Introduction

With VAMP enforcement beginning October 1st, 2025, and thresholds tightening dramatically by 2026, merchants who aren’t preparing now may soon find themselves facing substantial penalties. Despite the urgency, many still feel confused about how VAMP calculations work, what merchants need to monitor, and which tools and best practices can help businesses to stay compliant.

To cut through the noise, we recently brought together three payments industry leaders: Ami Patel, Vice President of Ecosystem Risk Programs at Visa; Robbie MacDiarmid, Global Head of Product at CMSPI; and Roenen Ben-Ami, Justt Co-Founder and Chief Risk Officer. Below we’ve summarized the five key takeaways from their conversation for merchants who are looking to get VAMP-ready. You can also watch the full 45 minute webinar on demand here.

Recap: The State of VAMP

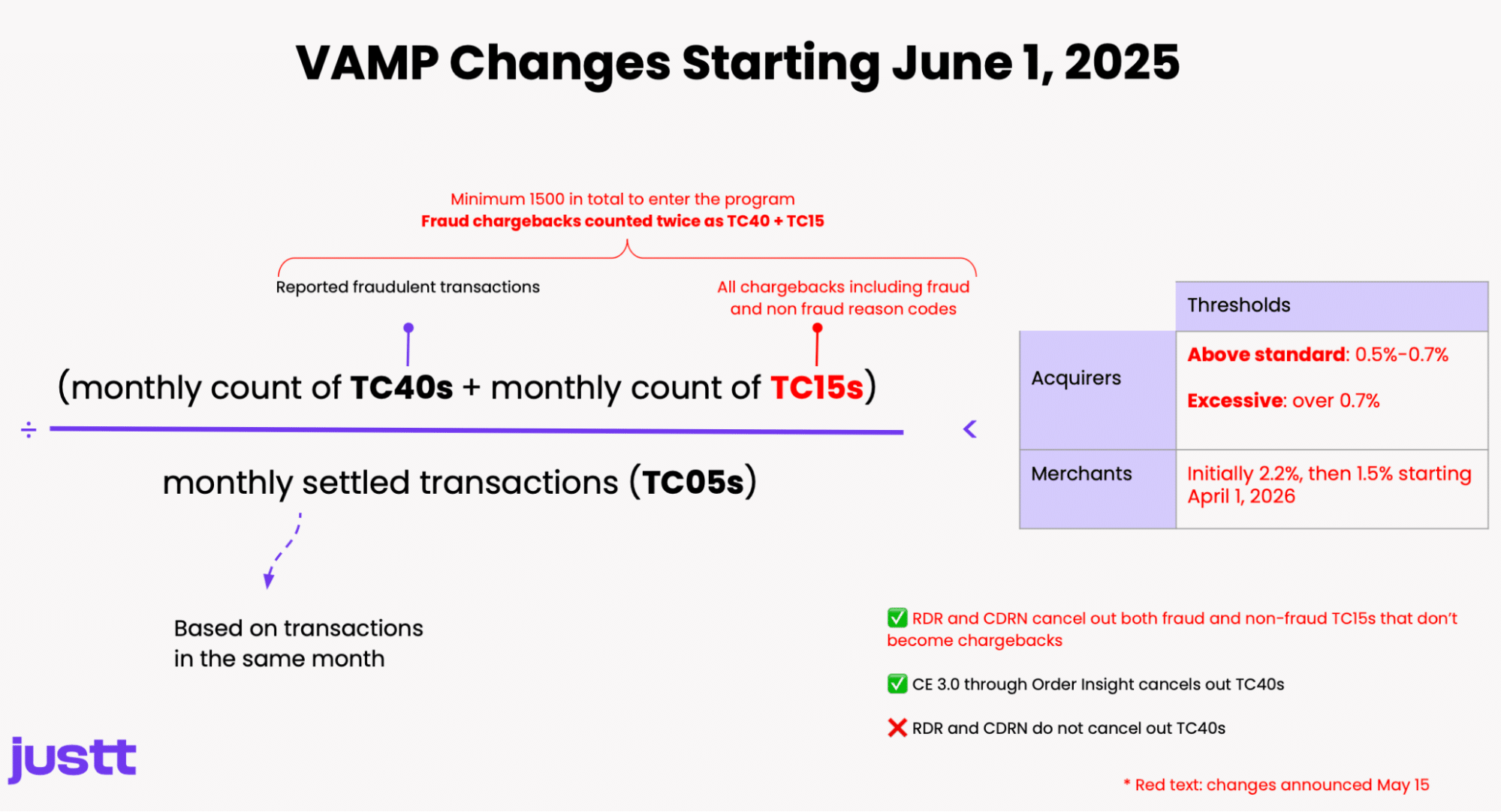

- The new Visa Acquirer Monitoring Program (VAMP) went into effect on April 1, 2025, with some of the program terms updated on June 1, 2025. VAMP consolidates the Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP)

- For merchants, this means a new metric for monitoring chargebacks and fraud, and a shift in how tools for fraud prevention and dispute resolution impact your standing with Visa.

- The VAMP ratio will determine whether merchants and acquirers are enrolled into the VAMP program, and potentially be subject to penalty fines.

- The VAMP ratio is calculated as: TC40 (fraud reports) + TC15s (all chargebacks including fraud and non fraud) / all transactions in calendar month (TC05s).

- Fraud reports that become fraud chargebacks will be double-counted- both as a TC40 and TC15.

- Penalty thresholds (Excessive) will initially be 2.2% for merchants, and decrease to 1.5% from April 1, 2026; for acquirers, the thresholds are 0.5% (Above standard) and over 0.7% (Excessive).

- The use of Rapid Dispute Resolution (RDR) and Cardholder Dispute Resolution Network (CDRN) will cancel out TC15s (chargebacks) but not TC40s (fraud reports).

- Merchants will not be included in the program if their total number of TC40s + TC15s is under 1500 in a calendar month.

Still not sure what’s actually going on? Check out our previous blog post and FAQs.

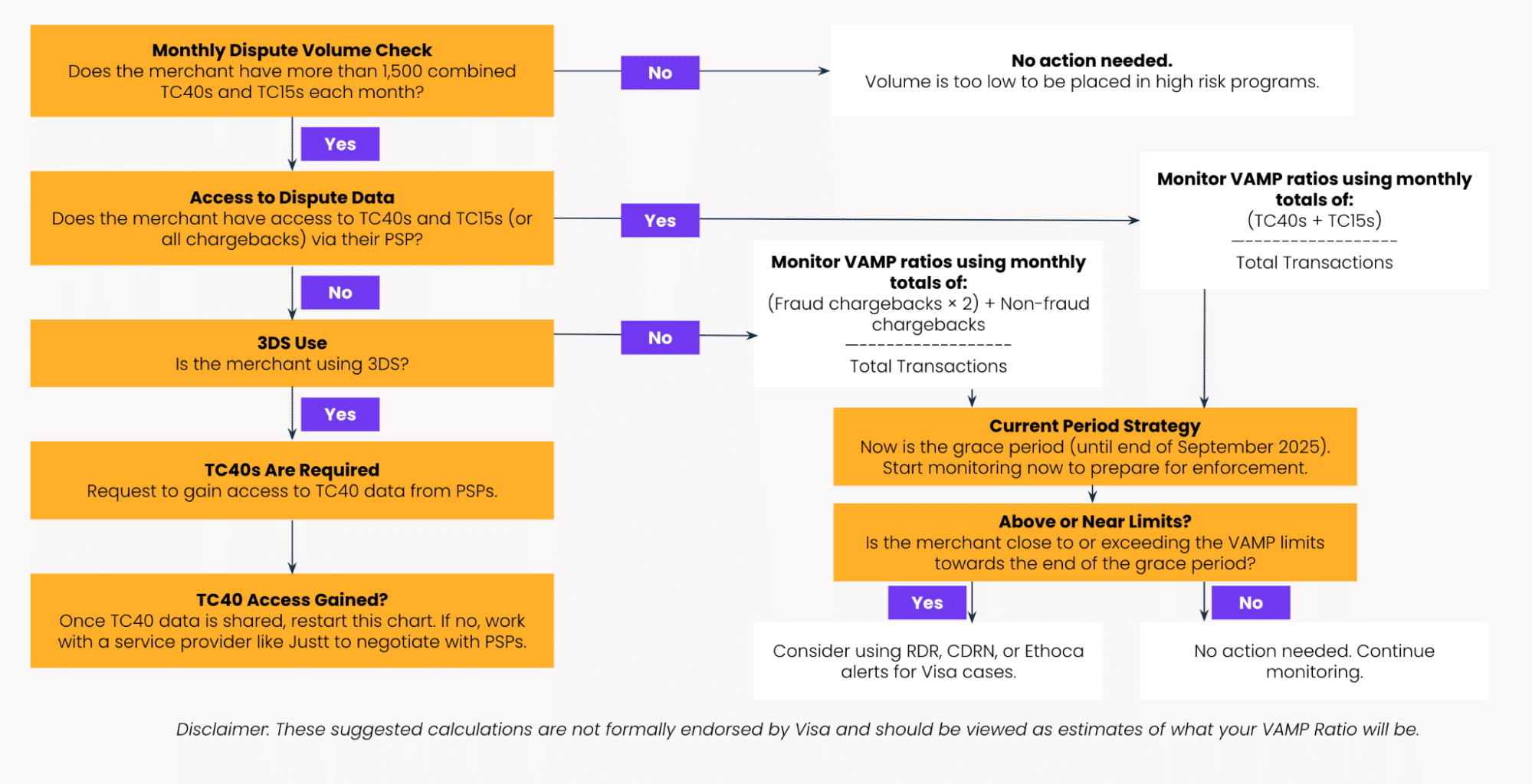

Calculating the VAMP Ratio – a flow chart

Use this chart to determine if and how you can monitor your VAMP ratio and prepare for enforcement at the end of September 2025.

1. Know Your Timelines: Use the Advisory Period

The advisory period, running from June 1st through September 30th, 2025, represents a critical window for merchants to prepare for VAMP enforcement without facing penalties. During this time, there will be no enforcement actions, making it the ideal opportunity to get VAMP-ready. Use this period to:

- Understand how to access and monitor your TC40 and TC15 data coming from payment service providers and acquirers.

- If your total number of TC40s and TC15s (combined) is above 1500, you are at risk of being enrolled into VAMP. Calculate and monitor your current VAMP ratios and understand where you stand relative to the thresholds.

- Review and strengthen risk controls, especially for if you’re above or close to threshold.

- Engage with acquirers (PSPs) during this time to understand any implications from the acquiring side, including how penalties might be passed through and what the acquirer’s own VAMP performance looks like (more on this below).

2. Get Access to Your TC40 and TC15 Data, and Monitor Your Ratios

VAMP preparedness starts with understanding where you are, and what you’re up against – this requires a firm understanding of the regulation’s nuances, your TC40 and TC15 rates, and how they measure up under the new system.

Roenen highlighted that accessing this data might not always be straightforward : “Though this is information that you should be able to get from your PSPs or acquirers, it’s often not readily available.” TC40 data – critical for calculating your fraud component – often sits locked within acquirer systems, invisible to the merchants who need it most.

This situation requires proactive engagement. Merchants should work with their different payment service providers to ensure access to TC40 and TC15. If the data isn’t readily available, push for commitments on when it will be. Consider this your most critical action item – you can’t manage what you can’t measure.

It’s worth noting that the situation is different for merchants who use 3D Secure (3DS), compared to those who do not:

- Merchants using 3DS are dependent on their PSPs for the TC40 data, as this creates a liability shift – meaning the fraud chargeback will not come in.

- Merchants not using 3DS that have a hard time getting TC40 data can get an approximate estimate of their VAMP ratio by multiplying their fraud chargebacks by 2x (as every TC40 should result in a fraud chargeback, and these are counted twice according to the new rules)

3. Find Opportunities to Reduce Disputes. Your Chargeback Data Can Help

It might seem like a no-brainer, but the most effective way to prepare for VAMP is to reduce your TC40s and TC15s – even if you’re not currently at risk of enrollment. Aside from ducking VAMP thresholds, this can benefit your entire payments operations.

“Merchants can really win by focusing on fraud and disputes. Our data shows that lower risk portfolios have a 10% higher approval rate for their transactions from issuers. If they have lower fraud, lower disputes, you know, issuers are savvy to that and they are able to approve transactions more.”

Ami Patel, Visa

Reducing fraud and chargeback-related disputes is a larger challenge that typically requires a combination of fraud prevention tools, clear return policies, a customer-centric commercial approach, and other operational improvements. An often under-used resource in this context is your chargebacks data. Roenen noted that this data “can reveal fraud rings getting through your system, and how to stop them, alongside legitimate consumer issues and technical problems in your system that are causing non-fraud disputes.”

To learn more, read our previous article: What Merchants Can Learn from Chargebacks Data

4. Engage Your Acquirer… Before They Engage You

Acquirers face their own stringent thresholds under VAMP – 0.5-0.7% for “above standard” status, and 0.7% for “excessive”. This pressure turns the merchant-acquirer dynamic into a risk partnership where both parties sink or swim together – with potential consequences for businesses facing VAMP enrollment.

Robbie MacDiarmid of CMSPI warns that “You can imagine merchants being penalized directly by their acquirer as a result of dragging their portfolio above the threshold,” and suggests that smart merchants will use the advisory period to reset these relationships.

Robbie recommends you start by asking your acquirer about their own VAMP ratio and how they plan to manage portfolio risk. Learning whether your PSP is comfortably below thresholds or scrambling to improve can inform your negotiation strategy and highlight potential risks to your processing relationships.

It is equally important to review contractual terms that were likely drafted before VAMP existed.

“It’s worth having a conversation with your acquirer about the agreement that you have and how the penalties will be passed through when they are ultimately passed through to you.”

Robbie MacDiarmid, CMSPI

5. Consider Your Use of Pre-Dispute Tools

Visa has strategically designed VAMP to incentivize adoption of pre-dispute resolution tools, like RDR, CDRN, and CE3.0. However, understanding how each tool impacts your ratios – and your bottom line – requires careful analysis of your specific dispute patterns and business model.

As mentioned above, RDR and CDRNs will allow merchants to avoid TC15s for the purposes of VAMP ratio calculations, as they enable some disputes to be resolved before becoming chargebacks. However, these tools will not cancel out TC40s, as these are registered before a chargeback is filed.

“Chargebacks avoided through tools like Verifi’s RDR and CDRN are excluded from the dispute (TC15s) side of the VAMP ratio equation,” Patel explains. “That’s to encourage their use and to help reduce the customer friction and the customer pain point.”

It’s worth noting here that the use of pre-dispute resolution tools can impact your overall revenue recovery rates since they result in refunds that affect your bottom line. Hence, it’s always worth considering your use of them as part of a broader revenue recovery strategy.

Another relevant tool is Compelling Evidence 3.0 (Order Insight), which allows merchants to share transaction data with issuers in real-time. This can help the issuers’ representatives dissuade cardholders from pursuing a dispute (e.g. by clarifying the time and place where the transaction was made based on the data received from merchants). In these cases, both disputes (TC15) and fraud reports (TC40) won’t be filed in the first place, and thus they will be excluded from VAMP ratios.

“If you’re close to, or have passed the limits, then it may make sense to start working with a third party that can provide you with CDRN, RDR or CE3.0, and figure out which is the best solution for you.”

Roenen Ben-Ami, Justt

The VAMP Ramp: How Smart Chargeback Management Can Help

The merchants who will thrive under VAMP are those who view this transition not as a burden, but as a catalyst for operational success. The same capabilities required for VAMP compliance – comprehensive data visibility, proactive dispute management, and strategic tool deployment – are those that create lasting competitive advantages in an increasingly complex payments landscape.

These are also the capabilities that an intelligent chargeback mitigation platform can offer merchants. Experts at Justt have seen firsthand how businesses that invest in comprehensive dispute management don’t just avoid penalties – they unlock revenue growth through improved authorization rates, reduce operational costs through automation, and build stronger relationships with both customers and payment partners.

Justt’s AI-powered solution provides a unified view of chargeback data,fully automating the diverse evidence collection and representment creation that wins disputes, and providing Verifi and Ethoca alerts through its platform when relevant for the merchant. Remember that while VAMP enrollment will hurt some businesses financially, losing those disputes will often hurt more – sometimes costing businesses up to 25% of net revenue. Win rates, fees, and operational costs should all be part of your broader revenue recovery strategy.

To learn more about maximizing your revenue recovery with Justt, schedule a demo with a chargeback management expert.