What is Rapid Dispute Resolution?

Rapid Dispute Resolution (RDR) is an automated dispute resolution program developed to streamline the chargeback process for certain types of transaction disputes, and currently offered by Verifi (part of Visa). RDR is designed to resolve potential disputes quickly and efficiently, before they escalate into formal chargebacks. The program uses predefined rules and transaction data to automatically resolve disputes, aiming to reduce the time, costs, and resources typically required for dispute resolution for merchants, issuers, and card holders.

The program was launched in April 2021, and later made mandatory for Visa issuers to offer in October of that year. RDR is only available to merchants using Visa affiliated accounts. The program charges a small amount per dispute alert, which varies according to merchant type.

How does Rapid Dispute Resolution work?

When a cardholder initiates a dispute, the RDR system automatically checks if the transaction meets specific criteria for automated resolution. These criteria are predefined by the merchant, and completely customisable. They typically include transaction amount, or reason for dispute, but can include currency type or risk score, as well as many other factors. The selected criteria typically reflect instances where a merchant believes legitimate disputes are common or inexpensive to resolve through refunds.

If the merchant is enrolled in RDR, all disputes meeting these criteria will be automatically refunded, while those that don’t advance to the chargeback stage. The RDR system proceeds across the following steps:

- The issuer submits the dispute through Visa Resolve Online (VROL), Visa’s online dispute resolution platform.

- Visa’s RDR engine evaluates the dispute against predefined rules and available transaction data.

- If the transaction meets the criteria for RDR, the dispute will pause for a 72-hour Pre-Dispute RDR Auto Decision.

- At this stage, the system may automatically resolve the dispute. In cases where this does not happen, the merchant has three days to investigate and decide whether or not to issue a refund.

- If the dispute can be resolved automatically, Visa credits the issuer and debits the acquirer, resolving the dispute and avoiding a chargeback.

- If the merchant declines a refund request, the VROL system issues the dispute to the acquirer, after which it becomes a formal chargeback.

This process significantly reduces the timeframe for dispute resolution, often settling matters within minutes or hours instead of the typical weeks or months required for traditional chargebacks. This rapid turnaround can significantly reduce the administrative burden associated with dispute resolution, while the reduction in chargeback volume can save merchants costly fees and reputational damage.

How Does Rapid Dispute Resolution Benefit Your Business?

RDR offers several key benefits for businesses. These include:

- Time savings: By automating the dispute resolution process, RDR significantly reduces the time merchants spend managing chargebacks.

- Cost reduction: With fewer disputes escalating to full chargebacks, businesses can save on chargeback fees and associated operational costs.

- Improved cash flow: Faster resolution means funds are not held in limbo for extended periods, improving overall cash flow management.

- Customer satisfaction: Quick resolution of disputes can lead to improved customer relationships and loyalty.

- Reduced workload: Automation reduces the manual effort required to gather and submit evidence for disputes.

- Lower chargeback ratios: By resolving disputes before they become chargebacks, RDR can help businesses maintain lower chargeback ratios, potentially avoiding penalties from card schemes.

Who Can Benefit Most from Using Rapid Dispute Resolution?

RDR means you are not fighting the chargeback and are refunding the customer. In cases where you have delivered the product or service, you are taking on both the lost CAGR and any potential profit from the transaction.

However, this can be advantageous for high-volume, low-value transaction merchants. For instance, businesses like fast food takeaways, convenience stores, or digital content providers often deal with numerous small transactions, which may frequently be subject to legitimate dispute. While most card holders will first contact the merchant to acquire a refund, some will go directly to the issuer to instigate a chargeback.

In these cases, RDR permits merchants to automate the refund process, rather than face chargeback fees and lengthy delays. Other prime candidates for RDR include subscription based services, where disputes over the payment of recurring bills are common, and in travel and hospitality, where disputes frequently relate to cancellations and no-shows. RDR allows both merchant types to set boundaries around what they are willing to refund, and to streamline that process.

What is the Difference Between RDR and CDRN?

Both Rapid Dispute Resolution (RDR), and Collaboration Dispute Resolution Network (CDRN) are Visa programs that aim to streamline dispute resolution. While RDR can be considered an upgraded version of CDRN – Visa’s legacy platform – it is important to be aware of some key differences. Unlike RDR, CDRN does not rely on automation. Instead, it offers a platform where issuers and merchants can engage in transparent communication regarding disputes, with the aim of achieving faster resolutions.

While RDR only covers Visa transactions, CDRN is available through multiple card schemes, and while CDRN is only available in the US, RDR offers coverage to Visa transactions globally. Finally, they are differently priced; CDRN charges $35 per chargeback alert, while RDR offers different rates depending on the merchant category.

When is Rapid Dispute Resolution Not Enough?

While RDR is an effective tool for many disputes, overreliance on the system – or setting excessively broad parameters as to what may be refunded – can result in huge costs for merchants. Not only do they suffer the initial cost of potentially fraudulent refunds, but merchants who gain a reputation for a lenient refund policy may face an increased volume of disputes by card holders looking for free items and services.

Merchants should be aware that sophisticated fraud schemes can bypass RDR’s automated systems, and nefarious card holders may become aware of your refund criteria – exploiting it for their own gain. For these reasons, it is essential to limit refund criteria to what your business can afford to pay, and to analyze RDR data regularly to determine if your rules are generating positive outcomes and ROI.

To further reduce chargebacks and get ahead of disputes, many merchants also rely on chargeback alert systems that provide early warnings before a chargeback is filed

A Two-Pronged Solution: Using Justt Alongside RDR for Maximum Chargeback Protection

Some merchants set overly broad RDR parameters due to a scarcity of time and resources allocated to chargeback processing, leading to excessive loss of income through friendly fraud. However, modern systems like Justt utilize automation and AI to deliver an inexpensive and hands-free approach to the chargeback process, vastly reducing overheads and administrative labor.

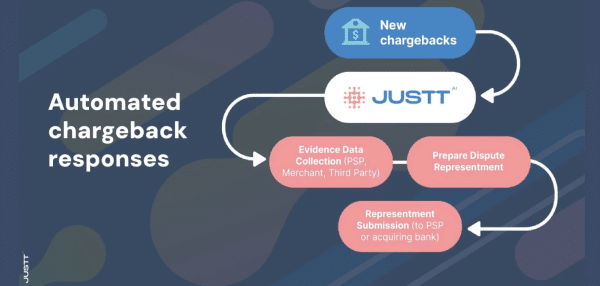

In the event of a chargeback, Justt automatically gathers data from the merchant, PSPs, and third party data sources. The system uses this data to generate evidence tailored to the specific demands of the issuing bank and dispute type. Machine learning technology allows the system to improve with each case it handles, leading to higher win rates as time passes. Unlike the templates often used by chargeback solutions providers, Justt’s system typically requires no input from the merchant.

By leveraging both RDR and Justt, businesses can create a robust, multi-layered approach to chargeback management, maximizing dispute win rates and minimizing the impact of chargebacks on their bottom line.