The Visa Acquirer Monitoring Program (VAMP) has officially launched – but many are still confused about the new system.

Welcome to your one-stop shop for VAMP information.

VAMP is a Visa program that penalizes both acquirers and merchants for failing to meet certain thresholds related to disputed transactions. It replaces Visa’s former monitoring programs – VDMP and VFMP – and combines them into one rate that monitors fraud and chargebacks for acquirers and merchants.

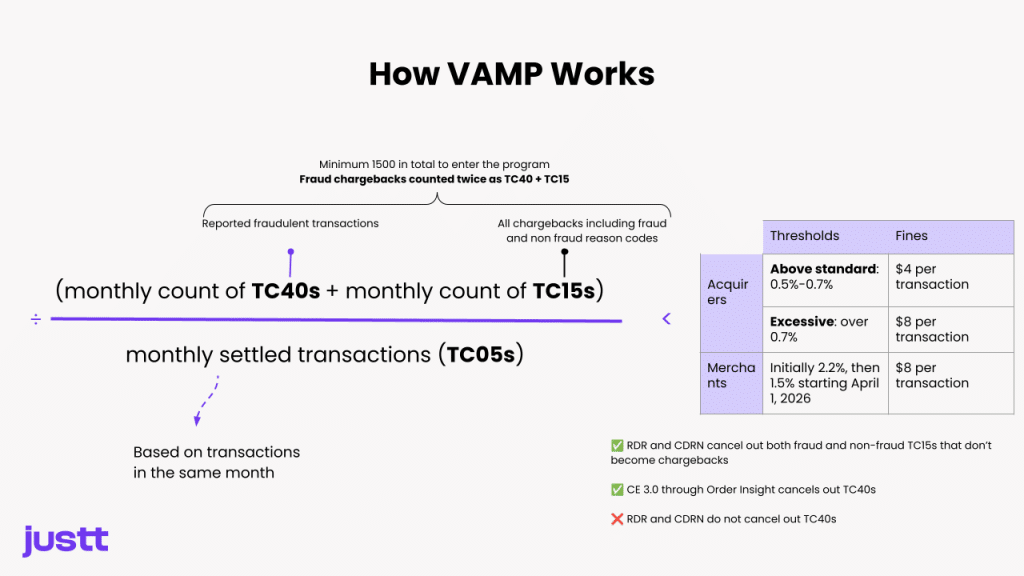

VAMP is based on Visa’s monitoring of three main metrics:

Merchants will not be included in the program if their total number of TC40s + TC15s is under 1500 in a calendar month. If they’re above 1500, the relationship between the three monitored metrics will determine whether a merchant will be enrolled into the program, and subject to penalty fines.

The VAMP ratio is what determines enrollment into the program. Merchants and acquirers whose rations are above their respective thresholds in a calendar month are at risk of being enrolled.

Here’s how the VAMP ratio is determined:

Both acquirers and merchants can be subject to fines if they are enrolled into VAMP:

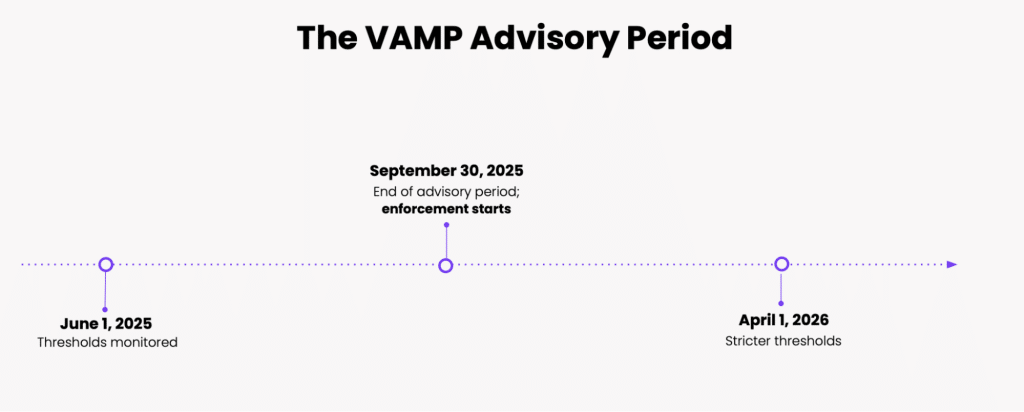

The advisory period is a sort of grace period allowing merchants and acquirers to better prepare. Recently it has been extended until the end of September 2025. Enforcement starts after this date!

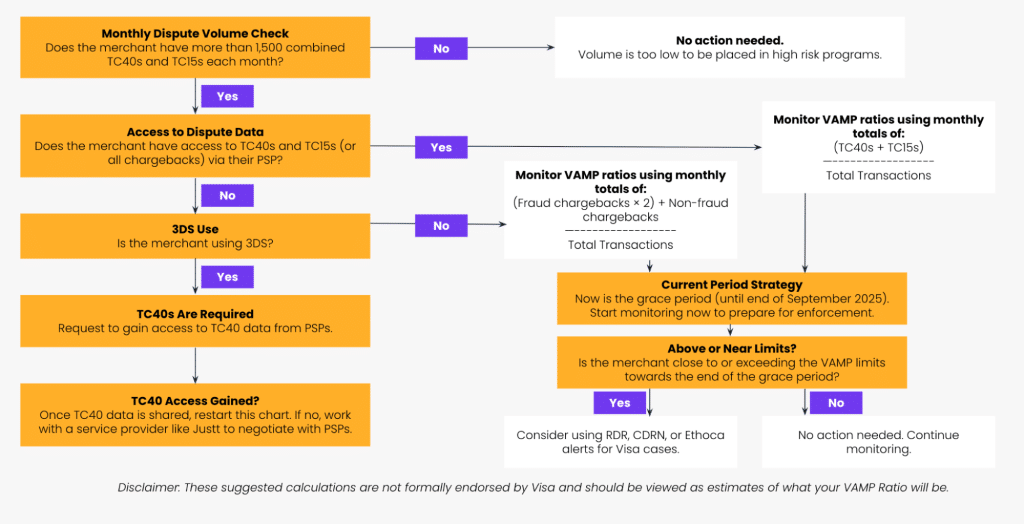

Use this chart to determine if and how you can monitor your VAMP ratio and prepare for enforcement at the end of September 2025.

Visa’s new system means merchants must adjust their practices to ensure they remain below excessive thresholds.

Watch Justt Cofounder and Chief Risk office Roenen Ben-Ami explain the 5 key steps merchants should take to prepare for VAMP (or read the summary below).

We’ve abridged our 5 most important preparation tips below- but If you want to explore more expert tips to prepare, check out the full webinar recording or our comprehensive ebook.

In this section:

The advisory period, running from June 1st through September 30th, 2025, represents a critical window for merchants to prepare for VAMP enforcement without facing penalties. During this time, there will be no enforcement actions, making it the ideal opportunity to get VAMP-ready. Use this period to:

VAMP preparedness starts with understanding where you are, and what you’re up against – this requires a firm understanding of the regulation’s nuances, your TC40 and TC15 rates, and how they measure up under the new system.

Merchants should work with their different payment service providers to ensure access to TC40 and TC15. If the data isn’t readily available, push for commitments on when it will be. Consider this your most critical action item – you can’t manage what you can’t measure.

It’s worth noting that the situation is different for merchants who use 3D Secure (3DS), compared to those who do not:

It might seem like a no-brainer, but the most effective way to prepare for VAMP is to reduce your TC40s and TC15s – even if you’re not currently at risk of enrollment. Aside from ducking VAMP thresholds, this can benefit your entire payments operations.

“Merchants can really win by focusing on fraud and disputes. Our data shows that lower risk portfolios have a 10% higher approval rate for their transactions from issuers. If they have lower fraud, lower disputes, you know, issuers are savvy to that and they are able to approve transactions more.”

Ami Patel, Visa

Reducing fraud and chargeback-related disputes is a larger challenge that typically requires a combination of fraud prevention tools, clear return policies, a customer-centric commercial approach, and other operational improvements. An often underused resource in this context is your chargebacks data.

To learn more, read: What Merchants Can Learn from Chargebacks Data

Acquirers face their own stringent thresholds under VAMP – 0.5-0.7% for “above standard” status, and 0.7% for “excessive”. This pressure turns the merchant-acquirer dynamic into a risk partnership where both parties sink or swim together – with potential consequences for businesses facing VAMP enrollment.

Start by asking your acquirer about their own VAMP ratio and how they plan to manage portfolio risk. Learning whether your PSP is comfortably below thresholds or scrambling to improve can inform your negotiation strategy and highlight potential risks to your processing relationships.

It is equally important to review contractual terms that were likely drafted before VAMP existed.

As mentioned above, RDR and CDRNs will allow merchants to avoid TC15s for the purposes of VAMP ratio calculations, as they enable some disputes to be resolved before becoming chargebacks. However, these tools will not cancel out TC40s, as these are registered before a chargeback is filed.

It’s worth noting here that the use of pre-dispute resolution tools can impact your overall revenue recovery rates since they result in refunds that affect your bottom line. Hence, it’s always worth considering your use of them as part of a broader revenue recovery strategy.

Another relevant tool is Compelling Evidence 3.0 (Order Insight), which allows merchants to share transaction data with issuers in real-time. This can help the issuers’ representatives dissuade cardholders from pursuing a dispute (e.g. by clarifying the time and place where the transaction was made based on the data received from merchants). In these cases, both disputes (TC15) and fraud reports (TC40) won’t be filed in the first place, and thus they will be excluded from VAMP ratios.

Struggling to accumulate and analyze the chargeback data needed to prevent TC40s and TC15s? Eager to improve authorization rates and reduce operational costs? Want to preserve and maximize your revenue through this crucial juncture and beyond? Justt has you covered.

Justt’s Insights and Analytics Dashboard doesn’t just consolidate chargeback data across PSPs and acquirers – it analyzes root causes and forecasts revenue retention, enabling targeted interventions that address the root causes of TC40s and TC15s.

With VAMP enforcement approaching, merchants have enough to worry about without mounting chargeback losses. Justt’s AI-driven system creates world-leading representments informed by winning strategies across millions of prior cases. This means that your win rates don’t just stabilize, but rise over time.

Without taking the time to learn VAMP’s rules and devise strategies to prevent TC15s and TC40s, merchants may soon be presented with hefty Visa fines. By fully automating the chargeback process from evidence collection, to submission, Justt handles chargebacks in seconds flat. This doesn’t just save you revenue, but vital time that you can use to truly understand and prepare for VAMP.

We’ve answered all the specific and general questions we’ve gotten about VAMP over the past few months – check out the full FAQ here, or the highlights below.

Yes. Both the ratio threshold and a minimum of 1,500 combined fraud (TC40) and dispute (TC15) events in a month must be exceeded.

By descriptor and acquirer relationship.

VAMP is measured per descriptor per acquirer.

Yes. Only Card-Not-Present (CNP) settled transactions count toward the denominator in the VAMP ratio calculation.

Not fully. VAP doesn’t always contain all the required fields for a full VAMP calculation.

Only cases that are resolved through CE 3.0 will exclude TC40s, other cases that are resolved though CDRN or RDR will exclude the TC15s, but not the TC40s. Specific TC40 codes have not been publicly listed as being excluded.

Yes, similar to RDR and CDRN, Ethoca Alerts for Visa transactions will exclude TC15s, but not the TC40s if resolved pre-dispute.

Acquirers do not need to receive the RDR and CDRN data in order to calculate VAMP. When RDRs or CDRNs are used properly the TC15 will not come through, so the acquirers or merchant can monitor based off of the TC15s and TC40s that do come in.

While Visa hasn’t issued specific guidelines, it promotes open communication between acquirers and merchants to manage risk effectively.

No changes to 3DS liability protections have been announced as part of VAMP.