While Mastercard’s First-Party Trust Program represents a significant step forward, it’s important to approach it with balanced expectations. The program is not a cure-all for all chargeback issues, but rather another tool in the ongoing fight against fraud.

Merchants should view this program as part of a holistic approach to chargeback management, complementing existing strategies such as:

- Robust customer service to address concerns before they escalate to chargebacks

- Clear communication about products, services, and billing practices

- Continual refinement of internal fraud detection systems

By learning from past initiatives like CE 3.0 and staying attuned to emerging trends, merchants can position themselves to navigate the evolving landscape of fraud prevention and chargeback management effectively. The key lies in remaining adaptable, data-driven, and proactive in the face of new challenges and opportunities.

To prepare for the First-Party Trust Program, merchants should conduct an internal audit of their chargeback management processes, identifying areas for improvement. Based on this assessment, develop a roadmap outlining necessary system and process changes before the program’s launch. Consider partnering with specialized services like Justt to navigate these changes effectively. Finally, ensure your team is well-educated on the program’s implications and prepared for its implementation.

Where Justt fits in

At Justt, we view this development as an opportunity to enhance our services and provide even more robust protection for our merchants. We’re committed to staying at the forefront of these industry changes.

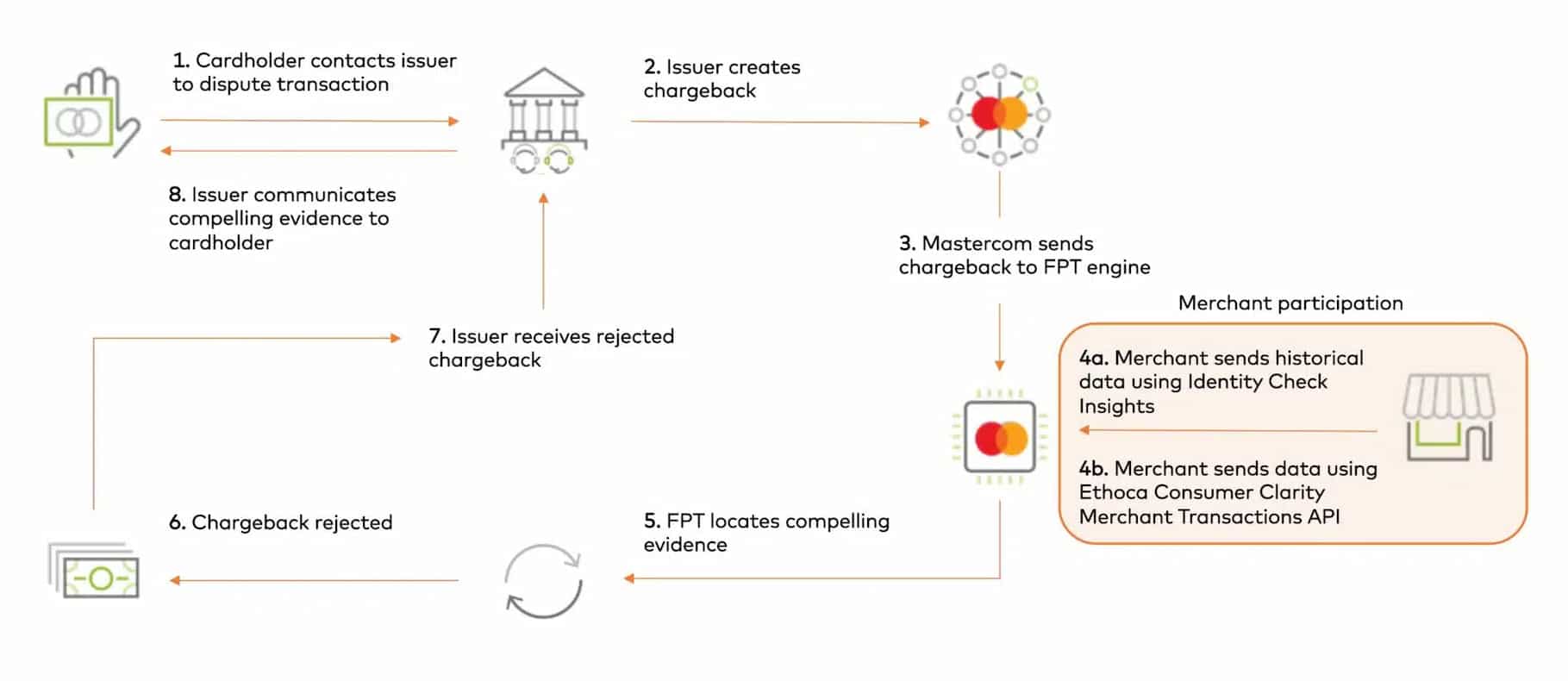

The First-Party Trust program is designed to benefit merchants in the pre-dispute stage. However, when a chargeback does occur, if the necessary merchant data is available, Justt will utilize it to build that most comprehensive evidence against the chargeback that abides by the program’s requirements for Mastercard cases.

Want to make the most out of Mastercard’s First-Party Trust program? Contact Justt today.