Equip your business with the ability to increase chargeback win rates effectively as transaction volumes scale.

Winning Chargebacks at Scale

Any business that accepts credit or debit card payments has to handle the occasional chargeback. Unfortunately, it has become a growing problem for many merchants, impacting profitability and their standing with payment processors. In certain cases, it may even lead to the termination of one’s merchant account. Chargebacks are rising by 41% every two years, and 58% of merchants indicated that their chargeback rate has increased. Chargeback fees range from $20 to $100 per claim. Factoring in processing fees and other costs (e.g. shipping,) a merchant could lose over $100 on a single order. This amount doesn’t even include the loss in revenue and merchandise. Not all these chargebacks are due to third-party fraud or merchant error, as 81% of customers admit to filing a chargeback out of convenience. Additionally, 86% of chargebacks are probable cases of “friendly fraud” where the customer tries to get money back from a legitimate transaction by filing a chargeback — costing merchants $2.40 for every dollar’s worth of items sold. Merchants can dispute many of these chargebacks, so they don’t have to suffer financial losses. However, the high volume of cases makes it increasingly difficult for large merchants to handle them at scale. Let’s review the top chargeback challenges merchants face and discover how you can cost-effectively win chargebacks at scale through a secure, customized approach that leverages data to inform your rebuttal — an approach that we apply at Justt.

Top Chargeback Challenges Faced by Merchants

While most companies don’t have any issue handling a few chargebacks, winning them can put a strain on your business. Here are the top challenges preventing merchants from effectively disputing chargebacks at scale:

- Lack of resources to handle the increasing volume: Handling chargeback disputes is time-consuming and labor-intensive. In fact, labor costs make up about 32% of net chargeback expenses. Many merchants simply don’t have the staff to handle all the disputes.

- High fixed cost of hiring in-house specialists: While larger organizations can afford to hire an in-house team to handle chargebacks, this strategy isn’t feasible for most merchants. There’s no guarantee that you’d get the money back, so you could risk having to pay for a team and losing revenues on the disputes.

- Difficulty in identifying winnable disputes: Due to various constraints, merchants only dispute 43% of chargebacks. If you can’t fight every chargeback, you have to pick your battles. However, the lack of data, access to supporting evidence, and transparency can make it hard to decide which disputes to pursue.

- The complexity of tracking down evidence: You must identify what documentation you need to build your case and compile the supporting paperwork, which is a process that can take a lot of time and require a lot of effort that many merchants can’t afford to spare.

- Lack of data: Most merchants can benefit from analyzing thirdparty data to find evidence. But most don’t have access to the data or the technology required to generate insights to incorporate in their rebuttal. That’s why here at Justt, we apply third-party data from multiple sources to build your case.

- Challenges with handling “friendly fraud”: Merchants struggle with handling dishonest customers in an environment that favors cardholders over merchants. Many companies shy away from disputing chargebacks due to the high number of friendly fraud cases.

- High processing fees and hidden costs: Fees can make up almost 40% of chargeback expenses, and they can be charged at different stages of the process by issuers, acquirers, and networks. If you challenge a dispute and don’t win, you lose the revenue and have to pay the fees.

How to Increase Your Chargeback Win Rate

Increasing your win rate is key to recovering more revenue and reducing the cost of chargebacks. A higher win rate can also incentivize issuing banks to conduct more research and do their due diligence before filing a chargeback. Not to mention, winning a chargeback can help prevent future “friendly fraud” from the same customer.

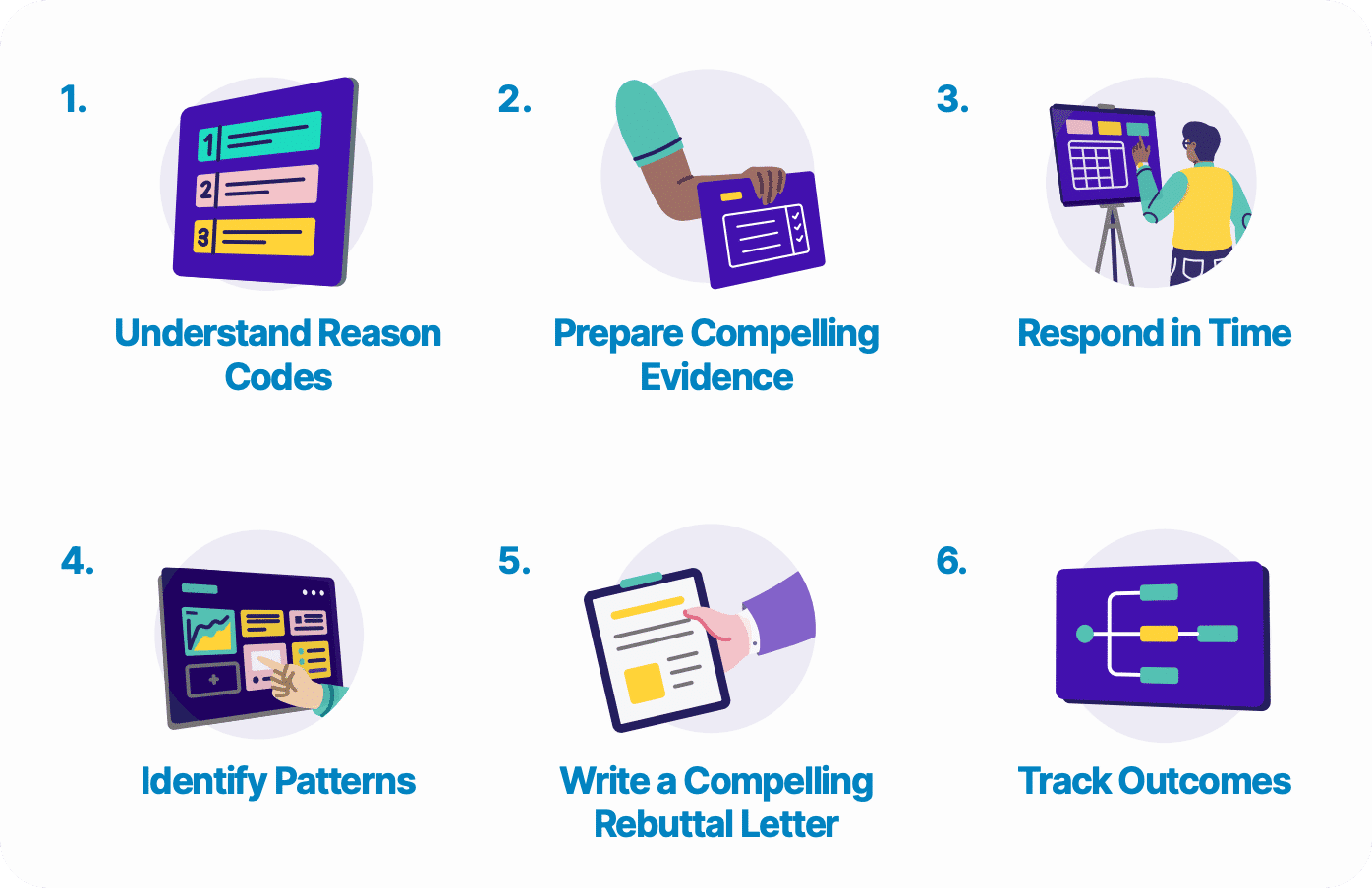

Here are the key steps to follow to maximize your chargeback win rate:

Understand the reason codes

Each chargeback includes a reason code that indicates why the customer filed the dispute. By understanding why the chargeback was filed, you can take the appropriate steps and compile the necessary evidence to resolve the case. You can also use the reason codes to identify patterns to prevent and defend future chargebacks more effectively. For example, you can see which code gets triggered most frequently and by which product so you can implement preventive measures. You can also see which transactions have the potential to affect your revenue the most. These codes vary from one card provider (e.g., Visa, MasterCard) to another, so you should use a chargeback reason code tool to look up the information. Also, these codes aren’t 100% reliable because friendly fraudsters often falsify reasons when filing a dispute.

Identify the required “compelling evidence”

You must prove the validity of the transaction in question with the appropriate documentation. Most of the evidence will come from your business records, such as sales receipts, order forms, and tracking numbers. But you can also tap into other information depending on your industry and the nature of the transaction. The more organized the evidence is, the easier it is to dispute a chargeback. You can include evidence such as communications between the customer and your customer service team, screenshots of a customer’s public social media profile showing the disputed goods being used, and matching AVS and CVV from the customer’s credit card. You can also demonstrate that the customer accepted your service, return, and refund policies, or that they have logged in, downloaded, and used a digital product.

Respond within the required timeframe

You can only dispute a chargeback within a strict timeframe, which differs from one payment network to another. For example, Visa gives merchants 30 days to respond, MasterCard allows 45 days, while American Express and Discover give you a 20-day window. Traditionally, card issues would assume that merchants who don’t respond to a dispute simply accepted the chargeback. But with the Visa Claims Resolution initiative, merchants could incur additional fines if they don’t submit a formal response to indicate whether they accept or deny the charge. You should check messages from your processor regularly to avoid missing any notification or an opportunity to challenge a dispute.

Organize your data and identify patterns

To dispute a chargeback promptly within the required timeframe, you must have all the information well-organized. Capture all relevant data sources that could aid a dispute (e.g., customer profiles, sales records, order details, and billing information) at the point of transaction and make sure they’re instantly recallable. You can also analyze the data to identify behavioral patterns (e.g., an address associated with multiple chargebacks) that may point to a customer being a fraudster. If you can present evidence that a customer habitually files chargebacks, you can build a stronger case against the fraudulent chargebacks in representment. The insights not only give you compelling evidence to bolster your case but also help you prevent potential fraud in the future.

Write a compelling rebuttal letter

You need to submit a rebuttal letter along with the evidence to support your case. While the letter should be fact-based and informative, it doesn’t have to be filled with dry legal language. Make it engaging and help the reader envision that you have done everything right to handle the initial transaction. Your rebuttal letter should be short and objective. Use clear and concise sentences and keep the length to one page. No matter how frustrated you are with the situation, keep your emotions in check and focus on presenting the facts. Also, call attention to the specifics by referencing details, such as the chargeback reason code, the contested amount, and any other evidence that helps your case.

Track success rates and learn from experience

Many factors affect the success of each chargeback dispute, and most of them are beyond your control. However, there’s still a lot to learn from each case to help you increase your overall chargeback win rate. Take note of which disputes are successful to see how you can replicate the process. You can also keep track of the chargeback reasons to identify trends and potential issues. For example, is the product description for an item on your website inaccurate? Do you have more than a few complaints about fraudulent card swipes at the point of sale? Investigating what triggers frequent chargebacks can help you prevent future disputes from happening.

How to Win Chargebacks at Scale Cost-Effectively

Over 80% of chargebacks are illegitimate. With the right strategies and compelling evidence, merchants can reduce their chargeback costs significantly. The challenge, of course, is to be able to do so at scale and during times when chargeback volumes fluctuate, for example, after the holiday season. So how can you overcome these challenges and win more chargebacks cost-efficiently? The good news is that you don’t have to do it alone. You can use a hands-off chargeback mitigation solution to help you recover more lost revenue.

The benefits of using a chargeback mitigation solution

Working with a reputable chargeback management service can help you dispute more chargebacks and increase win rates. Besides increasing your immediate revenue, here are other advantages of using such a solution:

- Lower operating costs: Outsourcing chargeback dispute management allows you to reallocate resources to focus on income-generating activities while lowering administrative expenses.

- Stop future losses: Winning chargebacks can help prevent friendly fraud from the same customers. A high win rate also incentivizes issuing banks to do their due diligence, so you’d less likely be hit with chargebacks in the future.

- Stay responsive: The online payment industry is fast-evolving, and it can be challenging to stay current. Outsourcing chargeback mitigation can help you stay agile without spending time and energy on tracking policy updates.

- Navigate the nuances: A chargeback management service knows the ins and outs of chargeback representment, such as how different issuing banks evaluate evidence, to help you present your rebuttal in the most favorable way.

- Increase revenue: The ability to win more chargebacks due to “friendly fraud” means you don’t have to decline as many potential fraudulent transactions. Effective chargeback management gives you peace of mind to accept more transactions.

- Improve customer relationships: You can better identify fraudulent claims to avoid fighting legitimate disputes that could impact customer experience and retention.

- Protect your merchant account: If your chargeback-to-sales ratio becomes too high, your acquirer may increase your processing fees or even terminate your merchant account altogether. Insights derived from a chargeback solution can help you minimize chargebacks without impacting sales to help you maintain a healthy ratio.

- Leverage data: A chargeback mitigation solution has access to vast amounts of data to identify patterns and increase win rates. The cost of accessing such information would be too expensive for most merchants.

Is a chargeback mitigation solution right for you?

Getting professional support can save you time and money if you handle chargebacks regularly. Merchants who use high-risk merchant category codes (MCCs), process many card-not-present transactions (e.g., eCommerce), and are at risk of exceeding their chargeback thresholds can benefit the most from using a chargeback management service.

How to Choose a Chargeback Mitigation Solution

A chargeback dispute is a complex process. An effective solution must address all the challenges and utilize the latest technologies to maximize win rates at scale. Here’s what to look for in a chargeback management solution:

A highly automated process

Any chargeback management services that rely on analysts to manually review chargeback will run into bottlenecks and scaling issues at some point. They’ll either be unable to handle your requests or compromise on the service quality to process more claims. Not to mention, delays can cause you to miss your deadline to submit a dispute. Look for a chargeback mitigation solution that leverages advanced automation technologies to ensure that all the steps are followed while effectively handling an unlimited volume of cases. For example, Justt uses machine learning (ML) models and automation to make the chargeback dispute process more efficient, so nothing falls through the cracks while handling all the disputes in a timely manner

A scalable solution

The number of chargebacks you get every month will vary depending on sales volume, seasonality, and other factors that are unpredictable and not under your control. Your service provider should offer the flexibility to scale up or down your volume so you’re not stuck with a plan that either can’t handle all your needs or makes you pay for services that you don’t use. Look for a pricing plan that allows you to shift your expense from fixed to variable cost and pay for only what you need. Your solution should have the capability to take on as many chargebacks as required so you don’t have to choose which ones to pursue and risk leaving money on the table.

A success-based pricing structure

One of the major chargeback challenges is the high cost associated with disputing the claims. Having to pay the various fees and invest in resources to file a case before having a chance to get the money back often causes smaller businesses to shy away from pursuing winnable disputes. We believe that merchants should be able to decide to pursue a chargeback dispute based on whether or not they believe it’s fair, not whether they have the resources to initiate the process. We pioneered a unique success-based solution that enables our customers to fight as many chargebacks disputes as they see fit. Our customers only pay us a set success fee for each won chargeback. If you don’t get your money back, you don’t have to pay us a dime.

Access to third-party data

You can’t fight chargebacks effectively without the right information and evidence. However, handling these disputes in-house limits the data you can access to internally available resources — which often isn’t enough to help identify patterns and support a comprehensive strategy. Relying solely on limited first-party data can also lead to errors and oversights. However, most businesses don’t have the resources to invest in expensive tools and data services in order to facilitate their evidence-gathering and investigation processes. Not to mention, without advanced AI and machine learning capabilities, sifting through all the data and identifying patterns can feel like looking for a needle in a haystack. Here at Justt, we leverage various third-party data sources to enrich evidence. Our experts constantly teach and refine our ML models to improve our win rates based on the latest real-world cases. When you partner with us, you can tap into insights and data that aren’t available to any single organization.

A secure system

When you work with a chargeback mitigation service, you need to open your books and share sensitive business and customer information. A data breach at your provider’s end could tarnish your company’s reputation, lead to loss of business, and even land you in regulatory hot water. It’s important to choose a solution that takes data security seriously. Look for a provider with a stellar reputation and a comprehensive security protocol. Inquire about their compliance status with privacy laws and security frameworks, such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and System and Organization Controls 2 (SOC 2).

Notifications and reporting

Responding to chargeback as soon as they come in gives you more time to gather evidence and build a stronger case. Meanwhile, tracking the status of your disputes can help you see trends and hidden patterns in your chargeback data. You can also identify the root causes of the chargebacks and take steps to prevent them. Your chargeback mitigation solution should provide an easy-to-use visual dashboard where you can see real-time status updates and analyze your data. We take transparency to the next level with Justt for Payment Service Providers. This solution enables payment service providers to notify merchants of new chargebacks, offer them clear status updates, and simplify evidence collection with a drag-and-drop tool.

A customized solution

Chargeback mitigation isn’t a one-size-fits-all solution. In many cases, merchants are disappointed about off-the-shelf solutions that promise the moon but fail to achieve satisfactory results because they don’t account for each business’s unique circumstances and challenges. Generalization doesn’t work when it comes to effective chargeback dispute management. When you partner with Justt, we don’t just put you into an industry vertical and push you through a cookie-cutter process. We take the time to understand your business and customize the solution for your needs. Why? Our success-based pricing structure means we have a lot of skin in the game!

Winning Chargeback at Scale Just(t) Got Easier

Managing chargebacks is challenging for merchants of any size. Navigating the complex and constantly changing rules is time-consuming and resource-intensive. Merchants who try to handle chargebacks in-house are stuck between a rock and a hard place: After the labor costs and fees, there isn’t much revenue left even if you win the chargeback. Identifying cases to pursue means you have to invest the resources upfront with no guarantee that you’ll win. But not submitting a dispute isn’t a good option either, as friendly fraudsters will learn they can take advantage of your policies to get free stuff. There are many benefits to using a chargeback mitigation solution. Not only can it help you lower operating costs and increase profitability, but you can spend that time building better customer relationships, protecting your merchant account, and navigating the nuances of the chargeback process cost-effectively. Justt is designed to address all phases of the chargeback process in order to help merchants win more and increase their profitability. Our AI-driven automated technology can scale up on a dime to handle any volume. Our industry-first success-based pricing structure means you don’t have to pay us until you get your money back. We leverage trusted third-party data to build your rebuttal and analyze all our cases to refine our approach. Additionally, our GDPR-, CCPA-, and SOC 2-compliant system gives you the peace of mind that your sensitive customer data is secure. Best of all, we customize our strategy for your business to maximize your win rates.

About Justt

Justt is dedicated to helping online merchants navigate the complex and costly system for credit card disputes. The company’s smart technology and in-house expertise successfully resolves chargebacks for merchants, automatically reuniting them with their revenue. Justt’s proprietary AI pulls the best evidence to build merchants’ most compelling defense and keeps getting smarter with time, so win rates continue to grow. Founded in Tel Aviv in 2020, Justt today numbers over 150 employees spanning three continents and supports enterprise level clients across a wide variety of geographies and business verticals.