Payment methods and fraud techniques are ever evolving, and that means your stack needs to evolve even faster. However, with so many technologies available, it’s hard to know what’s needed, what’s useful, and what you can do without. This article examines the essentials for any payment stack in 2025, as well as emerging technologies that are fast becoming indispensable for securing and maximizing your revenue.

What’s a Payment Stack?

Payment stacks are the layers of technologies, services, and tools that facilitate payments, from transaction initiation to final settlement. They comprise three layers: front end, middleware, and back end. The front end refers to the parts that consumers or buyers actually see and interact with – in a credit card transaction, this would be the cardholder. The middleware bridges various applications that enable communication and data transfers. The back end manages transaction processing and logging.

Why is this important? The short answer is that there’s a lot riding on your payment stack. These technologies determine: how likely users are to make a payment, along with your payment processing speed and costs, fraud losses, scalability, and ultimately how much revenue you can generate. For these reasons, it’s essential that you choose not only the right components, but the right variations of these components. First, let’s take a look at the essentials of the modern payment tech stack.

Getting the Basics Right

Front End

Checkout interfaces are where cardholders enter payment details and place their order – ideally with minimal friction. Modern interfaces should support guest checkout, minimize form fields, offer address auto-complete, and adapt seamlessly across devices. As the last step before a customer completes their purchase, these need to be reliable, secure, and trustworthy.

Middleware

Payment gateways are services that securely transmit payment information between your checkout and processors. They should provide clear error handling and messaging when transactions fail, recovering revenue that would otherwise be lost.

Payment APIs are software interfaces that enable businesses to flexibly integrate payments into their platforms, creating consistent experiences across devices and sites. New APIs should be thoroughly tested before going live.

Back End

Payment processors ensure quick, reliable transaction processing and timely fund settlement – directly impacting UX and conversion rates. Modern processors support intelligent routing that selects optimal processing paths based on card type, geography, and performance data.

Fraud prevention methods – like CVV and AVS – protect against unauthorized transactions and identity theft while minimizing false declines. Many modern systems use machine learning to analyze transaction patterns and assign risk scores in real-time.

Compliance tools ensure personal and financial data handling meets industry security standards like PCI DSS and regional regulations such as GDPR. This provides protection from regulatory penalties while maintaining audit trails for verification.

Reporting and analytics solutions deliver business intelligence on payment performance and customer behavior, enabling data-driven decisions. These tools should identify optimization opportunities like underperforming payment methods or regions with high decline rates.

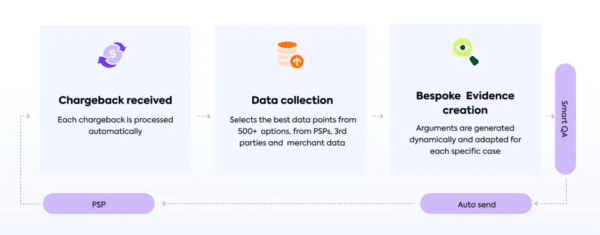

Chargeback management solutions recover revenue by overturning illegitimate transaction reversals. Effective systems automate evidence collection and submission while tracking dispute deadlines and rule changes across card networks. This space has become crowded in recent years, from simple tools that offer templated responses to advanced chargeback solutions such as Justt, which use AI and a system built off of dynamic arguments that change per case to craft evidence documents tailored to granular details in every case.

Futureproofing: AI, A2A, and Flexible Payments

The essential components of a payment tech stack will only get you so far. To maximise revenue, you’ll need to respond to contemporary payment trends with state-of-the-art technologies that can lend your business a competitive edge. While the effectiveness of some emerging payment tech is contingent on specific business concerns, some are likely to become ubiquitous – in which case, the early birds get the worm. Let’s take a look at some fast-growing payment stack components that can boost revenue and prepare you for tomorrow’s ecommerce landscape.

A2A Payment Gateways

Account-to-Account (A2A) payments are surging in popularity, with transaction volumes projected to grow from 60 billion in 2024 to 186 billion by 2029. One reason for this growth is that A2A solutions enable rapid payments with lower fees by eliminating traditional interchange costs, which can significantly reduce transaction expenses. They also enhance security by removing the need to share card details, while generally providing faster settlement times compared to card transactions.

However, implementation quality varies between providers. When evaluating options, assess supported regions, integration capabilities, transaction fees, security features, UX, and customer support.

Buy Now, Pay Later (BNPL)

BNPL services are another of the fastest-growing payment methods globally, with analysts projecting they’ll account for 12% of global e-commerce spend in 2025. These solutions allow customers to split purchases into smaller installments while merchants receive the full payment upfront, minus provider fees. When implementing BNPL, choose a provider that aligns with your average order value, target markets, and desired repayment terms – options like Affirm and Klarna each offer different geographic coverage and payment structures.

The business benefits are substantial: BNPL can increase revenue by up to 14% on eligible sessions, boost average order values, and attract younger demographics. Providers typically handle credit risk, fraud protection, and payment collection, allowing merchants to focus on core operations. However, carefully evaluate each provider’s fee structure and implementation requirements, as these vary significantly.

AI-Enhanced Fraud Prevention Tools

Standard AVS and CVV verification are no longer sufficient to combat today’s sophisticated fraudsters – many of whom are using AI tools to craft powerful malware and phishing attacks at never before seen scale. Modern payment stacks fight fire with fire, using AI-powered solutions that analyze transaction patterns, customer behavior, and emerging fraud trends in real-time. These advanced systems can identify anomalous activities with greater accuracy while dramatically reducing false positives that frustrate legitimate customers and cost merchants revenue.

Leading AI fraud prevention platforms like Forter, Riskified, and Ravelin use behavioral biometrics and transaction monitoring to create dynamic risk profiles that adapt to evolving threats. These solutions detect patterns invisible to rule-based systems, with some providers reporting up to 92% reduction in false positives. When selecting a provider, evaluate their machine learning capabilities, integration options with your existing stack, and industry-specific fraud detection models.

Pre-Dispute Resolution Services

Pre-dispute resolution services provide crucial early warning systems and compelling evidence for potential disputes, enabling merchants to address customer concerns before they escalate to formal chargebacks. Leading options include Ethoca Alerts (Mastercard) and Verifi CDRN/RDR (Visa), each offering notification windows ranging from 48 hours to 72 hours. These tools are most relevant when merchants find themselves approaching or exceeding chargeback limits, as refunded transactions are exempted from chargeback rates.

Beyond cost savings, systems like Verifi’s CE 3.0 provide data on dispute triggers that can inform product improvements and avert illegitimate disputes. Moreover, resolving in some cases this can prevent disputes from counting towards a merchant’s VAMP (previously VDMP) rates.

AI-Driven Chargeback Platforms

The global rise of friendly fraud has shown that manual dispute-handling approaches – and even template based outsourcing systems – are unable to provide tailored and high-quality responses to larger volumes of chargebacks, especially during unexpected surges. Fortunately, advanced chargeback management solutions use AI to fight fraudulent claims with maximal effectiveness and minimal merchant involvement. Systems like Justt collect and analyze evidence across +500 data sources, crafting responses precision-tailored for each specific chargeback to account for the data available, reason codes, regional regulatory variations, and even individual issuer preferences – without merchant intervention.

The best solutions consistently optimize by A/B testing millions of prior cases, Justt tests a host of different arguments and data points across a chargeback scenario, which allows all merchants to benefit through network effects – since everything learned is fed back into the system to improve outcomes for all future merchants faced with similar scenarios.

This means that win rates aren’t just maintained, but continue to rise, regardless of scale. For example, Justt’s AI-driven system automatically adjusts every aspect of your representments based on historical performance data, from formatting and content structure to evidence presentation and even language style.

The Future is Now

Ecommerce waits for no one, and companies that fail to think ahead will find themselves left behind. The payment tech stack that allows your business to function doesn’t guarantee that it will thrive – little can – but incorporating innovative technologies that respond to emerging trends can secure both your revenue, and a competitive advantage, ideally positioning your business to capitalize on the opportunities today’s complex payments landscape presents.