What Are Chargeback Analytics?

Chargeback analytics are a range of data analysis techniques that can be used to prevent, reverse, understand, and manage chargebacks. These approaches usually use AI and machine learning models in combination with dispute-related data to gain insights into strategies that can positively impact dispute processes. While many chargeback management solutions offer analytics, it’s important to be aware that offerings vary significantly in terms of power and depth.

How Do Chargeback Analytics Work?

Chargeback analytics require both chargeback data and an analytical component to function. While both dispute data collection and chargeback analysis were once achieved manually, or with basic automation tools, recent technological developments have vastly improved the accuracy, speed, and scope of what chargeback data can reveal about a merchant’s operations. Here are some of the most effective ways chargeback analytics is being used:

Surge Prevention and Financial Planning

AI-driven analyses of historical chargeback volumes now take seconds to uncover seasonal risk patterns that can predict dispute surges many months in advance. More sophisticated systems can even analyze the win-rate probability of the types of chargebacks most likely to occur. Merchants can use this data to make informed budgeting and spending decisions that would otherwise be impossible, or to allocate additional staff and resources during predicted high volume periods.

Detecting Operational Weaknesses

Chargeback analytics can also reveal weaknesses in merchant operations and suggest adjustments that lead to increased revenue retention. While until recently analytics software could only examine historical reason codes, state-of-the-art solutions now study the precise wording, disputed sums, and geolocations of chargebacks to pinpoint exactly what part of a merchants’ operation is leading to increased disputes. This strategy can rapidly identify whether a delivery partner or particular shipping destination is letting the operation down.

Uncovering Fraud Patterns

Advanced AI-driven analytics can quickly detect fraud patterns and signal methods for more effective fraud prevention. While blanket fraud measures can squander potential revenue by prohibiting large numbers of conversions, chargeback analytics can pinpoint high-risk consumer segments, allowing you to dial up fraud prevention strategies precisely where they are needed, while removing obstacles to low-risk conversions.

Winning Friendly Fraud Chargebacks

Research shows that the vast majority of chargebacks – Visa estimates 75% – originate from friendly fraud, rather than true fraud. While these transactions are legitimate, the resulting chargebacks are anything but, and should be merchants’ to win. Despite this, merchants have historically been able to reverse only a small percentage of friendly fraud disputes – until recently.

Fortunately advanced chargeback analytics can now be combined with A/B testing and past chargeback data to reveal exactly what evidence types, representment styles, and informational structures are most likely to reverse friendly fraud chargebacks. Solutions like Justt use these advanced analytic features to lift win rates to unprecedented heights within a few short weeks.

Challenges for Using Chargeback Analytics Effectively

With the vast benefits of chargeback analytics come several challenges – this is why not every merchant is forecasting revenue and curbing fraud with ease! Here are a few of the most significant hurdles to gaining insights from chargeback data:

Data Siloes and Harvesting Problems

Chargeback analytics can only perform valuable work if there is sufficient data to analyze. Small pools can lead to inaccurate findings that lead merchants down expensive rabbit holes. Data siloes can exacerbate this problem, as many data points must be read in combination with other forms for productive results.

The best third-party solutions use sophisticated APIs to collect your data, before comparing it against millions of prior chargebacks in similar industries. For best results, look for a solution with access to merchant, PSP, and third-party data enrichment capabilities.

Some Solutions Don’t Solve Anything

Powerful technologies tend to become buzzwords for companies trying to promote inferior products – and chargeback analytics are no exception. Despite their grand claims, most solutions can offer only superficial insights into historical volume fluctuations and revenue preserved, typically providing no predictive capabilities whatsoever. Be sure to conduct thorough research into several solutions and look for the features that can actually save your money – revenue forecasting, root cause analysis, and A/B testing-driven optimization.

Compliance Is Key

Data retention is essential for chargeback analytics, but increased enforcement of GDPR, CCPA, and other privacy protection legislation means that it’s essential that it’s handled responsibly. A strategic partnership with a trusted third-party solution can lighten this burden, as they can handle much of the encryption and anonymization required, or provide their own reservoir of anonymised chargeback data with which to compare your own.

Time Is Not on Your Side – But Justt Is

The best laid plans often go awry – and stringent chargeback deadlines can derail analytical efforts before they even begin. This is why in-house teams and manual (most) outsourced chargeback solutions fail to provide effective analytics. The need to cut costs while fighting disputes leaves little room for deep and regular data analysis, causing win rates to stagnate or fall over time.

Fortunately, Justt’s fully automated solution employs state-of-the-art machine learning and AI to deliver industry-leading representments in seconds, so chargeback analytics can be given the attention they deserve. Justt’s AI-driven Dynamic Arguments feature automatically selects the most compelling evidence from a pool of +500 sources, and assembles it into precision tailored representments that address the minutia of every chargeback. This comprehensive automation both enables and is powered by chargeback analytics.

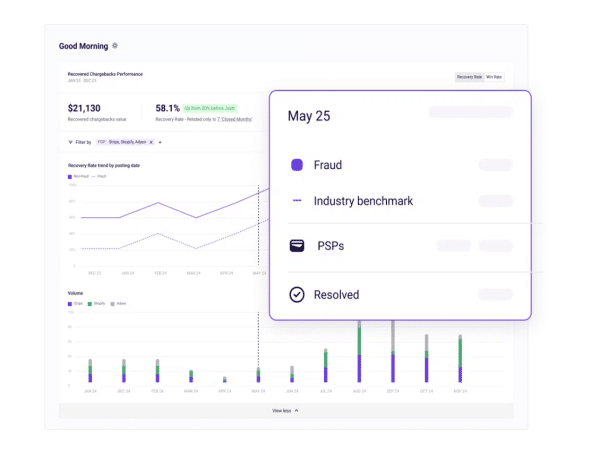

Justt’s world-leading A/B testing is constantly analyzing millions of past chargebacks to determine which course of action is most likely to win your disputes, so win-rates are always rising – hands-free. Meanwhile, the platform’s Insights & Analytics dashboard lets you see how disputes are trending, forecast revenue and chargeback results, and quantify the value of chargeback mitigation and prevention efforts. More importantly, it pinpoints operational problems and provides detailed advice for curbing fraud and chargebacks.