What is a Shopify Chargeback?

Shopify chargebacks occur when a customer disputes a transaction made through a Shopify-powered online store. If the issuing bank judges the dispute to be valid, the disputed funds are immediately withdrawn from the merchant’s account along with a chargeback fee. As a comprehensive ecommerce platform and PSP, Shopify plays the role of acquirer throughout the chargeback process, pulling and retrieving funds when necessary, and submitting evidence on behalf of merchants.

How Shopify Chargebacks Work

Shopify chargebacks closely resemble standard chargebacks, but with several key differences that are important to bear in mind. As with most disputes, funds and information are transferred through a structured flow that involves the cardholder, their issuing bank, the card scheme, the acquirer, and the merchant. Shopify acts as the acquirer, rather than the merchant of record; this means that merchants are financially liable for any chargeback losses.

If the issuer proceeds with a chargeback, they automatically deduct the disputed amount plus the chargeback fee from the merchant’s account. The merchant can then submit a representment of compelling evidence to Shopify to prove the transaction’s legitimacy and reclaim the funds. Shopify also sends all available transaction details to the issuer upon receiving a chargeback – in some cases this preliminary evidence can prevent a chargeback from escalating.

Issuers typically spend just a few minutes reviewing a representment before making a decision. If they rule in the merchant’s favor, the disputed funds return to the merchant’s account and Shopify refunds the chargeback fee. If the cardholder wins, the merchant loses the transaction amount, the product, shipping costs, and the chargeback fee.

Types of Shopify Chargebacks

Shopify categorizes chargebacks into eight distinct categories, each requiring different kinds of evidence to reverse:

Fraudulent: True fraud chargebacks occur when cardholders’ personal details or credit cards are stolen and used to authorize illegitimate charges. However, true fraud chargebacks are dwarfed in number by disputes resulting from friendly fraud, which originate when cardholders dispute legitimate transactions.

Unrecognized: These disputes occur when cardholders claim that they don’t recognize the merchant name or transaction on their statement, often due to unclear billing descriptors or forgotten purchases.

Duplicate: Cardholders may claim they were charged twice for the same transaction, whether due to merchant error, misunderstanding, or fraudulent intent.

Subscription canceled: Disputes can arise when customers claim charges occurred after subscription cancellation, frequently resulting from unclear cancellation policies or forgotten recurring payments.

Product not received: These disputes happen when customers claim non-receipt of goods, though friendly fraudsters often exploit this reason code to carry out cyber shoplifting.

Product unacceptable: Chargebacks may occur when customers receive – or claim to have received – items they consider defective, damaged, or not as described.

Credit not processed: Many customers dispute transactions after returning products or canceling orders without receiving timely refunds.

General: This is a catch-all category for disputes that don’t fit other classifications. Unfortunately, as friendly fraudsters become increasingly creative in their reasoning, these miscellaneous chargebacks are becoming much more common.

Shopify Chargebacks Challenges

Like standard disputes, Shopify chargebacks present challenges that extend far beyond the loss of the disputed sum. Merchants also typically lose the merchandise or service, shipping expenses, processing fees, and chargeback fees. High chargeback ratios – usually above 1% – trigger further consequences such as increased processing rates, monitoring program enrollment (such as Visa’s VAMP), potential fines, and even account termination. These combined losses can sometimes amount to 25% of net revenue.

Chargeback-related operational disruption can prove even more damaging than these financial impacts. Fighting chargebacks demands significant time and specialized expertise, diverting resources from core business activities. Volume fluctuations create additional strain – surges during peak seasons or after product launches can overwhelm manual teams, leading win rates and revenue to drop, while quiet periods leave dedicated dispute staff idle on your dime.

Preventing Shopify Chargebacks

Several prevention strategies can reduce the number of true fraud chargebacks merchants face. In the absence of the Shopify Fraud Filter, merchants can use traditional antifraud tools like CVV, AVS, and 3D Secure to screen stolen card usage. More advanced tools such as machine learning-driven heat maps and behavioural analytics can put further hurdles between true fraud and your payment gateways.

However, friendly fraud is both much more difficult to prevent and much more prevalent. While unintentional friendly fraud can be curbed through strategies such as clear billing descriptors, transparent policies, proactive customer service, and detailed product information, the vast majority of friendly fraud is intentional – and cannot be easily prevented. This is because antifraud systems are specifically designed to permit legitimate transactions, and friendly fraud transactions are legitimate, even if the following chargebacks aren’t.

Responding to Shopify Chargebacks

When prevention fails, effective dispute management becomes a merchant’s last line of defense. Success requires gathering comprehensive evidence tailored to the unique circumstances of each chargeback, crafting compelling narratives, and meeting strict deadlines. Evidence requirements vary by dispute type, but commonly include:

- Transaction details (date, time, amount, billing information)

- Customer data (IP address, email communications, order history)

- Fulfillment proof (tracking numbers, delivery confirmations, signatures)

- Product information (descriptions, images, terms of service)

- Digital service information (access logs, IP addresses, download timestamps)

The representment process demands speed, precision, rigorous detail, and clear, persuasive written communication. Merchants must compile evidence, draft rebuttals, and submit documentation within tight timeframes, while issuers need to review the resulting representments under even greater time pressure. Unfortunately, both manual teams and template-based systems struggle with surges in dispute volume and often fail to acquire the nuanced evidence types, or construct the delicate arguments necessary to win complex cases.

Justt: The Smart Solution for Shopify Chargebacks

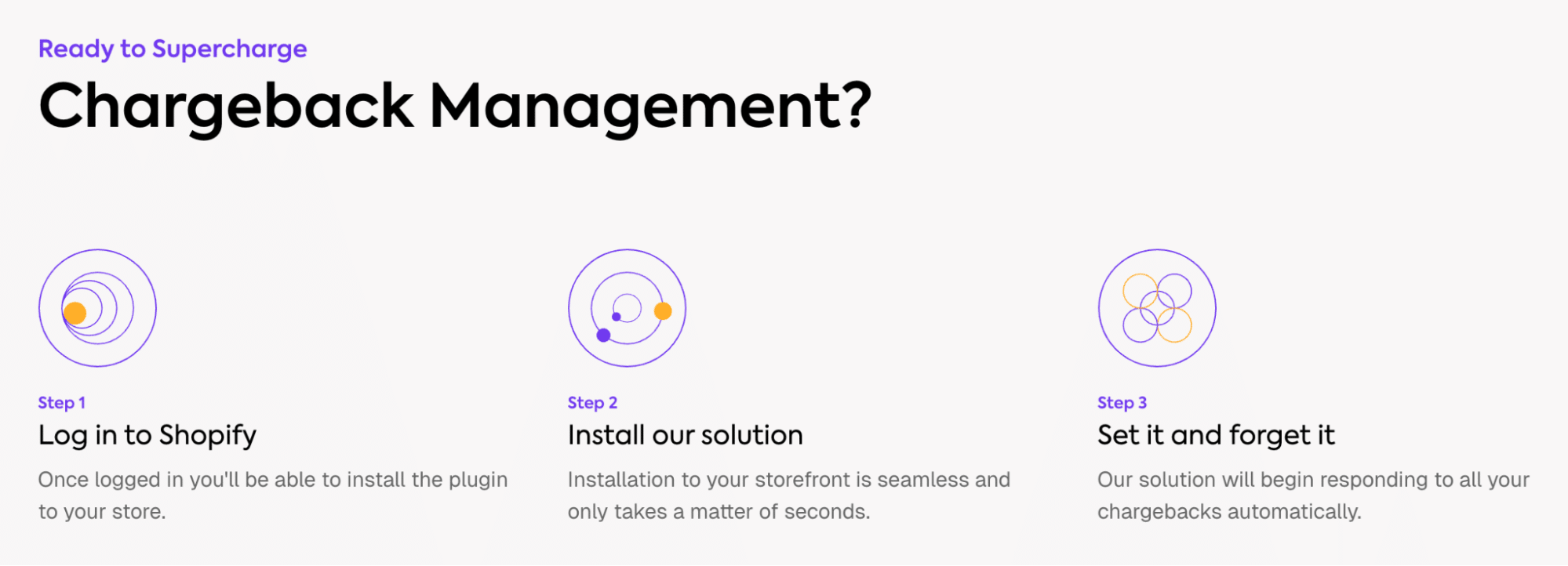

Justt’s AI-driven chargeback management harnesses end-to-end automation, panoramic evidence collection, and world-leading machine learning capabilities to fight Shopify disputes with all the nuance and efficiency they require. Better still, the platform is designed for near-instant Shopify integration, providing your win rates with an immediate boost.

First, the algorithm draws from a huge reservoir of +500 data sources – including internal merchant systems, third party providers, and PSPs. The platform’s Dynamic Arguments feature automatically selects the most compelling evidence from this pool, and uses it to compose precision-tailored representments – every detail, from informational hierarchy to language style, is granularly adjusted to be as persuasive as possible for the specific issuer reviewing the case.

This customization process is aided by machine learning that incorporates insights from millions of previous disputes, ensuring that win rates don’t just remain stable during volume surges but are always improving. This proactive approach means that merchants can enjoy all the benefits of Shopify without days spent on chargeback-related administrative burden. In fact, the entire process happens in seconds, so deadlines are always met, surges never affect response quality, and merchants never need to lift a finger.