Learn how chargeback management software helps merchants fight fraud, optimize disputes, and recover revenue

Friendly fraud is no small issue. Accounting for as much as 70% of all credit card fraud, it’s a major headache for merchants who stand to lose serious money in direct costs as well as fees and fines. To fight back, they’re turning to chargeback management software – a category of solutions that has emerged in the last few years to better manage the process of disputing illegitimate chargebacks from evidence collection to submission.

What is Chargeback Management Software?

Chargeback management software, also known as chargeback automation software, is a category of tools used to streamline and optimize the process of handling payment disputes for merchants. Solutions can offer different levels of functionality, from basic workflow and project management to end-to-end automation. The goal is to increase the efficiency of dispute handling, improve win rates, and help merchants recover more revenue that would otherwise be lost to illegitimate chargebacks.

Chargeback tools address the various stages of a chargeback dispute:

- Data collection: once a chargeback is received, the software can simplify the collection of relevant data from payment service providers, internal merchant systems, and third-party sources (the level of automation and the data being collected will vary by tool)..

- Tailoring responses: collating the evidence into a human-readable representment. Justt will automatically create dynamic arguments tailored to specific reason codes, issuing banks, and card networks. These are further optimized based on the win/loss analysis of previous submissions. Other tools will rely on a lesser level of automation, such as providing pre-built templates for chargeback departments to choose from (more details on this below).

- Submission: In the submission phase, the software automates the process of sending the compiled response to the appropriate parties.

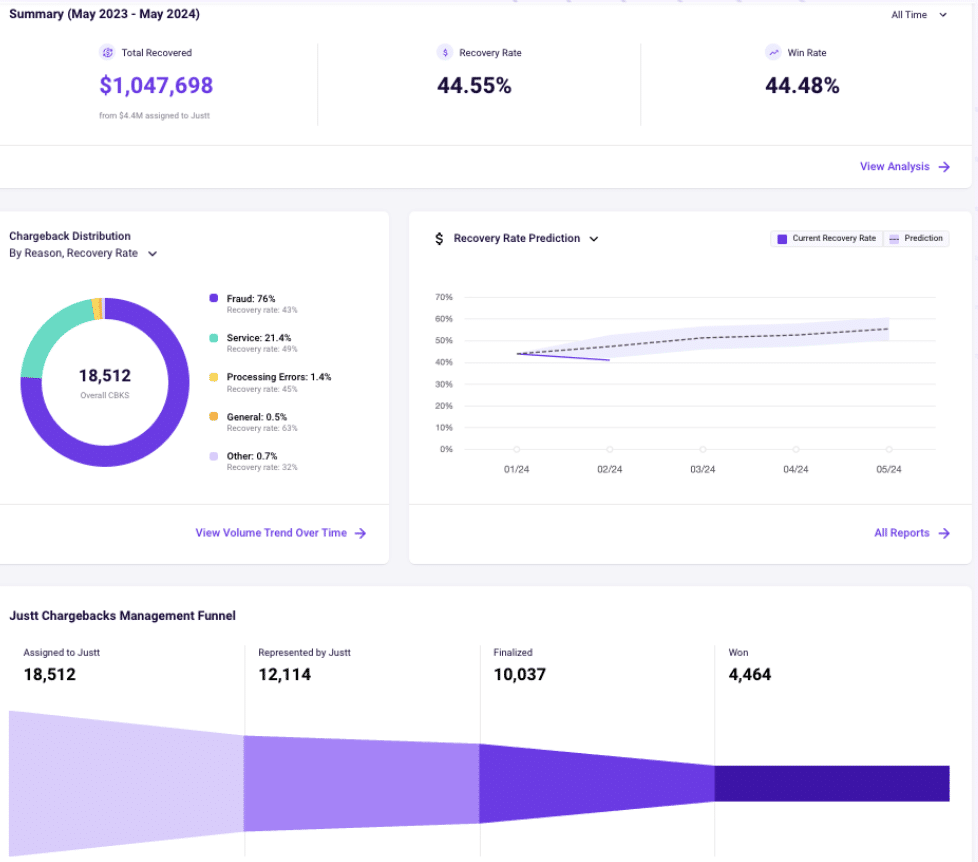

Analytics and optimization: Tracking the outcomes of a particular dispute and the broader win/loss rates over time. Some solutions will also provide further analytics and insights, helping merchants understand and optimize their overall chargeback prevention strategies. In a fully automated solution, this optimization might be “under the hood” – where the software itself learns to tailor future cases based on successful and unsuccessful submissions.

Fraud Prevention vs. Chargeback Management

Fraud prevention tools (such as Riskified and Forter) and chargeback dispute management are often confused. Both categories of solutions play a part in mitigating chargeback-related costs for merchants. However, they are actually solving two different problems and neither one can replace the other:

- Fraud prevention focuses on blocking transactions that are likely to be true fraud such as stolen credit cards (and thus result in a legitimate chargeback request). These tools focus on using advanced algorithms to detect potentially fraudulent transactions, allowing merchants to reject suspicious orders before they’re processed. They look at data such as customer behavior, device information, and transaction patterns in order to flag high-risk orders in real-time – thereby reducing the likelihood of legitimate chargebacks being filed by consumers. .

- Chargeback management typically refers to dispute management: this comes into play after an illegitimate chargeback has been posted. As we’ve discussed, this process involves responding to and contesting chargebacks to protect revenue. Effective dispute management requires a structured approach to gather evidence, present compelling arguments, and submit timely responses to issuing banks.

Using both types of tools – or finding other ways to address these two distinct challenges – is essential for minimizing the financial impact on merchants and maintaining healthy relationships with customers and PSPs.

Benefits of Chargeback Management Software for Merchants

Chargeback automation streamlines the payment dispute process by eliminating the need for manual chargeback management and allows merchants to respond to chargeback requests at scale while eliminating repetitive busywork. Key benefits include:

Reducing the financial impact of chargebacks

This is the biggest benefit for most merchants. The financial impact of chargebacks is substantial and when one does occur, the full amount of the sale is lost, not just the margin. For merchants that have low margins, and are being hit by a large volume of chargebacks, as much as 25% of net income could be lost. Chargeback automation is meant to reduce this impact as much as possible.

There’s also the cost of managing chargebacks. Automated chargeback management can be as much as 45% cheaper than manual processes due to the number of employee hours saved. In addition, merchants can save substantial amounts of money by avoiding the additional fees and penalties that are sometimes levied in cases of lost appeals.

Ability to respond to more claims

Cost considerations aside, there’s also the issue of volume. Merchants are now dealing with more disputes than ever. 238 million were filed in 2023 and by 2026, global chargeback volume is expected to rise by more than 40% to more than 337 million.

With a finite number of specialists available to deal with chargebacks in any given organization, simple bandwidth limitations mean that priority must be given to the higher value and more problematic disputes when they’re processed manually. This inevitably means that many go unanswered, and the organization loses by default. With chargeback automation – and especially tools that offer end-to-end automation (as we cover in the next section) – no dispute goes unanswered.

Maintaining the quality of responses

Chargeback automation software can help merchants maintain the consistency and quality of dispute responses. Manual processes are prone to human error, especially when dealing with high volumes of chargebacks. Automation ensures that each response is complete, accurate, and adheres to the specific requirements of different card networks and issuing banks. This consistency is crucial for maintaining high win rates across all types of disputes.

3 Types of Chargeback Management Solutions

Larger merchants are dealing with a lot of chargebacks, and they will have come up with some way to manage the process (even if it’s just a shared spreadsheet). However, focusing on tools that are specifically designed for chargeback management, we can identify 3 emergent categories:

1. Full Automation

Fully automated tools take a ‘hands-free’ approach, where the software handles most or all disputes without the merchant’s direct involvement.

This is the approach pioneered by Justt, an AI-native platform that uses the latest advancements in machine learning and predictive analytics to enhance the accuracy and efficiency of the dispute process. In this model, the system is self-driving and self-optimizing for most cases – allowing payments teams to focus only on a small subset of disputes, or simply “set it and forget it”, freeing up time for more strategic initiatives.

Justt uses hundreds of data points and proprietary benchmarks collected from millions of chargeback disputes in order to create dynamic arguments – tailoring each representment based on available data from internal sources, PSP-provided data, and 3rd party enrichment.

Rather than relying on manually tracking results, Justt uses machine learning to find winning combinations of evidence and representments via continuous A/B testing. This allows merchants to achieve significantly better win rates compared to alternative solutions while removing ±95% of the labor-intensive processes currently handled by payment teams.

Advantages of automation include;

- Ability to deal with volume fluctuations: since the solution is not dependent on headcount, you avoid the awkwardness of over- or under-staffed chargeback teams.

- Ability to produce tailored responses per each chargeback dispute, rather than rely on boilerplate.

- Continuous, automated optimization which enables the system to self-improve over time.

Learn more about Justt’s chargeback management software

2. Chargeback Outsourcing

Solutions that route some or all disputes to an outsourced chargeback team.

Chargeback outsourcing delegates chargeback management to a specialized third-party service provider. This approach allows merchants to leverage the expertise and technology of dedicated chargeback management firms for handling dispute resolution. Notable vendors in this space include Chargebacks 911, Accertify, and Chargeback Gurus.

Chargeback outsourcing can be cost-efficient and enable smaller teams to focus on their core business operations. The main concern in these cases is with maintaining quality at scale:

- The in-house team might still need to be involved, e.g. for evidence collection

- Due to volume fluctuations, outsourced teams might struggle to address all cases or “cut corners”. Outsourced teams will rarely allocate spare headcount to deal with surge periods.

- Outsourcing is reliant on manual work, and often by less skilled or less specialized employees. As such, it is always prone to human error; outsourcing providers are rarely incentivized to become more efficient over time, or to specialize in a merchant’s specific combination of industry, PSP, and dispute types

3. Partial Automation Tools

Tools that provide templates and workflows for chargeback departments.

Template and workflow tools provide structured frameworks and automated processes to help merchants efficiently manage disputes, reduce errors, and improve success rates in contesting chargebacks. There’s a wide variety of these that include everything from incredibly simple response boilerplates to more complex end-to-end workflow tools that scrape data, track disputes, and automate the submission of responses.

While these tools have obvious advantages over managing everything in spreadsheets, they have certain limitations. The biggest drawback is that templates are often static and cannot account for the nuances of each case. They rely on predefined formats that may not be flexible enough to handle unique or complex disputes.

Furthermore, the tools are still heavily reliant on the people operating them. As a result, the quality of responses can suffer during periods of surges in chargeback volumes, such as during the shopping holidays at the end of the year. When teams are overwhelmed with a high volume of disputes, the effectiveness of template-based responses may decrease, potentially leading to lower win rates and increased revenue loss.

Checklist: What to look for in a chargeback automation tool

When considering a chargeback automation solution, merchants should look for several key features to ensure they’re getting a comprehensive and effective tool. These include:

Dynamic responses: Look for a solution that can generate tailored responses for each chargeback case. Justt creates dynamic 6-20 page reports that highlight all necessary evidence to return revenue. This approach is far more effective than using static templates.

Access to PSP, internal, and third party data: The ideal solution should pull data from various sources, including:

- Data provided by the payment service provider (PSP) regarding the disputed transaction

- Third-party data enrichment such as additional information around Identity Verification Data (IDV)

- Merchant’s own data, including information related to the specific item/service purchased

Continuous optimization: Choose a solution that doesn’t just automate responses but also learns and improves over time. Justt uses machine learning to detect weak spots, conduct A/B testing, and continuously optimize responses based on win/loss decisions.

Flexibility in handling multiple PSPs: If your business uses multiple payment processors, ensure the solution can integrate with all of them and provide a centralized view of your chargeback data across different platforms.

Analytics and insights: Look for a solution that offers in-depth analytics and reporting. In Justt this is handled through the Customer Hub, which provides detailed insights into chargeback distribution, win rates, and recovery rates across different segments.

Ease of integration: The solution should offer multiple ways to integrate with your existing systems, such as API connections or CSV file uploads for data enrichment.

Automated submission: Ensure the solution can automatically submit responses to the relevant PSPs or acquiring banks, saving your team valuable time and ensuring timely submissions. Needless to say, this automation should not come at the expense of quality, since there is little value in on-time submissions when the wrong documentation is being submitted.

Scalability: The solution should be able to handle fluctuations in chargeback volumes without compromising on quality or response time. This is particularly important for handling seasonal spikes in chargebacks.

Compliance with latest regulations: As regulations like Visa’s CE 3.0 evolve, your solution should automatically update to remain compliant without requiring significant effort from your team.

Customization options: Look for a solution that can be tailored to your specific industry and business model. Understanding the card scheme rules and adapting them to specific industries and merchant flows is crucial.

Transparent pricing: Consider solutions that offer flexible pricing models, such as success-based fees or per-chargeback pricing, depending on what works best for your business.

Support and expertise: Choose a provider that offers not just technology but also expertise in the chargeback management field. This can be invaluable for staying updated on industry trends and best practices.

Futureproof your chargeback automation with AI

Chargebacks are complex. No single dispute is the same as another, and hundreds of individual data points could impact the outcome of each one. Considering just how many variables are at play in any chargeback dispute—products, customers, payment methods, reason codes, historical customer data, and much more—manual processes and basic rule-based automation cannot handle chargeback management properly at scale.

As the volume of chargebacks is expected to significantly increase in coming years, merchants, many of whom are already facing an uphill battle, may well find themselves drowning in an avalanche of chargebacks as time goes by. It’s at this point they’ll need to make a decision: Adopt an AI-powered solution that can scale chargeback management or continue as normal and watch as more disputes are lost, and revenue is thrown away.

Next steps:

- Read more about why AI is the future of chargeback automation

- Get a demo of Justt