Dealing with disputes may be a non-negotiable part of running a modern business, but most merchants fail to realize that it can also be an opportunity. In fact, chargeback data should be one of your business’ vital signs, indicating whether urgent action is required in a particular area, or whether to adjust certain commercial or fraud-related policies.

This article looks at four key insights that can be gained from your chargeback data & reports, as well as examples of how businesses can use them to generate and preserve revenue.

Uncovering Hidden Fraud Patterns

Chargeback data is a great way to reveal fraud vulnerabilities that fraud prevention tools might miss, or add another signal to the insights you’re getting from these tools. For instance, when enterprise retailers we’ve worked with see significant drops in win rates combined with increases in transactions flagged as high-risk, this signals that certain segments need tighter fraud controls.

By analyzing these high-risk transactions and lost fraud cases, it’s possible to identify customer segments that need to be monitored more closely (or banned completely). Pinpointing problem areas can help you avoid blanket fraud measures, which allows the rest of your revenue stream to continue uninterrupted.

Practical Takeaways

- Monitor key indicators such as segment-specific dispute spikes, win rate fluctuations, and high-risk flags.

- Segment chargeback data by region, product type, ticket value, and delivery vs. pickup. This allows you to pinpoint problem areas for potentially fraudulent disputes.

- Fine-tune fraud rules for problem segments, such as by tightening identity verification requirements.

- Distinguish between fraud and confusion – sometimes cardholders mistake legitimate transactions for fraud due to unclear billing descriptors. Err on the side of caution and make your billing descriptors as clear as possible.

Identifying Service and Fulfillment Gaps

Chargeback data can also serve as an early warning system for operational issues. A common pattern we see with multi-channel merchants is that “item not received” chargebacks vary significantly between carriers. Different carriers provide varying quality of delivery confirmation, with some documentation not meeting certain card networks’ evidence requirements. This data can provide vital insight into the businesses you partner with and their impact on your sales and customer experience.

Practical Takeaways

- Monitor carrier-specific dispute rates to discern whether poor delivery confirmation practices are costing you revenue.

- Scrutinize ALL partnerships. Sometimes it’s not the delivery person. High dispute rates on a certain product may mean that it’s poorly made, or that your marketing department or affiliated influencers might be overhyping your wares.

- Improve delivery confirmation documents to meet the requirements of every card scheme – including working with your delivery and fulfillment partners to ensure they provide the documentation you need.

Optimizing Authentication

Chargeback data can help to balance approval rates and chargeback exposure with insights that let you fine-tune your anti-fraud tool use. For instance, reducing 3DS usage for certain issuers can lift approval rates and conversions, but can also lead to increased fraud chargebacks and lower win rates from those issuers. By monitoring the effectiveness of authentication methods through chargeback data, you can assess whether those methods are working for you, and increase or relax restrictions as the situation demands.

Practical takeaways

- Evaluate 3DS trade-offs by analyzing your dispute rates with and without 3DS. You can conduct A/B testing by increasing 3DS usage at some times, for certain issuers and products, and decreasing it at others. Weigh conversion gains without 3DS to any concurrent fraud-related revenue loss. Similarly, compare fraud savings with 3DS to any decrease in conversions.

- Conduct issuer-specific authentication optimization with the insights gained from A/B testing. You can now fine-tune 3DS use across issuers and products, depending on what configuration is most profitable.

Navigating Seasonal Risk Patterns

Holiday season insights from chargeback data analysis can reveal your surge-readiness – or lack thereof. Many of our retail clients came to us because they faced higher ATV, increased fraud reason codes, and declining win rates during the holiday season. This indicated that their manual teams or outsourced solutions were not able to handle the busiest – and most revenue-critical – time of the year.

These insights can help with more effective seasonal resource planning and targeted prevention strategies, or signal a need for more scalable chargeback management solutions. .

Practical takeaways

- Use past seasonal chargeback data to inform staffing and resource allocation at the busiest times of the year – if dispute surges hit the last two Januaries in a row, it’s likely that the next one will be similar. Make preparations so that your team isn’t overwhelmed.

- Prepare targeted evidence packages for seasonal chargeback types. Historical data will show you roughly what kinds of disputes to expect, so you can get a headstart on evidence collection.

- Look for a fully-automated chargeback solution to handle seasonal surges, along with the rest of your chargeback woes. Every approach has been tried and tested, and the numbers are in: only an end-to-end automated solution like Justt can handle dispute surges without win rate fluctuations. In fact, Justt’s advanced AI and machine learning capabilities mean that the solution is not simply volume agnostic, but that win rates typically continue to rise throughout the year and beyond.

Do You Have the Data You Need to Improve?

We’ve seen how chargeback data can help improve your business and point you towards revenue saving measures that would never otherwise become apparent.

However, most merchants today are not making full use of this data – and in fact, the vast majority are struggling to even see a high level picture, since basic data points (such as win rates and reason codes) are scattered between different PSPs and portals – each with their own formats, quirks, and naming conventions

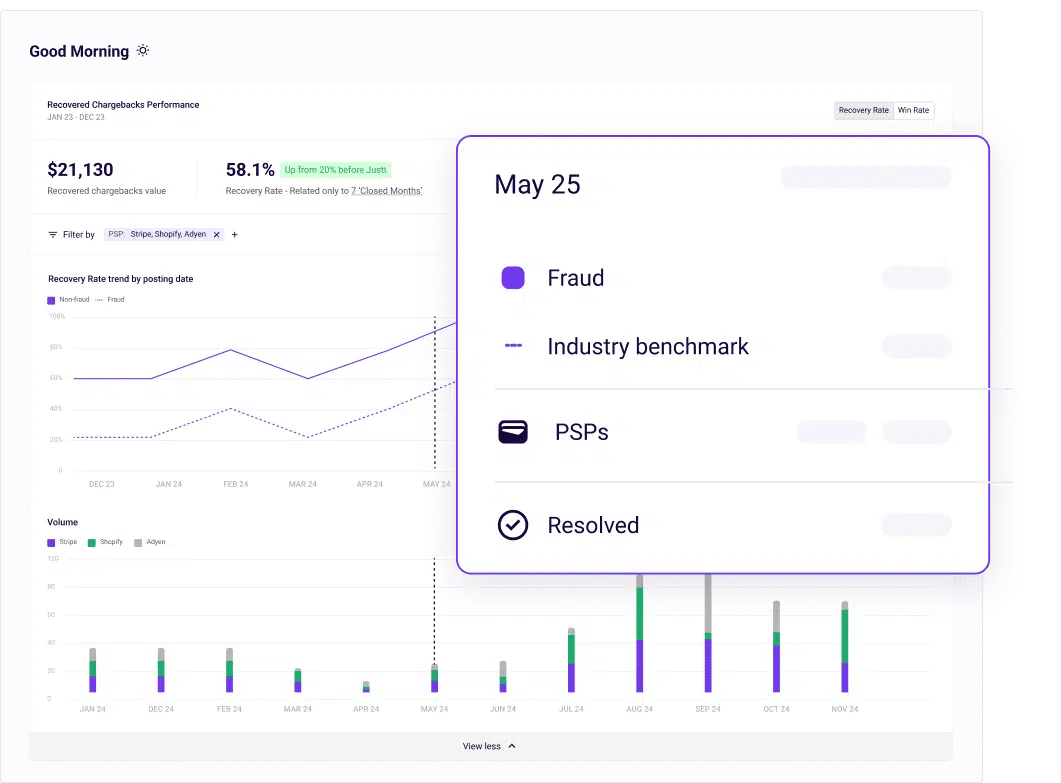

Fortunately, Justt isn’t only the world leader in AI-driven chargeback management, but also provides merchants with the best Insights & Analytics dashboard on the market. From this single location, you can access disputes forecasts, see what causes fluctuations, study ongoing chargebacks, and learn what operational changes you can make to recover more revenue.

To see how this will work with your own data, get in touch with our experts today.