What is Chargeback Fraud?

Chargeback fraud, or “friendly fraud”, occurs when a cardholder disputes a legitimate transaction with their bank or card issuer, usually with the intention of keeping both the transaction sum and the purchased product or service. This practice costs businesses an estimated $132 billion annually and accounts for 70% of all credit card fraud. Moreover, chargeback fraud is a growing problem; Verifi research shows that 79% of merchants experienced friendly fraud in 2024, a 34% increase from the previous year.

How Chargeback Fraud Works

Chargeback fraud exploits the payment card industry’s robust consumer protection measures, with the result that merchants bear the burden of proof. The process follows a pattern where a customer makes a legitimate purchase, but later contacts their bank to dispute the transaction, claiming it was unauthorized or that they never received the product.

The card issuer then initiates a chargeback, removing funds from the merchant’s account. To reverse this process, the merchant must send a representment of compelling evidence to their acquirer, who forwards the evidence to the issuer through the card scheme.

The issuer reviews this representment – usually in approximately three minutes – before making a decision. If they decide that the transaction was legitimate, the disputed sum is returned to the merchant’s account. If they decide in favor of the cardholder, the merchant loses the sum, the product, and any associated delivery fees.

Types of Chargeback Fraud

Chargeback fraud falls into two main categories – intentional and unintentional. However, with only the cardholder’s word to rely on, they are difficult to distinguish, and often prove equally damaging to merchants. As their names suggest, intentional chargeback fraud occurs when customers deliberately exploit the system, for instance by “cyber shoplifting”, while unintentional chargeback fraud happens when customers dispute legitimate charges without fraudulent intent. Let’s take a look at the most common types of each:

Intentional Chargeback Fraud

- Cyber shoplifting involves making purchases with the premeditated intent to file a chargeback, effectively acquiring goods or services for free. Serial cyber shoplifters can be very creative with their dispute claims, though the most common reason codes are “unauthorized purchase” and “item not delivered”.

- Refund policy avoidance is where cardholders file chargebacks after being denied a refund due to policy restrictions, such as expired return windows, or when an item is no longer in its original condition.

- Buyer’s remorse can lead cardholders to file a dispute simply because they changed their mind. Like cyber shoplifting, these disputes are not grounded in fact, and reason codes may vary substantially.

- Double dipping refers to where a cardholder requests a refund directly from the merchant, while also filing a chargeback for the same transaction.

- Service utilization claims involve cardholders disputing a digital product or service after fully using or consuming it, falsely claiming non-delivery, dissatisfaction, or non-use.

Unintentional Chargeback Fraud

- Transaction confusion may lead to cardholders failing to recognize a purchase on their statement due to unclear billing descriptors or forgotten purchases.

- Family fraud arises when cardholders dispute charges made by family members who used their payment information without permission.

- Subscription confusion can cause cardholders to dispute recurring charges for subscription services as unauthorized, simply because they have forgotten the subscription or failed to read the payment terms and conditions.

Why Chargeback Fraud is Challenging for Merchants

Fraudulent chargebacks present challenges for merchants that extend far beyond the initial loss of the disputed sum. Unlike refunds, which merchants manage according to their own policies, chargebacks are largely controlled by card issuers. Merchants typically learn about disputes only after funds have been withdrawn, with little opportunity to resolve issues directly with customers.

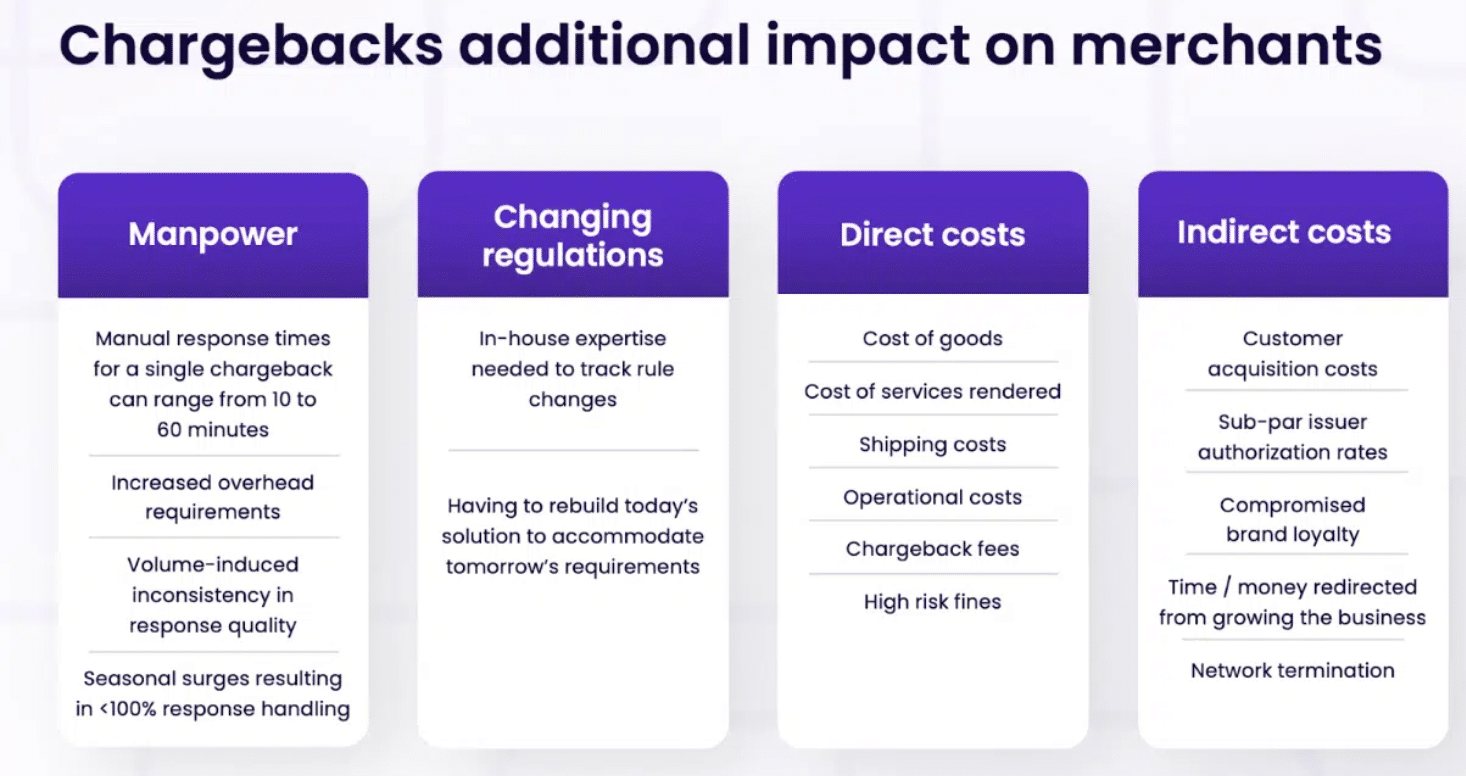

The financial impact of chargeback fraud also significantly exceeds the transaction amount, and includes chargeback fees, lost merchandise, shipping costs, and processing fees. High chargeback ratios can also trigger higher processing fees, fines, account restrictions, or even termination of merchant accounts. For businesses operating on tight margins, these combined losses can significantly impact profitability, amounting to losses of up to 25% of net revenue.

Moreover, disputing chargebacks effectively requires significant time and resources, diverting attention from core business activities. Chargeback fraud is unpredictable, prone to surge and ebb without notice. Surges can overwhelm manual teams and template based solutions, causing representment quality to suffer and revenue to be lost. Conversely, periods of inactivity can leave idle hands on your payroll.

Preventing Chargeback Fraud

Preventing chargeback fraud is a lot more difficult than stopping true fraud that results in legitimate chargebacks. This is partly because antifraud tools like CVV, AVS, and 3D Secure – while capable of weeding out bad actors using stolen card details – are expressly designed to admit cardholders who make legitimate purchases, even if they intend to fraudulently dispute them later.

In fact, there are very few measures merchants can take that effectively prevent intentional chargeback fraud unless the cardholder has previously offended – in these cases, advanced antifraud systems may flag the threat, or merchants may bar repeat offenders from making purchases.

However, there are a number of measures merchants can take to prevent unintentional chargeback fraud from occurring. Clear billing descriptors, transparent policies, customer service accessibility, and subscription reminders can all help to alleviate confusion and frustration that may lead cardholders to commit unintentional chargeback fraud.

How to Respond to Chargeback Fraud

Merchants find greater success by disputing fraudulent chargebacks when they arise, enabling them to overturn the results, and recover their lost revenue. In fact, consistently fighting chargebacks can build a hard-nosed reputation that deters friendly fraudsters, who may look for an easier mark elsewhere. The best defense is a good offense, after all.

The most effective chargeback response strategies combine: robust evidence collection practices, prompt action to meet deadlines, compelling representment narratives to persuade issuers, and comprehensive industry knowledge so that no regulatory change is unaccounted for.

However, this is easier said than done. Manual teams struggle with surges, losing revenue just when you need to preserve it most. Similarly, the template-based systems that most chargeback solutions use are unable to accommodate the nuances of unique cases, imposing rigid structures that forbid narrative flow, and bury vital information deep within the evidence document, where issuers may never see it.

Justt: The Smart Solution for Chargeback Fraud

Justt’s unique combination of world-leading AI and unparalleled evidence collection technology enables merchants to combat chargeback fraud hands-free – with the most effective representments on the market. First, the system pulls evidence from +500 data sources – including PSPs, internal merchant systems, and verified third-party providers – selecting the most compelling data points from the largest possible pool.

The platform’s Dynamic Arguments feature then creates precision-tailored responses for each dispute. Every detail from style and format, to layout and narrative flow is granularly adjusted to meet the preferences of the specific issuer reviewing the case. Justt’s end-to-end automation means that the entire process happens instantaneously, so that no deadline is ever missed.

Finally, the solution’s advanced machine learning capabilities mean that every dispute is informed by millions that preceded it, retaining strategies that prove effective and abandoning those that don’t. This approach ensures that your win rate isn’t simply stable during surges, but continues to rise over time.