What is BNPL Fraud?

BNPL fraud refers to any activity that targets Buy Now, Pay Later options with the aim of obtaining goods or services without full payment. These fraud techniques exploit the unique structure of BNPL systems, which offer frictionless purchasing and delayed payment terms, but with more relaxed verification measures than traditional credit systems. As BNPL services continue to grow, associated fraud is rising – with attacks on popular platforms increasing up to 54% annually.

How BNPL Fraud Works

BNPL fraud takes a wide number of forms, but most techniques rely on the inherent vulnerabilities of BNPL systems, such as “soft” credit checks, real-time approval, and delayed payments. These are often exploited in the following ways:

- “Soft” credit checks are minimal in scope and depth, which boosts conversions by decreasing friction at checkout. However, this practice also means that cardholder verification is less robust than with traditional forms of credit, enabling some bad actors to create fraudulent accounts.

- Similarly, the real-time approval process prioritizes speed and conversions over thorough verification. This creates further risk factors that may allow fraudsters to make illegitimate transactions using stolen details.

- Finally, BNPL’s installment plans enhance payment flexibility for consumers, but create a defined window of opportunity for default after initial down payment.

Most types of BNPL fraud can be separated into “true” fraud, where criminals use stolen card details, and “friendly” fraud, where cardholders claim that a valid transaction was illegitimate. This is a crucial distinction in the BNPL sector, as it can determine which party is liable for lost funds.

BNPL vendors typically assume liability for instances of true fraud. However, they will often shift responsibility to merchants for disputes involving claims of non-delivery, damaged goods, and product misrepresentation. As a newer and still underregulated payment option, liability agreements vary significantly across vendors, so it’s important to study them carefully before signing up. Let’s take a look at the most common types of true and friendly BNPL fraud:

Types of True Fraud in BNPL

- Account Takeover Fraud: Fraudsters often gain access to legitimate accounts through phishing, credential stuffing, and other ATO techniques. This approach is particularly prevalent as it bypasses initial identity verification processes and exploits the real user’s established credit history.

- Synthetic Identity Fraud: Criminals create fictional identities by combining real data, such as social security numbers, with fabricated personal details. These synthetic identities may pass initial verification checks but are untraceable when it comes to payment collection.

- New Account Fraud: Fraudsters often create multiple accounts using stolen or fabricated information to repeatedly exploit BNPL offers. This method allows them to scale their operations and maximize profits, making it particularly damaging for BNPL providers and affiliated merchants.

- Fraudulent Repayment: In this sophisticated approach, fraudsters use stolen payment credentials to make BNPL installment payments. While the BNPL provider initially receives payment, the actual cardholder will eventually notice and dispute the transaction, leaving the provider liable.

Friendly Fraud in BNPL – Typical Scenarios

Buyer’s Remorse

BNPL’s delayed payment structures remove the psychological barrier to more expensive purchases, leading to impulse buying. This can later cause buyer’s remorse, where a customer regrets a transaction and falsely claims non-delivery or product misrepresentation.

Family Fraud

Family fraud occurs when a family member uses a customer’s BNPL account without permission. Despite still qualifying as a legitimate transaction, this frequently leads to a dispute when the cardholder realizes what has happened.

Subscription Confusion

Cardholders sometimes forget about signing up for recurring BNPL payments and dispute charges that they fail to recognize.

Refund Abuse

Customers sometimes request refunds for products they’ve received and intend to keep, falsely claiming damage or non-delivery. Serial friendly fraudsters sometimes practice this technique across several BNPL platforms at once.

Preventing BNPL Fraud

BNPL fraud prevention strategies differ drastically for vendors and associated merchants. Vendors must balance robust verification capabilities with speed and credit flexibility, maximizing conversions and minimizing true fraud. However, BNPL’s “soft” credit checks can have dire consequences for merchants faced with rising friendly fraud disputes.

For these merchants, effective prevention strategies involve collecting evidence that proves they fulfilled their part of the transaction. Compelling evidence often includes detailed delivery documentation, customer communications, timestamped browsing history, and records of previous undisputed BNPL transactions from the same customer to establish patterns of legitimate purchases.

BNPL Chargebacks

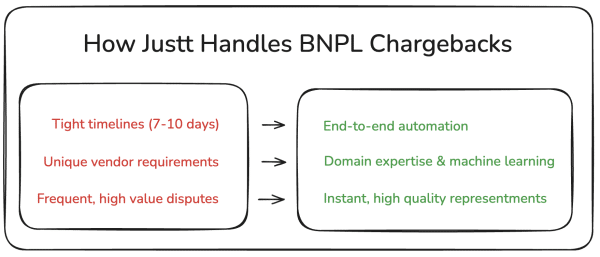

BNPL chargebacks differ significantly from traditional disputes. This is partly due to the involvement of the BNPL provider, who usually assumes an intermediary role that combines the functions of issuer and acquirer. For friendly fraud chargebacks, the vendor usually stages an internal dispute process, for which representment timelines are much shorter than traditional disputes – often as brief as seven to ten days.

Losing a BNPL dispute can also be costlier for merchants than a traditional chargeback loss. First, the average order value is typically larger, and second, vendor rules may require merchants to refund any interest accumulated, in addition to the transaction amount.

BNPL vendors’ unique dispute procedures add further complexity. With few overarching regulations governing the industry, each provider maintains different evidence requirements, response timelines, and merchant portals. This means that merchants must develop separate workflows for each BNPL service they offer, which can prove overwhelming during dispute surges.

How Justt Overturns BNPL Fraud

Justt’s AI-driven platform is expertly designed to navigate the compressed timelines and varying requirements of BNPL disputes. While manual and template-driven systems struggle with BNPL vendors’ brief response windows and high chargeback rates, Justt’s end-to-end automation ensures that merchants never miss these critical deadlines, and that representment quality never fluctuates.

Better still, each representment is composed using the most compelling evidence possible, which Justt automatically pulls from +500 sources, including internal merchant systems, PSPs, and third-party providers. This means that you no longer need to rely on BNPL customer verification or in-house detective work – if evidence exists online or in your systems that your customer is committing fraud, Justt can retrieve it and put it to use.

Rather than forcing merchants to maintain separate workflows for every BNPL service, Justt’s platform eliminates your dispute workflows altogether, harnessing advanced machine learning to precision tailor evidence packages that meet each vendor’s specific guidelines and preferences. Finally, the system’s continuous A/B testing ensures that every representment is informed by millions of prior disputes, so the AI engine continues to improve, and your win rates – and revenue – continue to rise.

Want to learn more about how Justt counters BNPL chargebacks? Schedule a demo today.