Looks like we finally have some clarity on VAMP. After many months of speculations and conflicting reports, Visa’s latest announcement should allow some of the dust to settle and give merchants the certainty they need to prepare for upcoming chargeback rules.

Previously on VAMP…

If you’ve not been following too closely, here’s what happened in the ‘previous episodes’:

- The new Visa Acquirer Monitoring Program (VAMP) went into effect on April 1, 2025, consolidating the Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP)

- For merchants, this means a new metric for monitoring chargebacks and fraud, and a shift in how tools for fraud prevention and dispute resolution impact your standing with Visa.

- There have been several changes announced so far in the program dates, its scope, and whether TC40s will be cancelled out by pre-dispute tools (RDR and CDRN).

The latest update:

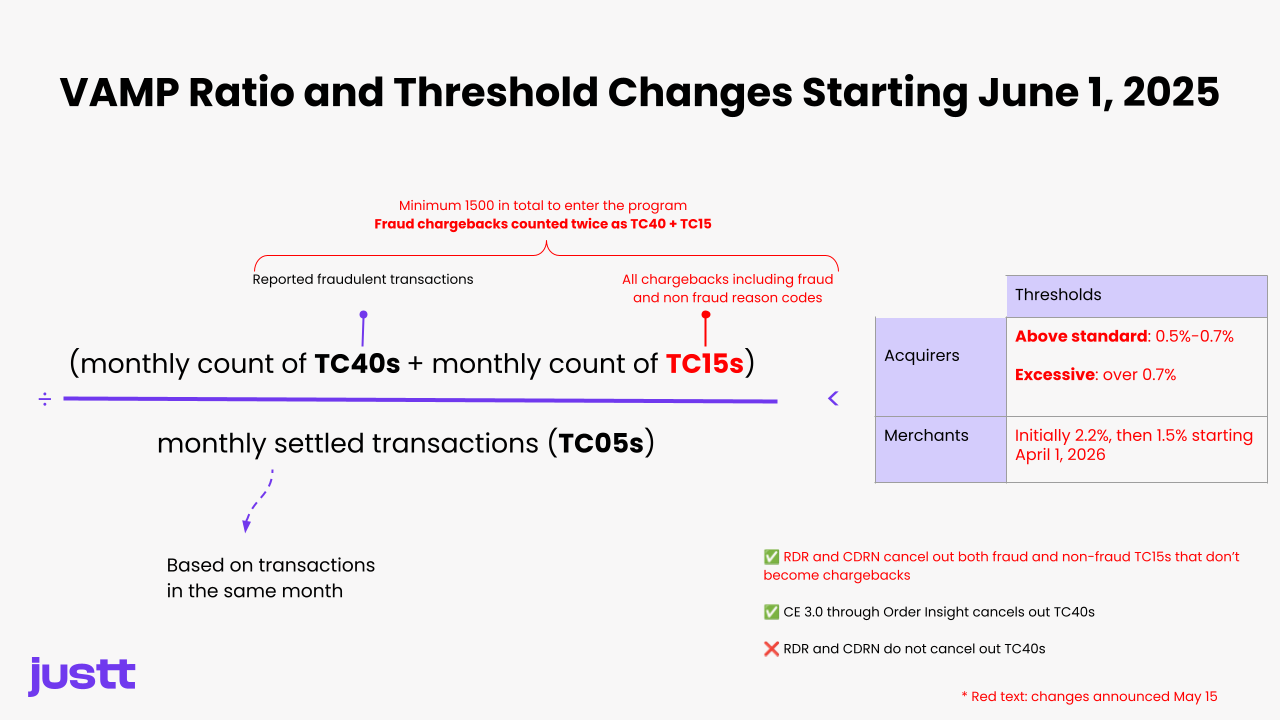

How VAMP is calculated – ratios and thresholds

Fraud reports (TC40s) that become chargebacks will now be counted twice for VAMP purposes. Previously VAMP was calculated as fraud reports (TC40s) + non-fraud chargebacks (TC15s) / total transactions (TC05s). However, TC15s have now been updated to include all chargebacks and not just non-fraud chargebacks – which in practice means that a fraud report (TC40) that then becomes a fraud chargeback would be counted twice, both as a TC40 and as a TC15. This will increase VAMP ratios for most merchants and acquirers – because if 3DS is not used, every TC40 should also lead to a fraud chargeback.

See a summary of the changes below:

Minimal number of cases to enter the program will increase: According to the latest update from Visa, the minimum monthly TC40s and TC15s needed to be considered for VAMP will increase from 1,000 to 1.500. Merchants below this monthly limit will not be at risk of entering the program.

Thresholds raised for merchants and acquirers. Potentially offsetting the change to how ratios are calculated, the VAMP ratio that triggers an acquirer or merchant being included in the program (and eventually being subject to penalties) have been raised. As you can see above, penalty thresholds (Excessive) will initially be 2.2% for merchants, and decrease to 1.5% from April 1, 2026; for acquirers, thresholds have been raised to 0.5% (Above standard) and 0.7% (Excessive).

Impact of RDR and CDRN

TC15 disputes avoided via RDR and CDRN will not be counted in VAMP. One of the more controversial aspects of VAMP was the previous announcement that TC40s would not be blocked by pre-dispute tools (RDR & CDRN). According to Visa’s latest update, RDR and CDRN still will not block TC40s, but they will cancel out TC15s for both fraud and non-fraud cases (as long as these are resolved before becoming chargebacks). This can help merchants mitigate the impact of fraud chargebacks, as it will help them avoid the double-counting (TC40 + TC15) that would otherwise occur.

What will block TC40s? This is unchanged – still only Compelling Evidence 3.0 through Order Insight will block TC40s from affecting VAMP ratios.

Grace period extended

While the new thresholds are going into effect on June 1, 2025, there is a grace period from that date until September 30, 2025. At the end of the grace period, merchants and acquirers who exceed thresholds could be enrolled in the program

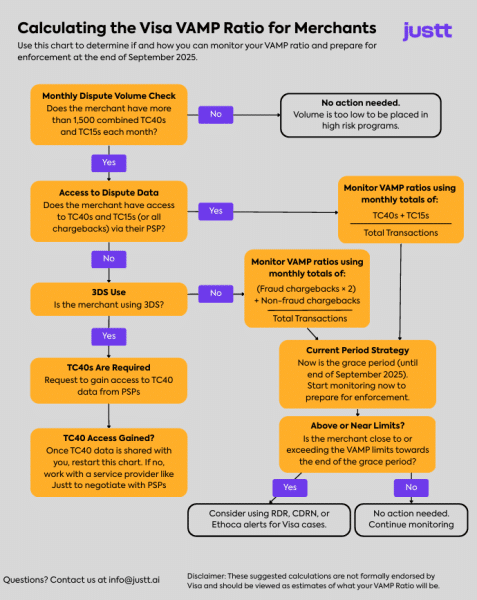

Calculating your ratio

Calculating your VAMP ratio is a great way to estimate if you need to take action before the enforcement period. Use the flowchart below to get calculate your ratio.

Is this good or bad for merchants?

It is too early to say whether these changes will be beneficial to merchants or not, and beware of anyone who is rushing to give you a definite answer. There are several changes at play here, and the ways in which they offset and impact each other is something that will need to be tested with real data and on a case-by-case basis. It is also still unclear how different acquirers will respond to these changes in terms of the rules they impose on merchants.

What is clear right now is that RDR and CDRN are still relevant when it comes to keeping merchants below the VAMP ratio limits; however, Visa will still have the ability to monitor (and penalize) fraud limits through TC40s.

What’s also clear is that merchants should ensure they have access to all their chargebacks data, as well as a way to receive their current TC40 reports (which are not always easily available). Merchants should also continue to evaluate their use of tools such as RDR, CDRN, and Order Insight as part of a holistic chargeback management and mitigation strategy.

Learn more about VAMP and how to stay compliant in our full Visa Acquirer Monitoring Program guide