Chargebacks in the dawn of agentic commerce

Amazon’s new “Buy for Me” beta feature lets shoppers outsource the entire checkout process on third-party sites to an in-app AI agent—no browser, no manual form-filling, just one click. This shift marks the rise of “agentic commerce,” where AI agents will drive trillions in spend by automating price-shopping, coupon stacking, and instant checkout around the clock.

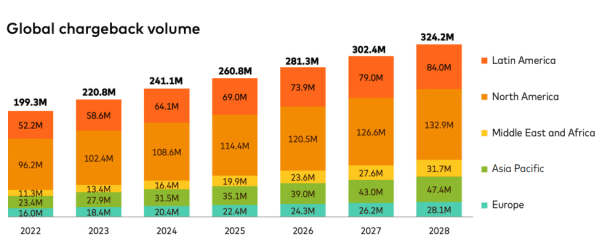

But as AI agents become the new checkout assistants, they also introduce more risk. According to Mastercard’s 2025 State of Chargebacks, global disputes are expected to jump from 261 million in 2025 to 324 million by 2028—a 24% surge largely driven by card-not-present transactions.

Merchants who continue to treat chargebacks as an edge-case cost center risk, may soon find themselves drowning under the sheer volume of incoming claims.

Image source: Mastercard

Double-Edged AI: Convenience vs. Risk

Yesterday, bot-like traffic screamed “card-testing script.” Today, that same pattern might be a legitimate shopping agent buying groceries on a customer’s behalf. Fraud teams must now distinguish between “helper” agents from hostile automation, even as both generate headless API calls that bypass browser-based defenses and operate directly with the merchant backend API.

Friendly-Fraud 2.0—“I Don’t Remember Authorizing That”

A 2025 MIT Media Lab EEG study of 54 students showed that heavy LLM users exhibit reduced memory retention and critical-thinking activity, often failing to recall their own work minutes later.

When shoppers outsource cognition to agents, expect a spike in friendly disputes: forgotten orders, mis-prompts (“I meant one, not ten!”), or agent glitches—all creating chargebacks where merchants are left holding the bag.

This isn’t just speculation; similar incidents have already occurred, such as, lawyers who relied on fake citations in their evidence, or an AI agent that deleted a company’s whole database!

We’re also likely to see a rise in buyer’s remorse, not due to fraud, but genuine confusion. When shoppers don’t directly experience the purchase flow, they’re more likely to dispute transactions they don’t fully recall or recognize.

This changes how we think about chargeback evidence. It’s no longer sufficient to show a smooth checkout. Merchants will increasingly need to prove:

- That the consumer had a clear agreement with the AI agent

- That they knowingly authorized the agent to transact on their behalf

- That the merchant fulfilled the order exactly as described

Evidence in an Agentic World

Traditional chargeback evidence— like IP geolocation and browser fingerprints—is rapidly losing relevance in cloud-native, agent-drive interactions. Images such as a screenshot of the checkout pages might even become obsolete. To win tomorrow’s disputes, merchants need richer telemetry:

| Classic Proof | Why It Fails with Agents | Modern Alternative |

| Customer IP | Cloud VM ≠ cardholder | Agent ID hash, API key |

| Device print | Resets with each headless session | Orchestration trace |

| Session flow | Single API call | Agent interaction logs or search history |

What Merchants Should Prepare for Agentic Commerce

Agentic transactions might look different under the hood, but the fundamentals of chargeback defense still apply. To stay ready, merchants should focus on capturing and storing key datapoints that can support representment.

- Order context: Items ordered, prices, fulfillment timelines

- Execution signals: Timestamps, session tokens, API headers, or agent IDs (if exposed)

- Account-level info: Customer ID, historical behavior, login and payment consistency

Even if the full customer-agent conversation isn’t visible, having a clear view of the execution trail can be enough to build a compelling case.

It’s not about perfect visibility; it’s about meaningful traceability.

At Justt, we understand that not every merchant stores data the same way. That’s why our platform accepts evidence through APIs, cloud storage links (like S3 or SFTP), CSV/PDF exports, or direct platform integrations. However you track your orders, we make it easy to put that data to work.

Our dynamic argument builder tailors each representment to the nuances of the transaction—adjusting for signals like cloud-based agent infrastructure, API-initiated checkouts, and alternative ID patterns—so your defense stays strong, even when the ecosystem evolves.

The Bottom Line

Agentic commerce is already reshaping e-commerce logistics, payments, and consumer behavior. Chargebacks are next.

The good news? Most merchants already have the infrastructure to adapt. A bit of planning today ensures you’re ready to handle tomorrow’s disputes with speed and confidence.