When merchants search for “chargeback tools,” they’re shown everything from fraud prevention vendors to alert services to dispute recovery platforms.

But these tools live in different layers of the chargeback lifecycle, meaning that each has a different function and serves different needs. Since it’s easy to get confused – we’ve decided to map the different tools so that merchants can easily find the ones they need.

This post breaks down the ecosystem, clarifies what each category actually offers as a benefit, and shows how these layers work together to build a complete chargeback management strategy.

Summary

- True chargeback automation refers to the recovery layer, where technology directly fights and wins disputes.

- Chargeback prevention and alert tools remain essential and work best as part of an integrated stack of chargeback management.

- Each layer of chargeback management tools automates a different part of the lifecycle: risk, resolution, or recovery.

- The most effective approach connects these layers through data, creating a system that learns and improves over time.

The challenge with the term “chargeback automation”

Search Google or ChatGPT for chargeback automation tools and you’ll see names like Ethoca, Verifi, Sift, Riskified, Midigator and Justt, all positioned around automation.

They’re all legitimate solutions. But they don’t automate the same thing.

Some spot fraud before it becomes a chargeback. Others intercept disputes and send alerts before they hit your chargeback ratio. And some, like Justt, automate the recovery process after a chargeback occurs.

Individually, each category has value. Taken together, they form the foundation of effective chargeback management. But it helps to understand what “automation” actually means at each layer,…and what it doesn’t.

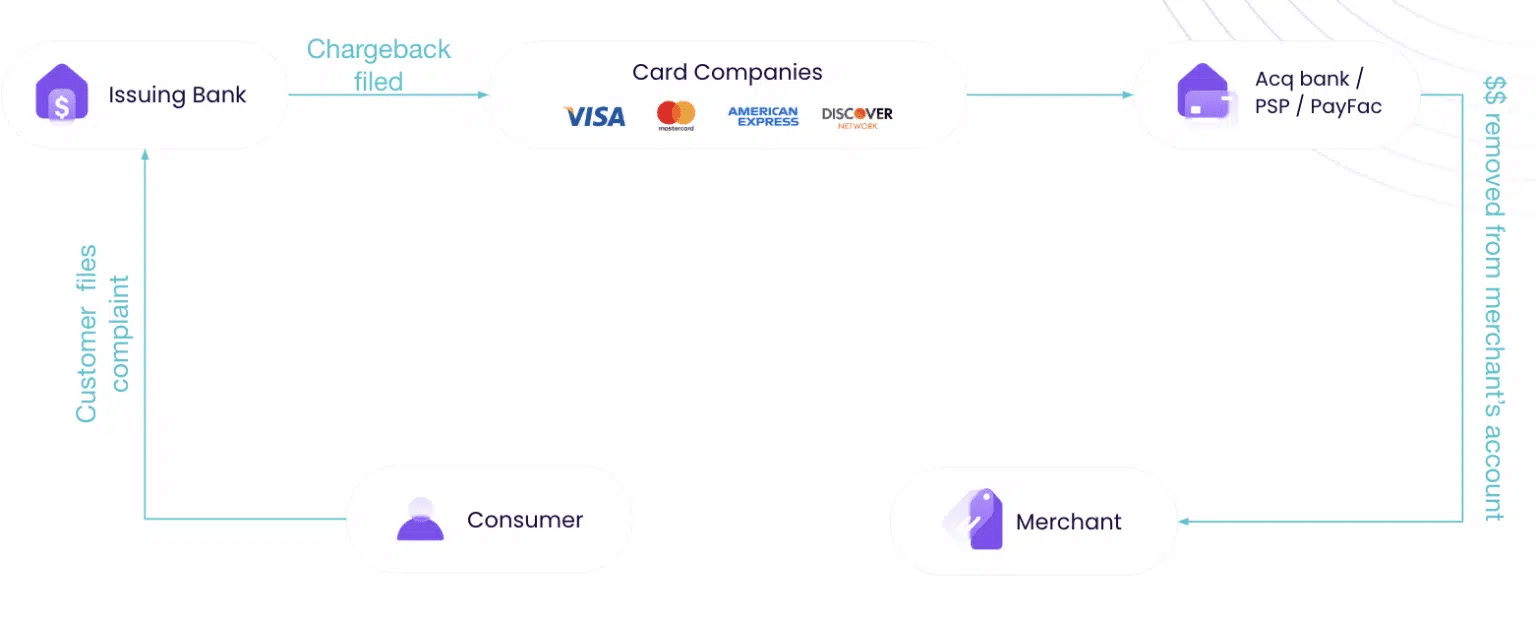

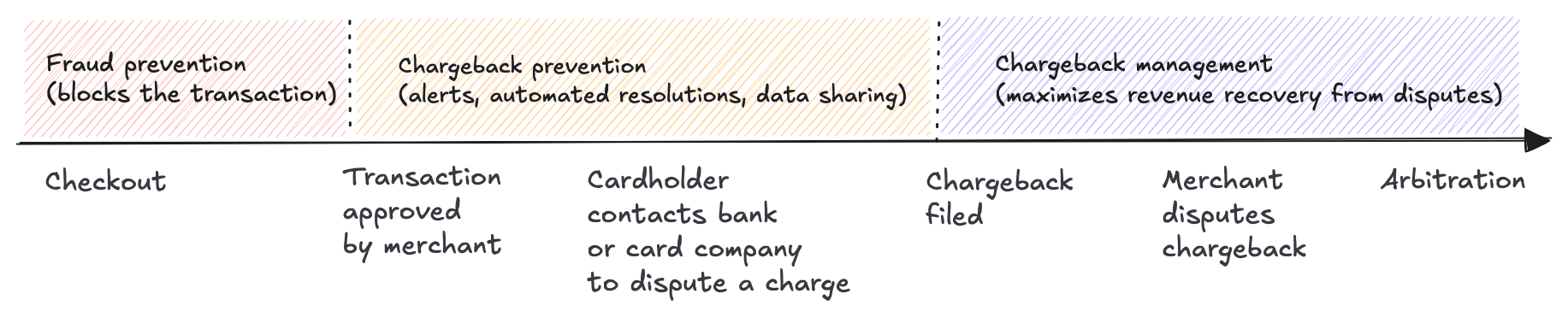

The three layers of chargeback management

The modern chargeback ecosystem breaks down into three main layers:

- Fraud prevention and chargeback insurance tools – stop fraudulent transactions before they lead to chargebacks.

- Pre-dispute / alert tools /chargeback prevention tools – detect and resolve potential chargebacks before they become formal disputes.

- Chargeback automation platforms – handle chargebacks that occur and automate the process of fighting and winning them, leading to revenue recovery.

Each layer uses automation differently. And they work best when they’re connected.

Layer 1: Fraud prevention tools – Automating fraud control

Purpose: Prevent chargebacks before they happen

Examples: Sift, Riskified, Forter, Signifyd

How they automate:

- Real-time fraud scoring and decisioning

- Adaptive rules that adjust risk thresholds by product, geography, or buyer profile

- Continuous learning from transaction outcomes

What they cover: Fraud-based disputes and payment risk

What they don’t cover: Friendly fraud, service disputes, or legitimate customer dissatisfaction, all of which now make up a large share of chargebacks

Fraud prevention tools are essential. They protect the top of the funnel, reduce risk exposure, and help maintain healthy chargeback ratios. But they don’t address disputes that happen after an authorized transaction, including friendly fraud, which is where many merchants see the bulk of their chargeback volume today.

2. Pre-dispute and alert tools – Automating early resolution

Purpose: Identify and resolve potential chargebacks before they reach the card network

Examples: Verifi and Ethoca

How they automate:

- Real-time notifications when a cardholder queries a charge.

- Automated refund workflows based on merchant-defined rules.

- Integration with acquirers and PSPs to intercept disputes in progress.

What they cover: Early-stage disputes that can be defused with proactive communication or refunds

What they don’t: Chargebacks that have already been filed, or the analysis and evidence-building needed to fight them

Pre-dispute tools are crucial for keeping chargeback ratios under control and maintaining compliance with monitoring programs. They give merchants an early warning system and the ability to resolve disputes before they escalate. Not all merchants need them. Typically merchants that do need chargeback prevention tools have high chargeback ratios or seasonal business and they use alerts to ensure they don’t exceed the thresholds.

The key is knowing when to use them, and when not to. Auto-refunding every dispute keeps your ratio low, but it also surrenders revenue you might have won back. That’s where recovery automation comes in.

Layer 3: Changeback recovery automation – Automating dispute resolution

Purpose: Automate the representment process once a chargeback has occurred, recovering revenue that would otherwise be lost

Examples: Justt

How they automate:

- AI-powered data collection from multiple sources (PSPs, CRMs, processors)

- Dynamic evidence package creation tailored to reason code, issuer, and card network

- Automatic submission and tracking of representments

- Continuous learning to improve win rates and efficiency over time

What they cover: The full dispute lifecycle, from case identification to optimization.

This is where comprehensive chargeback automation lives: technology replaces manual case handling with intelligent, data-driven workflows.

Automation here saves time but also improves accuracy, consistency, and ROI.

Platforms like Justt enable merchants to scale dispute management efficiently and improve win rates, through:

- Pulling complete evidence from every relevant system

- Tailoring submissions to what specific issuers and networks actually want to see

- Meeting every deadline

- Learning from outcomes and refining strategy over time

Platforms like Justt enable merchants to scale dispute management efficiently while integrating with upstream systems to create a connected ecosystem.

Why it takes all three layers

Each tool type serves a specific purpose:

| Layer | Purpose | Core Automation | Ideal Outcome |

| Prevention | Block fraud before it happens | Real-time risk scoring | Fewer fraudulent chargebacks |

| Pre-dispute / Alerts | Resolve potential disputes early | Instant refund rules, alerts | Lower ratios, avoided disputes |

| Recovery Automation | Fight and recover revenue | Evidence collection, representment, optimization | Higher recovery, data-driven insights |

The real power comes when these layers are connected. When your recovery platform feeds dispute outcome data back into your prevention models or alert rules, you create a closed feedback loop across the entire chargeback lifecycle.

For example:

- Recovery data shows you win 80% of “item not received” disputes from a specific product line → your alert system stops auto-refunding those

- Dispute patterns reveal issues with a particular shipping carrier → that insight feeds back into your fraud prevention logic

- Reason code analysis identifies trends → informing both prevention strategies and early resolution workflows

Leading merchants orchestrate these tools so each layer makes the others smarter.

So, what is “chargeback automation,” really?

“Chargeback automation” gets used broadly to describe any technology that simplifies chargeback management. But in practice, it has a more specific meaning:

Chargeback automation is the use of AI and data-driven systems to automatically build, submit, and optimize dispute representments—not just issue refunds or block transactions.

That’s an important distinction. It doesn’t diminish the value of prevention or alerts. Instead, it clarifies where automation reaches its fullest form. Prevention protects future revenue. Alerts manage risk and ratios. Recovery automation returns revenue from disputes that have already occurred.

All three matter. But only one gets your money back.

How Justt fits in the ecosystem

Justt is built to complement the other layers of a merchant’s chargeback stack.

It connects downstream to recover what prevention and alerts can’t address, while feeding performance data back upstream to inform risk decisions and early-resolution logic.

In practice, it works like this:

- Your fraud prevention tool blocks suspicious orders → reducing preventable chargebacks

- Your alert system intercepts pre-disputes → minimizing unnecessary chargebacks

- Justt automates the rest → recovering revenue from legitimate disputes efficiently and intelligently

That’s a complete chargeback management ecosystem—one where each layer supports the next.

What makes Justt’s approach effective:

- Full automation — Complete evidence collection, package creation, and submission without manual work

- Adaptive intelligence — AI trained on millions of disputes that tailors strategy to card network, issuer, and reason code

- Closed-loop learning — Every dispute outcome feeds back into the system, making your entire stack smarter over time

For more detail on how Justt’s automation works, read here.

The future of chargeback automation

New technologies, from agentic commerce to advanced payment orchestration, are changing how and when chargebacks occur. Networks are expanding monitoring programs like Visa’s VAMP. Issuers are introducing more automated dispute handling.

In that environment, automation becomes even more critical, not just for scale, but for continued adaptability and intelligence.

Merchants will need tools that can handle growing dispute volumes automatically, integrate across payment systems for unified visibility, and use outcome data to continuously improve prevention and resolution strategies.

Ready to build a smarter chargeback stack?

Book a demo to see how end-to-end automation can recover more with less effort.