This post covers the insights of Justt CEO Ofir Tahor in our recent webinar “Fight or Flight? Alerts, Disputes and the Hidden Costs of Chargebacks,” where we explored strategic approaches to chargeback management and revenue recovery.

The “Cost of Doing Business” Fallacy

Many people think of chargebacks as simply part of doing business with credit cards, an inevitable cost that comes with the territory. But while chargebacks may only account for 0.3–0.5% of total transactions, their impact on actual revenue can be much larger.

Taking a closer look at them not only helps recover revenue that might otherwise be lost, but also reveals the reasons disputes happen in the first place. With that knowledge, merchants can address root causes and strengthen the customer experience.

Small Percentages, Massive Impact

The math behind chargeback losses can be misleading. At first glance, disputes affecting less than half a percent of transactions appear negligible. But looking more closely shows that the compounding effects of chargeback costs turn what seems minor into a meaningful financial impact.

| Total Revenues | $681B |

| COGS | -$512B |

| OPEX | -$140B |

| Operating Profit | $29B |

| Interest & Taxes | -$9B |

| Net Income | $20B |

| Net Income Margin | 2.9% |

Consider one of the world’s leading retailers with a chargeback rate of just 0.3% of total transactions. With revenues starting at $681 billion, the impact might seem minimal at first glance. However, once you factor in lost merchandise, operational costs, taxes, and chargeback fees, a different picture emerges. The real impact of chargebacks balloons to over $20 billion — nearly 3% of total revenue.

Without proper measurement, this snowball effect means you could be leaving substantial money on the table. The critical question every merchant should ask: what is your current recovery rate from total losses?

The Post-Transaction Ecosystem

In the payment ecosystem, the burden of proof falls squarely on the merchant after a chargeback is filed. This creates a strategic imperative for a merchant to develop a comprehensive approach to managing chargebacks, from alerts to disputing.

Chargeback alerts provide real-time notifications when a dispute is about to be filed, giving merchants a chance to resolve issues preemptively through refunds. However, it’s crucial to understand that alerts don’t help you save money, they help you avoid penalties. The main benefit is preventing enrollment in high-risk programs with card schemes, though you’re still paying for both the alert and the refund. While alerts play an important role in preventing chargebacks, the only way to fully recover lost funds is by successfully disputing the chargeback itself.

Strategic Alert Deployment: High-Fraud vs. Low-Fraud Environments

| Scenario | High-Fraud Case | Low-Fraud Case |

| Fraud Type | Friendly fraud, stolen cards, repeat abusers | Occasional customer dissatisfaction or delivery issues |

| Chargeback Volume | High | Low |

| Alert Strategy | Early detection and immediate refunds to reduce ratios | Selective deployment with ROI calculations |

| Tactics | Auto-refund high-risk orders upon alert | Manual review per alert; refund only clear errors |

| Goal | Keep chargeback ratio below 1%, even at revenue cost | Maintain ultra-low ratios (0.2%) while protecting margins |

For high-volume, high-fraud merchants, alerts become essential for maintaining processor relationships and avoiding monitoring programs. To protect revenue in low-fraud environments, you can take other measures to dispute chargebacks and will use alerts differently. The key metric for both of these situations is ratio monitoring on daily, monthly, and quarterly bases to ensure maximum effectiveness.

Bottom line: using alerts means both losing revenue and paying alert fees, but they’re crucial for maintaining your ability to process payments if you’re close to certain ratios.

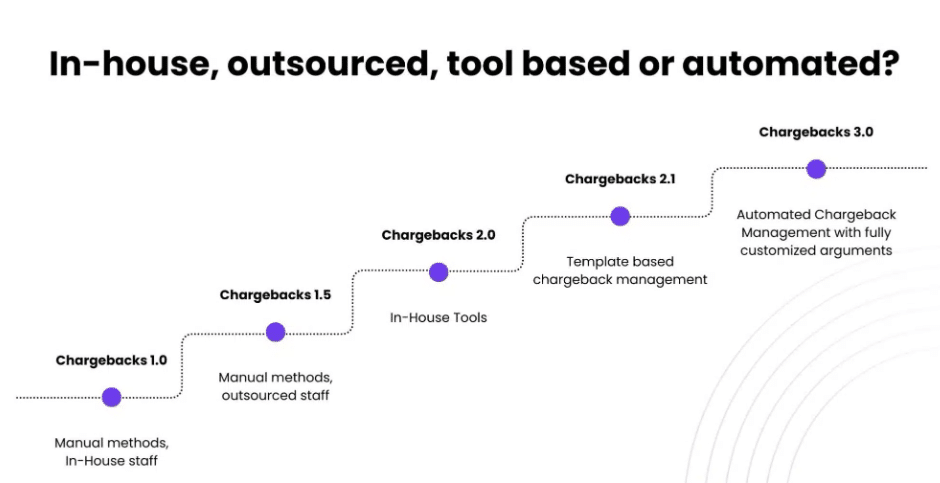

The Evolution of Chargeback Management: From Manual to Machine Learning

The chargeback mitigation landscape has transformed dramatically, evolving through four distinct phases:

Phase 1: In-House Manual Processing

The original approach, and still surprisingly common, involves dedicated staff manually fighting each dispute. This creates a perfect storm of inefficiency:

- Each manual dispute requires 20-60 minutes of analyst time

- Quality fluctuates based on individual expertise and workload

- Seasonal spikes overwhelm teams completely

- Reporting becomes a nightmare across multiple PSPs and systems

Many merchants in this phase aren’t fighting all disputes. This isn’t due to volume constraints, but because they lack understanding on how to handle chargebacks effectively.

Phase 2: Outsourced Teams

Recognizing the resource drain, many merchants outsource chargeback handling to specialized firms. While this solves staffing challenges, it introduces new problems: reduced control, generic approaches, and misaligned incentives.

Phase 3: Tool-Based Solutions

Chargeback management software promises better efficiency and consistency. These solutions automate evidence collection and provide standardized templates, but still rely heavily on one-size-fits-all approaches.

Phase 4: AI-Powered Automation

Today’s leading solutions leverage machine learning to create truly dynamic responses. Instead of static templates, they analyze hundreds of variables to craft optimal arguments for each specific dispute.

The Template Trap: Why One Size Doesn’t Fit All

Traditional chargeback management relies on templates—separate, pre-written responses for each unique combination of variables. While this approach seems like the logical first step in building an efficient strategy, it’s inadequate when you consider the variables at play.

To exemplify this, pretend you’re the following merchant:

- You are using two payment service processors (PSPs)

- You support two card schemes

- There are ten different reason codes your team is handling

- The evidence will be reviewed by one of ten different issuing banks

- You are currently running five A/B tests to optimize arguments.

To achieve the same results as a truly tailored solution, you would need 2,000 different templates. That calculation only accounts for the different arguments within each template, it doesn’t even consider that the order of information matters differently to each issuing bank.

Why so complex? A dispute is built on three pillars: data enrichment, evidence creation, and optimization. The number of template permutations grows exponentially with each new variable introduced to the process, and the data points you choose change the decision about which argument to use before evidence is even built.

The Dynamic Arguments Revolution

Justt’s modern chargeback automation solves this complexity through dynamic argument generation. Instead of selecting from pre-written templates, AI systems guided by domain experts analyze each dispute’s unique characteristics and construct custom responses in real-time.

This approach considers:

- Transaction Context: Purchase amount, merchant category, timing

- Evidence Strength: Quality and relevance of available proof

- Issuer Preferences: Historical data on what works with specific banks

- Reason Code Nuances: Tailored responses for each dispute type

- Regulatory Requirements: Compliance with evolving card network rules

Winning a chargeback isn’t just about having evidence, it’s about having the right evidence, properly selected, contextualized, and ordered. Building this comprehensive picture requires data enrichment from both internal and external sources (i.e. transaction logs, fraud detection signals, third-party fraud databases, and industry-specific data providers, etc.)

AI-powered automated dispute systems then build cases around these enriched data parameters, incorporating rules from the applicable issuing bank, card scheme, and PSP to design optimal responses. Continuously optimizing, Justt’s solution A/B tests evidence, analyzes past results, and adapts to industry changes, creating network effects and scaled expertise for improved outcomes.

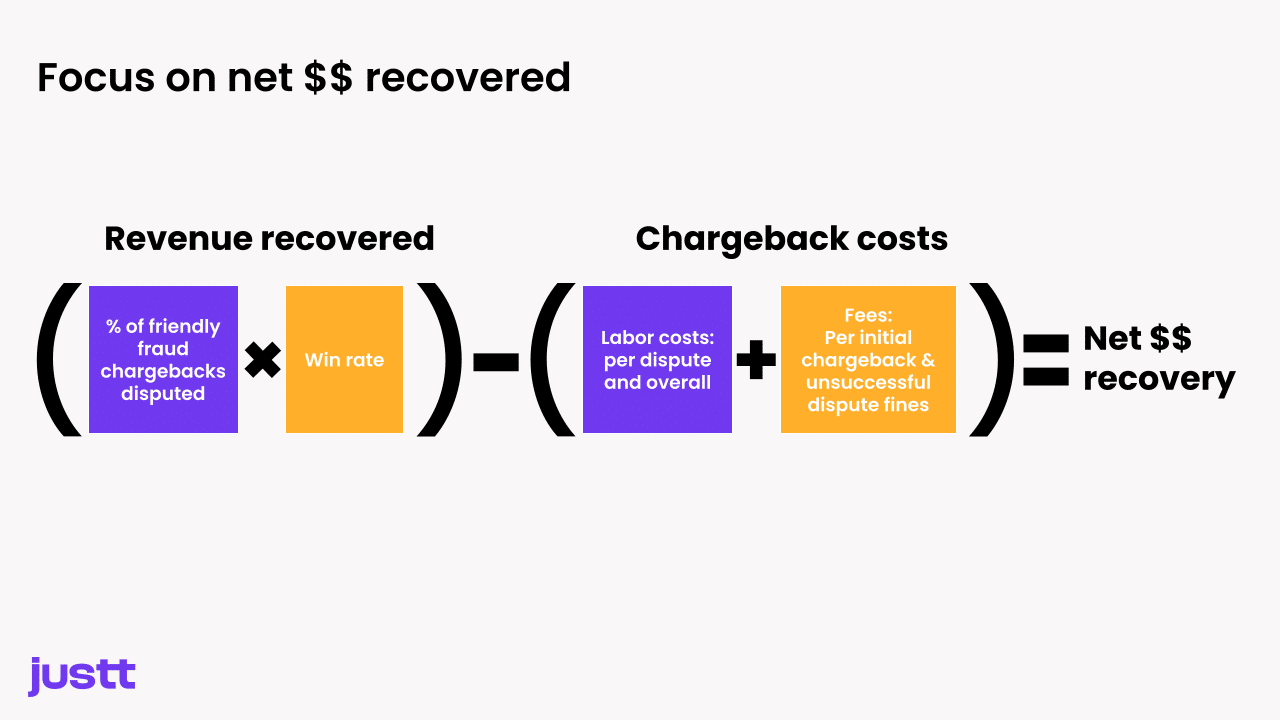

Measuring What Matters: Revenue Recovery as the North Star

The most critical shift in chargeback management is measurement philosophy. Traditional metrics focus on win rates or processing speed, but the only KPI that truly matters is net dollar recovery.

This comprehensive metric accounts for:

- Recovered transaction amounts

- Avoided chargeback fees

- Operational costs

- Processing time and resources

Without this holistic view, you could be leaving significant money on the table. Many merchants discover their “successful” chargeback programs are actually destroying value when all costs are properly calculated.

The Future of Chargeback Management

As payment ecosystems evolve, with agentic commerce, alternative payment methods, and changing consumer behaviors, chargeback management must evolve accordingly. The merchants who thrive will treat chargebacks not as an operational nuisance, but as a revenue recovery opportunity demanding the same rigor as any other profit center.

This requires establishing clear targets, implementing robust measurement systems, and ensuring accountability at the executive level. Every uncontested chargeback represents revenue walking out the door.

The question isn’t whether you can afford to optimize your chargeback management. It’s whether you can afford not to.