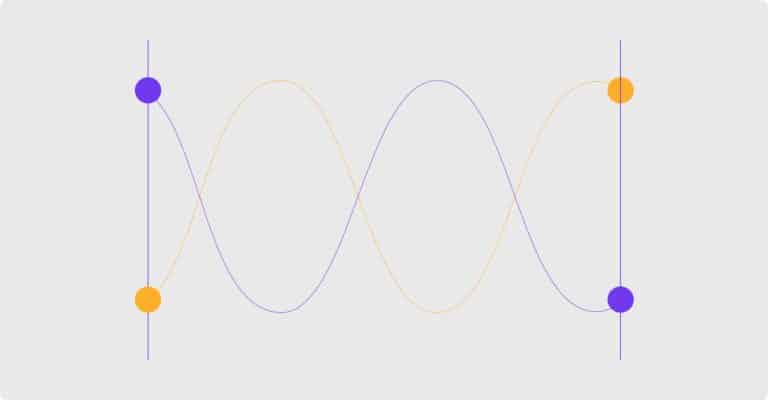

Managing chargebacks with templates seems logical at first. Create one response for fraud disputes, another for authorization issues, maybe a few variations for different payment processors. But when you actually do the math on what effective template management requires, the numbers reveal a fundamental problem. It’s not that templates are a bad idea—it’s just that they do not and cannot scale.

Summary

- Relying on static templates for chargebacks is complex due to exponential combinations.

- Generic one-size-fits-all chargeback templates are ineffective, leading to lower win rates.

- Template systems have high maintenance costs and coverage gaps.

- Using dynamic arguments for chargebacks offers scalable, automated, and more successful chargeback outcomes.

The Template Multiplication Problem

In a recent webinar appearance, Justt Co-founder and CEO Ofir Tahor discussed the issue of relying upon a collection of templates for managing chargeback disputes.

Let’s work through a realistic example.

- Your business processes payments through two processors—say, Stripe and PayPal.

- You handle Visa and Mastercard transactions.

- You deal with ten common reason codes, from ‘fraud’ to ‘goods not provided’.

- You work with ten major issuing banks.

- And you want to run basic A/B tests on your templates to optimize performance of your chargeback disputes.

If you use one generic template for all, you will probably have sub-standard win rates. Can you generate templates for all these permutations?

Here’s the math:

2 payment processors x 2 card schemes x 10 reason codes x 10 issuing banks x 5 A/B testing variations = 2,000 unique templates

That’s not an exaggeration—it’s what you actually need for comprehensive coverage. Each combination requires different evidence, different adherence to processor and issuing back preferences, a different order in which to present the arguments in the template, different arguments, and different approaches to maximize win rates.

What’s more, these templates “assume” all evidence is identical, while in real life the evidence (supporting data) for each chargeback is different, meaning that templates also need to be adjusted based on the actual evidence per case.

Every Variable Matters

Payment processors structure their data differently. Stripe provides detailed fraud scoring and transaction metadata that you can leverage in disputes. PayPal, on the other hand, has strict and unique requirements for the data needed to process both Paypal claims and chargebacks Using a generic template misses the opportunity to incorporate these processor-specific advantages.

Card schemes also impose different evidence rules. Both Visa and Mastercard recently introduced fraud reason code updates: Visa with Compelling Evidence (CE) 3.0 and Mastercard with First Party Trust. While these frameworks are similar, there are nuanced differences in their requirements. Tailoring dispute submissions to align with each card scheme’s rules is critical.

Though issuing banks evaluate representment evidence based off of the card scheme rules, they vary significantly in how they evaluate disputes. Since analysts typically spend only about three minutes per case, they often don’t review the entire evidence package in detail. This makes evidence prioritization essential. The most impactful evidence should be placed at the top, and what’s considered “most important” can differ by bank. For example, for fraud reason codes, some issuers weigh past transaction history heavily, while others focus on CVV or AVS data.These seemingly minor preferences directly impact win rates.

The Maintenance Reality

Template systems create cascading maintenance costs that compound over time:

Constant Updates: Visa updates dispute rules quarterly. Every change potentially affects hundreds of templates. Payment processor API updates require revisions across dozens of related templates.

Testing Overhead: A/B testing 2,000 templates requires massive sample sizes to achieve statistical significance. By the time you validate improvements across all combinations, market conditions have shifted.

Coverage Gaps: Without templates for every combination, you’re forced to use suboptimal responses. Using fraud arguments for authorization disputes or applying Visa formatting to Mastercard cases reduces win rates.

For businesses processing significant chargeback volumes, these maintenance costs often exceed the operational savings templates were supposed to provide.

Dynamic Arguments: More Efficient, Easier to Manage

Dynamic argument systems approach the problem differently. Instead of choosing between pre-written templates, machine learning models analyze each dispute’s specific characteristics and automatically construct the most effective response based on historical performance data.

When a dispute arrives—let’s say a Chase Visa fraud case processed through Stripe—the system doesn’t look up template #1,247. It evaluates the transaction data, customer history, and fraud indicators specific to that case, then builds arguments proven to work for similar situations. It even orders the evidence to strategically place the most influential evidence at the top, a factor which wasn’t even accounted for in the template multiplication problem.

Using this system, adding a new payment processor doesn’t require creating hundreds of new templates. The model retrains automatically, optimizing performance across all existing combinations without manual intervention.

Why the Math Won’t Get Better

The template multiplication problem is a mathematical constraint, not a process issue. Every attempt to improve template systems makes the exponential growth worse:

- Adding geographic variations multiplies all combinations by the number of markets

- Including transaction amount thresholds creates additional variables

- Seasonal optimization requires time-based variations

- Regulatory compliance demands region-specific approaches

Meanwhile, payment complexity continues to increase. New processors, additional reason codes, evolving bank preferences, and changing regulations all make the template management problem harder over time.

Making the Transition

Businesses serious about chargeback recovery need systems that scale with mathematical reality rather than fighting against it. Template systems made sense when payment complexity was lower and dispute volumes were smaller. Today’s environment demands automated optimization that can handle exponential combinations without exponential overhead.

If you’re ready to leave templates in the past, let’s talk!

FAQs

How many templates do most businesses actually need?

Most enterprises require 1,500-2,500+ template combinations to handle realistic payment complexity. Even smaller businesses typically face 100-500+ combinations for basic coverage, making manual management challenging.

What happens if you don’t have templates for every combination?

Missing combinations force you to use suboptimal responses, directly reducing win rates. Using a Visa template for Mastercard disputes, or fraud arguments for authorization cases, significantly decreases recovery success rates.

How often do templates need updates?

Card scheme rules change quarterly, PSP APIs update monthly, and regulatory requirements change continuously. Each update potentially affects hundreds of related templates, creating ongoing maintenance overhead that scales with system complexity.

Can template systems achieve the same performance as dynamic arguments?

Theoretically, yes—if businesses maintained thousands of perfectly optimized templates with continuous A/B testing. In practice, the maintenance overhead makes this economically impossible, leaving template users with consistently lower performance.

How do dynamic systems handle new PSPs or reason codes?

Dynamic systems automatically adapt to new variables without template multiplication. Adding a PSP or reason code triggers model retraining that optimizes performance across all combinations without manual maintenance overhead.