What is Chargeback Mitigation?

Chargeback mitigation refers to systems and techniques that reduce the frequency or impact of disputed transactions. Most common approaches combine preventative and responsive strategies to maintain acceptable chargeback ratios and recover lost revenue. While chargeback mitigation can be handled in-house, the global rise of friendly fraud – costing businesses $132 billion annually and accounting for 70% of all card fraud – has led to the increased popularity of using chargeback mitigation solutions.

How Chargeback Mitigation Works

Effective chargeback mitigation relies on two basic principles: prevention before disputes arise and strategic response when they occur. Prevention focuses on implementing systems and practices that reduce the likelihood of transactions being disputed, while response strategies maximize the chances of successfully fighting illegitimate chargebacks.

The mitigation process typically begins with a risk assessment to identify common chargeback triggers specific to the business. Merchants then implement targeted preventive measures like fraud detection tools, customer service improvements, and clear billing descriptors to reduce chargeback rates. The response phase involves countering chargebacks with compelling evidence, submitting timely representments, and continuously refining strategies based on outcomes.

Why Chargeback Mitigation Matters for Merchants

Record levels of global friendly fraud and increasingly punitive card scheme regulations mean that managing chargebacks is now more vital than ever – with the potential to make or break businesses at any stage of growth. Here are a few reasons why chargeback mitigation should be prioritized:

Revenue Protection

Chargebacks usually cost merchants far more than the disputed transaction amount. In fact, chargeback fees ($15-50 per dispute), lost merchandise, shipping costs, and processing expenses can lead to much higher costs. For businesses operating with tight margins, these compounded losses can significantly impact profitability, sometimes costing up to 25% of net revenue.

Relationship and Reputation Preservation

Excessive chargebacks strain relationships with payment processors, which can lead to higher processing rates, risk reserves, or even account termination. Furthermore, merchants who exceed card networks’ dispute thresholds risk enrollment in card scheme monitoring programs, such as VAMP, that impose additional fees and requirements.

Operational Efficiency

Disputing chargebacks manually can be incredibly time-consuming and resource-intensive. Effective mitigation strategies reduce both the volume of disputes and time spent on the response process, allowing merchants to concentrate resources on core business concerns – this is much easier to achieve with the assistance of a dedicated chargeback management solution.

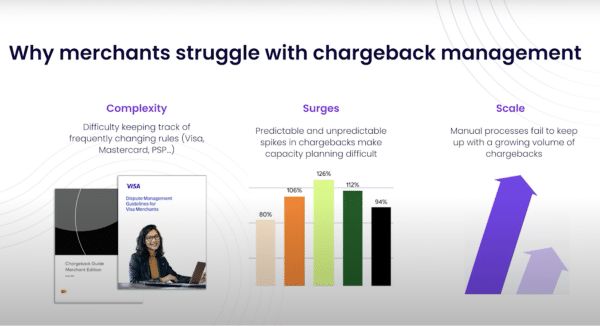

The Challenges of Chargeback Mitigation

Merchants implementing chargeback mitigation strategies often find themselves caught between resource constraints and the rigorous demands of evidence collection, card scheme regulations, and representment deadlines. Countering these challenges requires specialized knowledge, consistent execution, and adaptable systems that many businesses struggle to develop or maintain. Here are a few of the most common obstacles to effective chargeback management:

- Complex rules and regulations: Each card network maintains different rules, reason codes, evidence requirements, and response timelines, creating a confusing landscape that requires multiple mitigation strategies.

- Resource limitations: Effective dispute management demands dedicated personnel, specialized technology, and ongoing training that competes with core business priorities for limited resources.

- Unpredictable volume fluctuations: Seasonal surges, product launches, and promotional campaigns can trigger sudden increases in dispute activity, overwhelming even the best-prepared manual teams.

Types of Chargeback Mitigation Solutions

The challenges of fighting chargebacks in-house lead many merchants to outsource their mitigation needs to dedicated chargeback management solutions. While a discerning choice may result in huge savings in time and revenue, even the most popular offerings vary wildly in terms of evidence collection capabilities, representment building, and domain expertise. This leads to vastly different impacts on merchants’ win rates. Here a few of the most common types:

Chargeback Management Tools

Chargeback tools allow in-house teams to streamline the representment process with standardized response templates and online assistance with basic case management. While these solutions can accelerate certain aspects of dispute handling, they still require significant staff time to operate effectively, causing win rates to drop during busy periods.

Furthermore, template-based approaches cannot accommodate the nuanced arguments required to win complex cases, and often bury pertinent information deep within the evidence document, where issuers – with only three minutes to review – may never read it.

Manual Outsourcing

Manual chargeback solutions transfer the responsibility of fighting chargebacks to third-party specialists. These services may remove the need for an in-house team, potentially offering cost savings for merchants with moderate chargeback volumes. However, manual outsourcing remains vulnerable to human error and typically still rely on template-based responses. This means that response quality often deteriorates during high-volume periods, and merchants frequently need to provide additional information and oversight.

Semi-Automated Outsourcing

Automated solutions incorporate smart technology to accelerate the dispute management process. These systems often combine template-based approaches with partial automation of evidence collection and response generation, reducing the time merchants spend on each dispute while providing more consistent results than manual approaches.

However, most automated solutions still require some level of merchant involvement, including the manual upload of screenshots and other evidence, while others fail to specify the exact nature of their automation. Moreover, the vast majority continue to rely on templates, which limits their ability to respond adequately to unique or industry-specific disputes.

AI-Native Chargeback Mitigation

Justt’s AI-driven platform combines end-to-end automation, panoramic evidence collection, and world-leading machine learning capabilities into the most comprehensive chargeback mitigation solution on the market.

The platform’s unique approach begins by gathering evidence from +500 sources – including PSPs, internal merchant systems, and third-party databases. Justt’s Dynamic Arguments feature then transforms the most compelling data points into tailored responses that address the granular details of each dispute. Unlike template-based systems, Justt’s AI engine automatically adjusts every document element, from narrative flow to informational hierarchy, to match the preferences of the specific issuer reviewing the case.

https://www.youtube.com/watch?v=4pWH6P0Yfgg

Meanwhile, Justt’s machine learning capabilities ensure that every dispute benefits from insights gained from millions of previous cases. The system constantly refines its approach based on what proves effective, seamlessly adapting to evolving fraud patterns and issuer practices, so win rates aren’t just stable, but continue to rise over time. This entire process is fully automated and happens in seconds, so deadlines are instantly met, surges never affect response quality, and merchants never need to lift a finger.

Ready to transform your approach to chargeback mitigation? Contact Justt today to learn how our AI-powered solution can help protect your revenue and reputation.