Cryptocurrency ownership rates have soared in 2024 to 6.8% globally, a 34% increase from 2023. Crypto value has also skyrocketed to $3.5 trillion, up 36% from the previous year. But this positive news for crypto merchants (such as exchanges and wallets) comes with a catch. Chargebacks on cryptocurrency purchases have reached unprecedented highs, and signs suggest this trend will only accelerate. This article addresses mounting confusion around cryptocurrency chargebacks, what to expect in the near future, and what cryptocurrency sellers can do about it.

Cryptocurrency Chargebacks in a Nutshell

It is first essential to note that while peer-to-peer crypto transactions and crypto purchases of goods or services can’t be charged back, any purchases of cryptocurrency with fiat currency remain vulnerable to disputes. When cardholders buy crypto through exchanges or from other sellers using traditional payment methods, these purchases can be charged back just like any other card transaction.

In fact, a combination of factors – that we’ll examine in detail – ensure that crypto sales are among the worst-hit industries for chargebacks, resulting in some of the most damaging chargebacks faced by any merchant type.

The Rising Threat of Crypto Friendly Fraud

Friendly fraud, also known as first-party fraud, is rising the world over. Already accounting for 80% of all chargebacks, friendly fraud is rising by 33% YoY, and shows no signs of slowing. This type of fraud occurs when cardholders dispute legitimate purchases unfairly, often due to buyer’s remorse or a poor understanding of terms and conditions surrounding their transactions – both of which are typically more pronounced in crypto purchases.

Crypto exchanges have become increasingly popular targets for friendly fraud, largely due to the unique characteristics of cryptocurrency trading. The combination of liquidity, instant transactions, and pseudo-anonymity make cryptocurrency transactions a particularly lucrative target for both true and friendly fraudsters.

True fraud: Liquidity means it’s easy to turn the disputed product into cash (compared to physical products), the instantaneous quality of crypto means it’s time-efficient, and relative anonymity means there’s no physical address required, just a crypto address.

Mistakes and friendly fraud: Additionally, the complexity of crypto markets leads to genuine misunderstandings, especially among newcomers who may not fully grasp what they’re purchasing. But this also serves as an excuse for those simply looking to hedge bets on their crypto purchases; rather than accept a failed bet on an outsider currency, it can be tempting to instigate a chargeback and recoup your original investment.

Buyer’s remorse is a huge problem. Cardholders may come to believe they have made a poor financial decision, or become daunted by the technical knowledge required to navigate crypto markets. Often, cardholders file disputes with crypto sellers over transactions made with their purchased currency down the line – which is a misuse of the chargeback mechanism but tempting for bad actors and remorseful buyers.

The Crypto Price Volatility Paradox: Why Chargebacks Increase When the Price Changes in Either Direction

Cryptocurrency price fluctuations create a unique “lose-lose” situation for merchants when it comes to chargebacks. Regardless of whether prices are rising or falling, significant market movements tend to trigger increased dispute volumes.

- During price drops, overall purchase volumes decrease, but chargeback rates spike as disappointed investors attempt to recover losses through disputes. This can quickly push merchants toward dangerous chargeback ratios, as lower transaction volumes make each dispute more impactful.

When crypto prices surge, the influx of new investors and higher transaction volumes brings its own chargeback challenges. While the increased transaction volume helps keep chargeback ratios manageable, the absolute number of disputes still rises as newcomers enter the market with limited understanding of crypto trading. These new participants are more likely to file disputes due to confusion about fees, trading mechanics, or simple buyer’s remorse when trades don’t meet their expectations.

Unique Challenges for Crypto Merchants

We’ve established that crypto merchants experience more chargebacks than most industries. But volume is only half the battle. This is partly because, with traditionally thin profit margins, chargeback costs can represent up to 30% of an exchange’s net profits. Furthermore, the high value of individual transactions means each chargeback represents a significant loss, with average buy values in the tens of thousands of dollars range.

These challenges become even more acute at the representment stage. Traditional chargeback rules weren’t designed for crypto purchases, making standard evidence like delivery receipts largely irrelevant. Additionally, where mainstream banks generally tend to side with cardholders in disputes – it’s estimated that merchants only win 20-30% of friendly fraud chargebacks – issuers’ skepticism towards crypto can exacerbate these circumstances, decreasing win rates further still.

Finally, surges in dispute volumes during price drops can quickly push merchants beyond acceptable chargeback ratios, incurring fines, fees, and penalties from card schemes, and even risking account termination. The volatile nature of many cryptocurrencies means these surges can happen very often, and when they do merchants are faced with rising numbers of chargebacks that are unusually difficult to fight. Without an effective chargeback management solution, this typically leads to decreased response quality and mounting losses.

Fighting Crypto Friendly Fraud Effectively

First things first – generic template-based solutions are simply inadequate for crypto disputes. Without recourse to traditional evidence types, merchants need access to multiple data sources and must craft highly specific representments that clearly explain:

- The exact service provided as the merchant of record

- Proof of crypto delivery to the customer

- Clear explanations of downstream purchases where relevant

- Documentation of customer authentication and verification processes

- Evidence of customer acknowledgment of crypto purchase risks, along with their digital agreement to terms and conditions and any refund policy.

Due to the surge-heavy nature of cryptocurrency exchange chargebacks, merchants also need to implement a robust, data-centric chargeback mitigation strategy that can address these requirements at scale. Like template-driven solutions, in-house teams will typically be unable to deal with these unpredictable fluctuations, and result in money lost on labor.

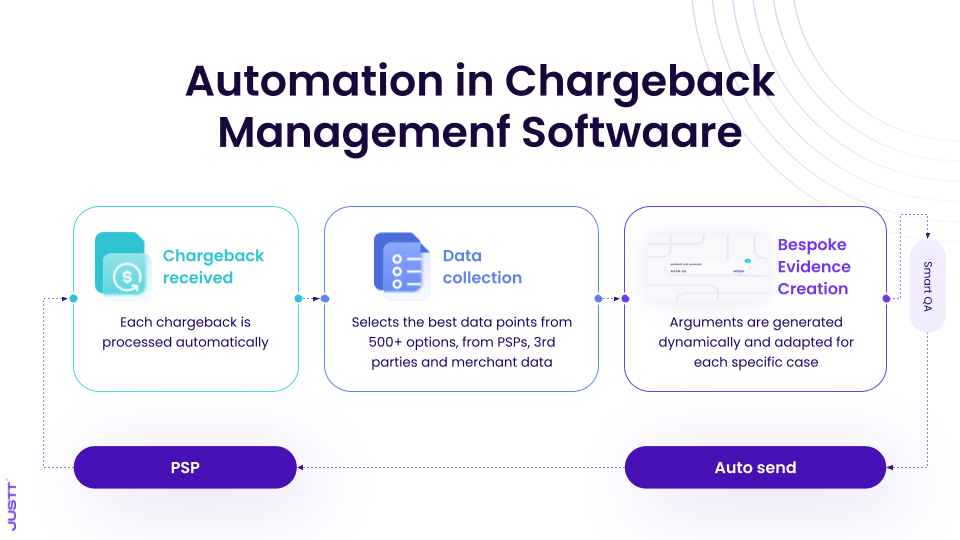

In fact, the only solutions sufficiently scalable are those that are automated to the point of being “hands-free”, while the only automated solutions equipped to handle the nuance required will have recourse to third party, acquirer, and merchant data, and advanced AI driving the construction of tailored compelling evidence per case. Justt’s is perhaps the only solution capable of handling this delicate balance.

While implementing strict Know Your Customer (KYC) procedures can improve win rates by 30-40%, it creates friction that may reduce conversions. Merchants must balance these concerns while maintaining the ability to handle sudden surges in dispute volumes triggered by price fluctuations. This becomes particularly challenging during market volatility, when dispute volumes can spike dramatically within days or even hours.

Justt: The Chargeback Solution for Crypto Problems

Justt’s AI-powered solution is specifically designed to handle the complexities of crypto chargebacks at scale, and based on techniques originally developed to handle the unique nature of crypto chargeback disputes.

Justt leverages machine learning and third-party integrations to build strong cases, even in the face of limited customer information. With just a crypto address, Justt can pull data from the correct blockchain to prove a crypto transaction occurred.

By drawing from +500 data points, including third-party sources, blockchains, acquirer records, and merchant data, Justt’s platform builds comprehensive compelling evidence documents that can address the unique challenges of crypto disputes. The system’s AI-driven Dynamic Arguments feature, crafts nuanced compelling evidence documents for even the most diverse dispute scenarios, whether they involve buyer’s remorse over price volatility, customer misunderstanding, or alleged unauthorized transactions.

Perhaps most importantly, Justt’s fully automated approach maintains consistent quality even during volume surges triggered by market movements. The platform learns continuously, using rigorous A/B testing to refine its approach based on the outcome of millions of cases, adapting to every factor from evolving dispute patterns to the minutia of issuer preferences. In a cryptocurrency space characterized by unpredictability and rapid fluctuations, Justt’s solution offers unparalleled reliability, rising win rates, and the freedom to focus on what matters to your company.