What is compelling evidence in a chargeback scenario?

Compelling evidence refers to the data and documentation that merchants provide to prove the legitimacy of a disputed transaction. This evidence is used in the chargeback representment process, where merchants attempt to reverse a chargeback and recover lost revenue. Compelling evidence typically includes any written or electronic documentation, or other relevant data, that verifies the merchant followed established transactional procedures and that the cardholder’s claims are unfounded.

The importance of fighting chargebacks with compelling evidence

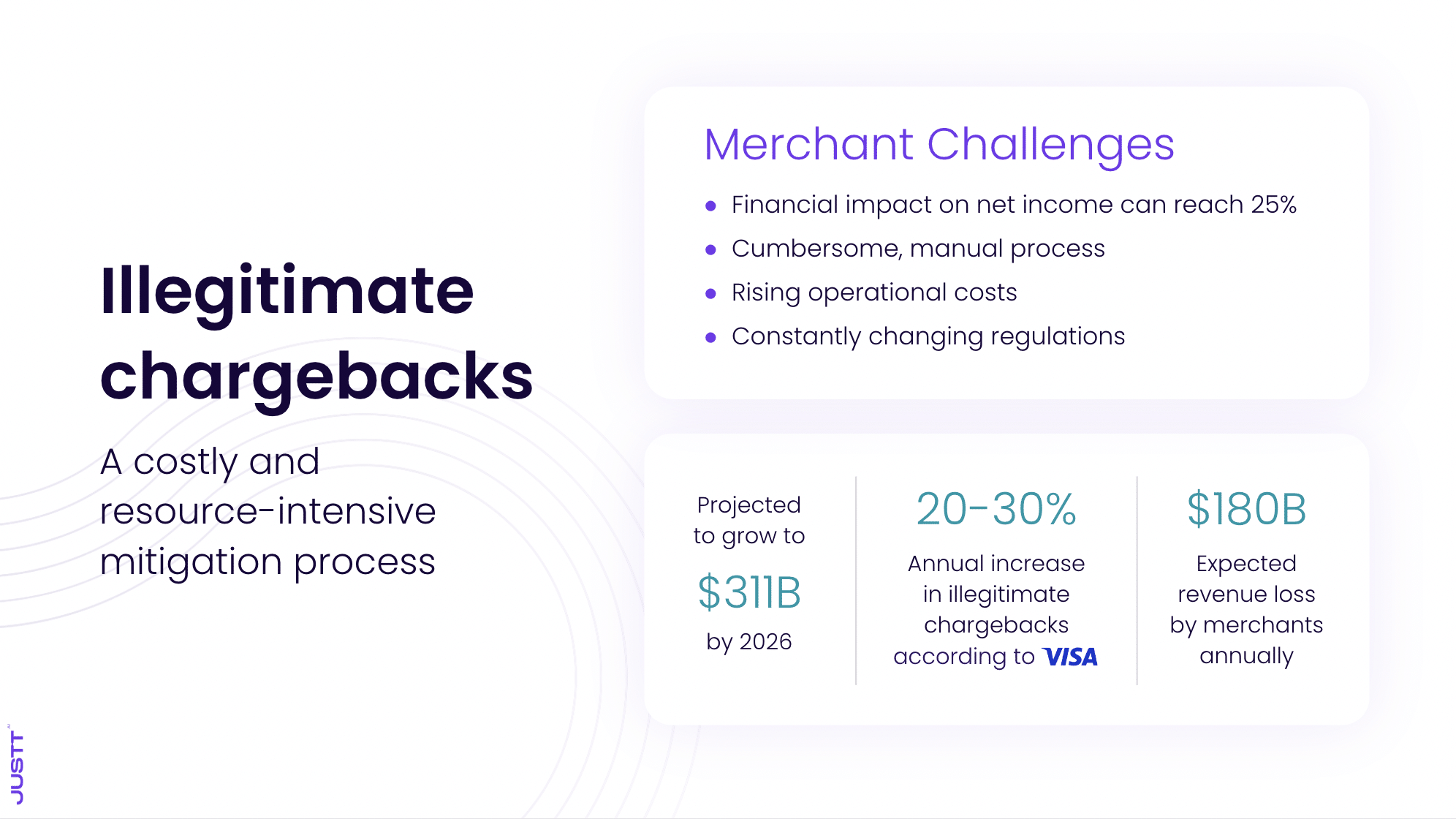

Fighting chargebacks with compelling evidence is essential to protect revenue from instances of first-party, or ‘friendly fraud’, where cardholders knowingly or unknowingly dispute legitimate transactions. First-party fraud is a growing problem; research shows that instances rise by 20-30% annually, and now represent more than 61% of all chargeback cases.

Chargebacks are incredibly costly, not only in terms of lost sales and merchandise but also due to potential damage to the merchant’s reputation with payment processors, and the fines, fees, and penalties they issue for high chargeback rates. Lost revenue from chargebacks alone can amount to 25% of a business’ net income – and that is without taking into account these additional fees. Compelling evidence is the only way that merchants can overturn illegitimate chargebacks, and recover their lost revenue.

How does compelling evidence work?

When a cardholder initiates a dispute with their issuer, the issuer makes a decision about whether to instigate a chargeback based on the evidence provided. If a chargeback is initiated, the issuer sends the information to the card scheme, who forwards it to the merchant’s acquiring bank, who debits the merchant the price of the chargeback, plus additional chargeback fees. The chargeback amount then flows back through the chain, to the issuer, who credits the cardholder.

The merchant has the opportunity to contest it through the representment process. They must submit compelling evidence to their acquiring bank, which then forwards it to the issuing bank via the card network. The issuing bank reviews this evidence and decides whether to uphold or reverse the chargeback. Compelling evidence works by creating reasonable doubt about the cardholder’s claim, demonstrating that the transaction was legitimate and that the merchant fulfilled their obligations.

What kinds of evidence are compelling when fighting chargebacks?

The type of evidence considered compelling varies depending on the nature of the dispute, the reason code/s involved, card schemes’ criteria for what constitutes compelling evidence, and issuers’ differing assessment procedures. However, the most common forms of compelling evidence include:

- Transaction receipts: These are records of the purchase, typically including details such as the date, time, amount, and items purchased. For card-present transactions, they may include a signature. Transaction receipts may prove that the transaction occurred and was authorized by the cardholder.

- Delivery confirmation receipts: These documents prove that the goods were delivered to the address provided by the cardholder. They often include the date and time of delivery, and sometimes a signature from the recipient. This evidence is particularly useful in countering “goods not received” claims.

- Proof of customer authentication: This includes data from Address Verification Service (AVS) and Card Verification Value (CVV) checks. A match in these areas suggests that the person making the purchase had access to information that should only be known to the legitimate cardholder, strengthening the case that the transaction was authorized.

- Communication records with the customer: These can include emails, chat logs, or transcripts of phone conversations. They can demonstrate that the customer was aware of and agreed to the transaction, or that they received and were satisfied with the product or service.

- IP address logs: These show the geographic location from which the order was placed. If this matches with the cardholder’s known location or previous purchasing patterns, it can help prove that the transaction was legitimate.

- Device identification data: This information can show that the purchase was made from a device the customer has used for previous, undisputed transactions, suggesting that the current transaction is also legitimate.

- Signed orders or contracts: These documents, bearing the customer’s signature (either physical or digital), can prove that the customer agreed to the terms of the transaction, including any recurring billing arrangements.

- Product or service usage logs: For digital goods or services, these logs can show that the customer accessed or used the product after purchase, countering claims that the product was not received or the service not rendered.

Copies of relevant policies: Providing the terms and conditions, return policy, or cancellation policy that was in effect at the time of purchase can demonstrate that the merchant acted in accordance with their stated policies, which the customer agreed to during the transaction.

What are chargeback reason codes?

Chargeback reason codes are standardized codes assigned by card networks to categorize the reason for a dispute. Each code represents a specific type of claim, such as “goods not received,” “transaction not recognized,” or “recurring transaction canceled.” These codes help guide merchants in understanding the nature of the dispute and determining what type of compelling evidence is most relevant to contest the chargeback.

Most chargeback solutions providers offer formulaic templates standardized to the reason code alone. However, this approach risks omitting important factors such as the preferences of the issuer, the prioritizing and arrangement of key information on a case-by-case basis, and the inclusion of more nuanced arguments than the reason code permits. This approach consequently results in relatively low chargeback win rates compared to more advanced, machine learning-driven solutions.

What challenges can fighting chargebacks with compelling evidence present?

Fighting chargebacks with compelling evidence can be challenging for several reasons. First and foremost, the process is intrinsically biased towards the cardholder. Numerous federal and financial regulations have been designed to protect customers from merchant malpractice. However, the burden of proof consequently lies with the merchant, and ample compelling evidence must be provided to reverse a chargeback. Other challenges presented by compelling evidence include:

- Time constraints: Merchants often have limited time to gather and submit evidence. Card networks and banks typically impose strict deadlines for chargeback responses, usually ranging from 7 to 30 days. This short window can be challenging, especially for merchants dealing with high transaction volumes or complex cases that require extensive evidence gathering.

- Varying requirements: Each card network has different standards for what constitutes compelling evidence. Visa, Mastercard, American Express, and Discover each have their own set of rules and expectations. Additionally, individual issuing banks may interpret these rules differently. This inconsistency means that evidence that works for one dispute might be insufficient for another, even if the circumstances seem similar.

- Resource intensity: Gathering and organizing evidence can be time-consuming and labor-intensive. It often requires coordination between multiple departments (e.g., sales, customer service, shipping) to collect all necessary documentation. For smaller merchants, this can mean diverting significant resources away from core business operations. Larger merchants sometimes have dedicated teams to handle chargeback responses, leading to increased operational costs.

- Complexity: Understanding which evidence is most relevant for each specific chargeback reason code can be difficult. Each reason code requires different types of evidence, and merchants need to be well-versed in these requirements to craft effective responses. This complexity is compounded by frequent updates to card network rules and regulations, requiring merchants to continuously educate themselves on best practices.

- Inconsistent outcomes: Even with strong evidence, the results of representment can be unpredictable due to varying interpretations by issuing banks. Two seemingly identical cases might result in different outcomes depending on the issuing bank’s reviewer. This inconsistency can make it challenging for merchants to develop standardized processes for chargeback responses and to predict the success rate of their efforts.

- Data management and storage: Properly storing and quickly retrieving relevant transaction data and customer communications can be challenging, especially for high-volume merchants. Effective evidence submission requires robust data management systems and practices, which can be costly to implement and maintain.

- Keeping up with technological changes: As ecommerce evolves, so do the types of evidence that may be relevant in a dispute. For instance, the increasing use of biometric authentication or blockchain technology in transactions may require merchants to adapt their evidence-gathering processes.

Language and cultural barriers: For international merchants, providing compelling evidence can be complicated by language differences and varying cultural norms around business practices, potentially leading to misunderstandings during the dispute process.

Fighting chargebacks effectively with Justt’s Dynamic Arguments

Justt’s Dynamic Arguments feature was developed to comprehensively address the many challenges presented by fighting chargebacks with compelling evidence. This AI-driven system fully automates the process of gathering, organizing, and presenting compelling evidence, relieving the merchant of all associated labor, and the vast majority of the costs involved.

Dynamic Arguments analyzes each chargeback case individually, pulling relevant data from merchants, acquiring banks, and third-party sources to create tailored, highly optimized responses within seconds, and at any scale. The system considers the preferences and quirks of each issuer to construct the most compelling evidence, formatted and arranged in the most persuasive way. By leveraging machine learning and continuous optimization, Dynamic Arguments consistently improves your win rate over time, typically doubling successful chargeback reversals within weeks.

- Data aggregation: Justt systematically gathers and organizes evidence from various sources, including merchants, Payment Service Providers (PSPs), and third-party databases. This extensive collection of over 500 data points serves as the core for building robust evidence documents.

- Personalized dispute handling: The system leverages this comprehensive dataset to craft unique arguments for each case. It evaluates the specific elements of every dispute and identifies the most compelling and relevant evidence to include.

- Continuous enhancement: The model employs ongoing A/B testing of different evidence types and submission methods, selecting approaches that maximize chargeback recovery rates. This data-centric strategy allows the system to evolve constantly, adapting to new trends in chargeback disputes.

This automated approach not only increases the likelihood of successful chargeback reversals but also allows merchants to focus on their core business operations rather than the complexities of chargeback management. As regulations, best practices, and issuers evolve, Justt’s system adapts, ensuring that the compelling evidence presented remains current and effective in the fast-changing payment ecosystem.