Friendly fraud is soaring across the world – and SaaS organizations have become one of its primary targets. Now classified as a high-risk merchant category, the cloud-based nature of software-as-a-service companies makes them particularly vulnerable to fraudsters, who exploit the intangible quality of digital services to engage in cyber shoplifting and free-trial abuse. This article explores why the industry is vulnerable, and what you can do to prevent SaaS chargebacks affecting your bottom line.

Why Software Subscriptions Create Chargeback Challenges

While the card-not-present nature of cloud-based services means that SaaS companies are no strangers to true fraud, it is “friendly fraud” disputes that do by far the most damage. In many cases, these will be cases where software buyers falsely claim their own SaaS purchases were made from elsewhere using stolen data.

But false claims of true fraud are only one of myriad reasons that SaaS companies have come to fear chargebacks. The particularities of how these subscriptions are used, and even the ways that people have come to think about them, come with a unique range of vulnerabilities that launch millions of illegitimate disputes daily. Let’s take a look at a few of the most common:

Subscription remorse

SaaS companies usually operate via a subscription model. But when a cardholder stops using the service, they often forget to cancel the subscription. This leads to buyers’ remorse when they realise they’ve been paying for a service that they don’t use or use infrequently. Rather than seek a refund, chargebacks are often their first port of call. This dynamic is part of the reason why subscription services suffer higher than average chargeback rates than other merchants.

Free trials

There are few more effective ways to generate SaaS conversions than a free trial period before monthly or biannual payments are taken. This gives users a chance to test the product and make their own mind up about whether to cancel or continue. However, it’s free trials are easy to forget about, and can result in surprising or unwanted charges.

For example, a user might sign up for a free trial of a time tracking app with the intention of testing it out; while the initial signup is free, after seven days their credit card is charged. In this case the user might have forgotten about ever starting the free trial, or simply feel that they have been ‘ripped off’ even if it was within the Terms and Conditions. In these cases, they might resort to a chargeback to get their money back.

Family or household purchases

In cases of consumer SaaS (such as mobile apps), family members – or other members of the cardholder’s household – may use card details to pay for a subscription without the cardholder’s knowledge. For example, children might purchase games or subscriptions to streaming services by using already-entered card details, if the relevant controls are not in place. Once detected – and this might take a while – these types of purchases can then result in the cardholder filing a chargeback.

Complex tools

Many SaaS tools require a learning curve, tutorials, and practice to operate successfully. Unfortunately, this catches many cardholders by surprise. “Dissatisfaction with service” or “technical issue” chargebacks are frequently the result of a frustrated customer. It’s up to you to prove they received a fully functioning product – a difficult task for which a collection of comprehensive user records will prove absolutely indispensable.

Multiple payments

Finally, while most chargebacks dispute just one payment, the monthly or biannual payments involved in most SaaS products mean that disputes can target dozens of expected payments at once. Multiply this by the hundreds of thousands of users, and that’s a serious dent in your revenue. It doesn’t help that each dispute can count as a separate transaction, affecting chargeback rates and the SaaS vendor’s reputation as a merchant.

How to Combat Friendly Fraud in SaaS

While the challenges friendly fraud chargebacks pose to SaaS companies are significant, it is essential to remember that these disputes are illegitimate – in other words, they can and should be won by the merchant, provided the right strategies are followed. In fact, while the lack of a physical evidence trail in SaaS can pose problems, every digital interaction potentially creates timestamped compelling evidence that can help your case. Let’s look at a few simple ways to boost your SaaS dispute win rates:

- Implement robust logging and data retention policies that track user activity, login history, and feature usage, creating a digital paper trail that proves service delivery and customer engagement.

- Utilize AVS and CVV verification during signup and payment processing, and consider implementing 3D Secure to establish further authentication evidence.

- Create clear subscription terms with checkbox confirmations and email notifications before renewal dates, providing evidence that customers were informed about billing.

- Send regular usage summaries and engagement metrics to establish proof of value delivery and reduce non-usage claims.

- Develop a streamlined cancellation process that’s easier than filing a chargeback, reducing the likelihood that customers will choose the dispute route.

- Consider implementing dynamic billing descriptors that clearly identify your company and include support contact information to prevent “don’t recognize” disputes.

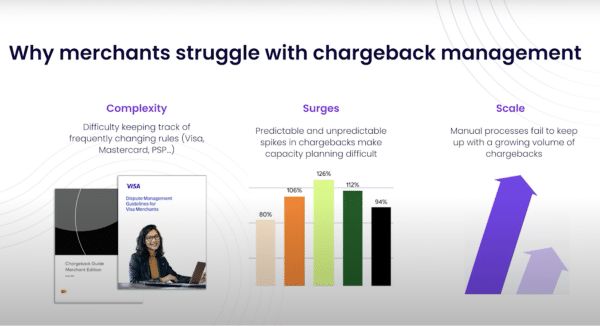

However, given the sheer volume of transactions SaaS companies process and the high percentage of subscriptions that result in chargebacks, these prevention measures ultimately won’t eliminate 100% of illegitimate chargebacks. At a higher scale, you will need to manage a post-transaction chargeback mitigation effort. As your subscription base grows, you’ll find yourself dealing with thousands or millions of subscribers, where even a small percentage of disputes can overwhelm internal teams and third-party services that rely on templates or manual review, sending win-rates crashing and potentially sacrificing up to 25% of net revenue.

Fully Automated Chargeback Management Fights SaaS Chargebacks Hands-Free

For SaaS companies dealing with the unique challenges of digital goods and subscription-based disputes, fully automated solutions offer a scalable lifeline. Just like designing software, the key is to use technology to reduce busywork and automate repetitive tasks.

One repetitive task in chargeback management is evidence collection and designing the representment letter. Justt uses advanced AI to automatically gather evidence from 500+ data sources – including merchants, PSPs, and third party enrichment – to build precision-tailored representments with zero merchant intervention.

Look for a solution that doesn’t only automate the process based on static templates, but continuously optimizes it. Justt’s Dynamic Arguments feature adjusts every aspect of dispute responses based on performance data across millions of prior SaaS cases, tailoring content, formatting, and evidence presentation to match reason codes, regional variations, and even granular issuer preferences. This intelligent approach is backed by rigorous A/B testing, which means win-rates aren’t just maintained, but typically rise over time.

Responding to SaaS-specific scenarios: The best systems provide tailored evidence for the type of disputes that appear in a software context, which might be very different from retail or event ticketing. For forgotten subscriptions, Justt can automatically retrieve proof of ongoing usage. For trial period disputes, it compiles records of EULAs. For auto-renewal complaints, they can gather evidence of disclosure during signup and renewal reminders sent before billing. This SaaS-specific evidence contextualization dramatically increases the likelihood of winning disputes.

Another advantage is the ability to handle both low-MRR and high-ACV transactions with equal efficiency. In manual systems, a smaller dispute might not be worth the 15 minutes a chargeback analyst spends on the response; this can obviously create big problems for companies that sell lower-ticket items. Automation helps here: whether you’re processing thousands of $9.99 monthly subscriptions or enterprise-level deals worth thousands, Justt’s fully-automated system effortlessly scales to handle any volume while maintaining pristine quality and meeting every deadline. This allows SaaS companies to protect all revenue streams from chargeback surges without needing to waste merchant time on decisions about which disputes are “worth fighting.”

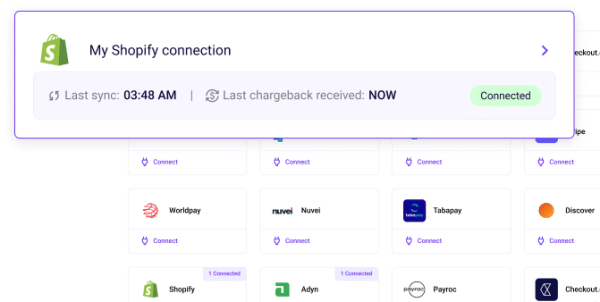

Finally, integrations matter. Your chargeback solutions should work seamlessly with the digital payment systems SaaS companies already use. Justt integrates directly with popular payment service providers including Stripe, PayPal, Adyen, and others, pulling transaction data automatically through secure integrations (via API or otherwise). The system also leverages third-party data sources to strengthen evidence, while offering multiple options for uploading proprietary data that often proves crucial to winning disputes.

Don’t Let Chargebacks Come Between You and Your MRR

In an industry where recurring revenue is the lifeblood of growth and valuation, every percentage point of MRR protected translates directly to improved sustainability. This means you simply cannot afford to take chances on friendly fraudsters who increasingly target digital services. While strong preventative measures help, the scale and complexity of SaaS disputes demand automated chargeback solutions. Not only can these systems secure your MRR, but they free your staff to focus on generating more for your business.