What is a billing descriptor?

A billing descriptor is a piece of identifying text that appears on a cardholder’s credit or debit card statement, providing information about a specific transaction. This short description typically features just the merchant’s name but may include additional details about the purchase. Billing descriptors serve as an important record and reminder of the cardholder’s transaction, helping them recognize and validate charges on their statement. They generally range from 20-25 characters, with the exact length varying depending on the issuing bank.

Types of billing descriptors

Soft vs. Hard Descriptors:

Soft descriptors appear on a cardholder’s online statement immediately after their bank authorizes a transaction. They serve as temporary placeholders, noting pending transactions in progress. Soft descriptors are often accompanied by the word “pending” or a similar phrase until the transaction is settled.

Hard descriptors are the permanent merchant billing information that replaces soft descriptors once a transaction is settled. This process typically takes a few days. Hard descriptors appear on the cardholder’s final statement along with the settled transaction amount.

Static vs. Dynamic Descriptors:

Static descriptors remain consistent for all transactions from a particular merchant. They typically include only the merchant’s name but may include their email, phone number, or other fixed information. Static descriptors are most suitable for businesses offering a single product or service, where additional transaction details aren’t necessary for customer recognition.

Conversely, dynamic descriptors can be programmed to respond with a different descriptor for each transaction. They allow merchants to include specific information about the purchase, such as the product name or order number. Dynamic descriptors provide cardholders with more context about their transactions, helping to prevent the chargebacks that may arise from unrecognized transactions.

Billing descriptors vs payment reference numbers

While billing descriptors and payment reference numbers both appear on card statements, they serve different purposes. Billing descriptors are designed to help cardholders recognize and remember transactions, using familiar words and business names. In contrast, payment reference numbers are unique identifiers consisting of random letters and numbers, primarily used for internal transaction tracking.

Payment reference numbers don’t provide cardholders with information about what they purchased or which business they transacted with – that’s the role of the billing descriptor. However, cardholders can use payment reference numbers when communicating with their bank about specific transactions.

Why are billing descriptors important for merchants?

Clear billing descriptors help cardholders easily identify legitimate transactions, reducing the likelihood of ‘friendly fraud’ chargebacks that may arise when misleading descriptors lead cardholders to dispute legitimate charges.

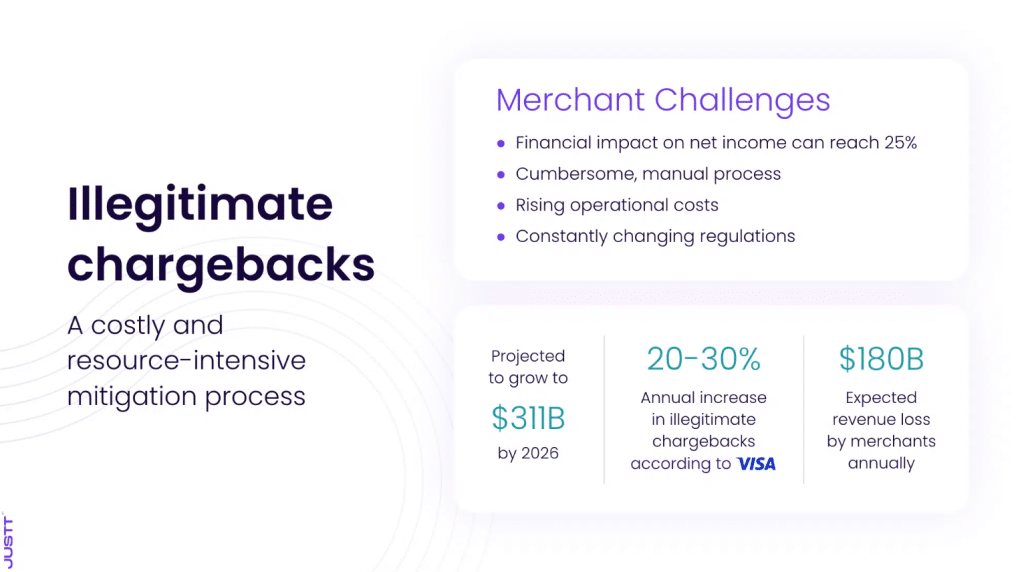

High chargeback rates can damage a merchant’s reputation with payment processors and card networks, potentially leading to higher fees or even account termination. Furthermore, they can take a devastating toll on profits, sometimes costing merchants up to 25% of net income. Traditional chargeback solutions are also time-intensive, requiring administrative labor that prevents employees from focusing on strategic business concerns. Informative billing descriptors are an important line of defense against illegitimate chargebacks.

Consistent and clear descriptors also contribute to a transparent purchasing experience, which fosters customer trust. This transparency can significantly improve customer relations and reduce inquiries about unrecognized charges. Finally, billing descriptors may serve as a tool for brand reinforcement, acting as a touchpoint for brand recognition with each transaction.

How to create effective billing descriptors to prevent chargebacks

To create effective billing descriptors that help to prevent chargebacks, merchants should follow these best practices:

1.Use Recognizable Names: Ensure the descriptor includes a name that cardholders will easily recognize – preferably your “doing business as” (DBA) name rather than a legal entity name. This is crucial because customers are more likely to remember the name they interacted with during the purchase process.

2.Include Contact Information: If space allows, include a customer service phone number or website URL. By giving customers a direct line of communication, you can often resolve issues before they escalate to disputes.

3.Be Specific: Dynamic descriptors tend to be more effective for preventing chargebacks. Use specific transaction details like product names or order numbers to avoid confusion regarding transactions. This additional context can jog a cardholder’s memory about a purchase they might otherwise have forgotten.

4.Avoid Abbreviations: Unless necessary due to character limits, avoid abbreviations that might confuse cardholders. While it might be tempting to squeeze in more information by using abbreviations, this can often lead to more confusion and potential chargebacks.

5.Test Your Descriptors: Regularly review how your descriptors appear on different card statements to ensure clarity and recognition. This is important because descriptor appearance can vary between different card issuers and payment processors. What looks clear on one statement might be truncated or formatted differently on another.

6.Use Clear Language: Avoid industry jargon or internal codes that cardholders won’t understand. Remember that your customers may not be familiar with industry-specific terms or your company’s internal product codes. Always opt for language that is easily understood by the average consumer.

7.Update Promptly: If you change your business name or structure, update your descriptors immediately. Failing to update your descriptors after a business change can lead to a surge in chargebacks as customers fail to recognize the new name on their statements.

What to do when effective billing descriptors are not enough?

While optimizing billing descriptors is a crucial step in preventing chargebacks, it’s far from a complete solution. Illegitimate chargebacks will still occur due to reasons including intentional first-party fraud, buyer’s remorse, or dissatisfaction with products and services. When chargebacks do happen, merchants need an effective strategy to fight them and recover lost revenue.

This is where modern chargeback management solutions like Justt prove essential. Justt’s platform leverages advanced machine learning to collect and collate relevant transaction data from multiple sources, including PSPs, third-party databases, and merchant systems. Justt’s Dynamic Arguments feature transforms this data into tailored evidence documents for each chargeback case, featuring arguments optimized according to the specific reason code, card scheme, and issuing bank involved.

Justt’s AI system continuously learns from outcomes, refining its approach to improve win rates over time – and typically doubling chargeback win rates within a few months. This solution is infinitely scalable, allowing it to handle fluctuating chargeback volumes without requiring additional staff or resources, and permitting your employees to focus on core business activities rather than dispute management.

By combining optimized billing descriptors with Justt’s advanced chargeback management solution, merchants can create a comprehensive defense against chargebacks stemming from first-party fraud. This dual approach not only helps prevent chargebacks from occurring in the first place but also ensures that when they do happen, merchants are well-equipped to fight them effectively and protect their revenue.