to report unauthorized or incorrect electronic fund transfers from their accounts. Unlike credit card chargebacks, ACH disputes are governed by the National Automated Clearing House Association’s (Nacha) rules and guidelines, which typically prevent merchants from contesting outcomes or submitting representments.

Nacha Money: How ACH Disputes Work

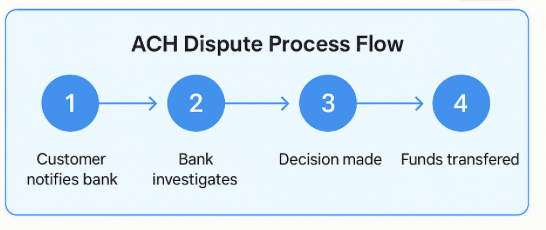

The ACH dispute structure resembles the chargeback process in some ways, but differs considerably in others – limiting chances for appeal or evidence submission. First, the customer informs their bank about their intent to dispute an illegitimate transaction. The customer’s bank then notifies the merchant’s bank and initiates an investigation by gathering relevant information, such as transaction details and authorization records. This sometimes – but not always – involves requesting evidence from the merchant’s bank.

Based on the investigation findings, the customer’s bank determines whether the dispute is legitimate. If deemed valid, the bank typically reverses the transaction and credits funds back to the customer’s account. The merchant’s account is then debited the disputed amount plus any applicable fees (usually $5-35).

Unlike credit card disputes, ACH disputes do not permit merchants to appeal decisions that result in a transaction reversal. Instead, merchants must work directly with customers to resolve the situation and potentially secure a new payment.

Valid vs Invalid Reasons for ACH Disputes

Nacha’s rules have established a limited number of reasons for legitimate disputes, while other reasons are classified as illegitimate and should result in a dispute being overturned. Valid reasons for Nacha disputes include:

- Unauthorized Transactions: The customer did not authorize the transaction or revoked authorization before the removal of funds.

- Incorrect Amounts: The amount debited differs from the authorized amount.

- Incorrect Timing: The transaction was processed before the authorized date.

- Duplicate Transactions: The customer was charged multiple times for the same transaction.

- Non-Receipt of Goods or Services: Payment was made, but the promised goods or services were not delivered or not as described.

- Reversal Errors: A requested reversal was processed incorrectly or not at all.

- Inaccurate Account Information: The transaction used incorrect or outdated account details.

A few common reasons for illegitimate Nacha disputes include:

- Buyer’s Remorse: When customers spend beyond their means and regret making a transaction, they may initiate an illegitimate dispute rather than seek a refund.

- Delayed Delivery: Delayed deliveries may be frustrating, but as long as they don’t violate preagreed terms and conditions, they are not legitimate cause for a dispute.

- Forgetting Direct Debits: Customers may forget about direct debits unless they receive frequent email reminders. This can lead them to initiate illegitimate disputes.

- Failure to Recognize: Unclear billing descriptors are one of the most common reasons for ACH disputes, as they can lead customers to believe a legitimate transaction was unauthorized.

The Challenges of ACH Chargeback and Dispute Management

While accepting ACH payments may provide merchants with lucrative new revenue streams, the resulting disputes pose several challenges that can exceed those of standard chargebacks.

No Merchant Appeal

Unlike chargebacks, ACH disputes do not guarantee merchants an opportunity to present their case. While merchants are typically notified of the disputes before funds are removed from their accounts, they will only be asked for evidence in specific circumstances, such as for claims of “non-receipt of goods”, or “item not described”. Furthermore, any decision by the customer’s bank is final, and requires litigation to reverse.

Revenue Protection

ACH disputes can lead to substantial revenue losses beyond the disputed transaction amount. When a customer successfully disputes an ACH transaction, merchants lose not only the payment but also the product or service, any delivery fees, and incur additional fees ranging from $5 to $35 per dispute.

Unfamiliar Regulations and Evidence Requirements

ACH disputes are governed by Nacha’s Operating Rules and Guidelines, which specify timeframes, protocols, and evidence requirements for handling these contested transactions that differ substantially from those of card schemes. This means that merchants need to develop separate workflows for handling ACH disputes, which can overwhelm internal teams already spread thin by chargeback demands.

How to Prevent ACH Disputes

There is nothing merchants can do to prevent ACH disputes completely – most cases result from intentional friendly fraud, which bypasses preventative systems designed to permit legitimate transactions, even if they are illegitimately disputed later. However, a combination of several best practices can reduce the overall amount of disputes you face, especially those resulting from true fraud and unintentional friendly fraud.

Preventing unintentional friendly fraud requires making the entire purchasing process as transparent as possible, removing any potential for customer confusion. Effective strategies include clear billing descriptors, email reminders for recurring payments, highlighting returns and cancellation policies, and maintaining accessible customer service channels.

Let Justt Fight the Disputes You Can Win

Although ACH disputes limit merchants’ ability to submit evidence in their defense, the vast majority of disputes arise from credit card chargebacks – which merchants are given every chance to fight and win.