What Is a Chargeback Threshold?

A chargeback threshold refers to the upper limit of disputes per transaction a merchant can receive in a specified timeframe before they are penalized by a card scheme, acquirer, or other institution. Penalties may include fines, additional processing fees, more stringent monitoring, or even account termination.

How Do Chargeback Thresholds Work?

Chargeback thresholds typically take two forms. First, card schemes impose strict limits on merchants’ chargeback ratios, or the number of chargebacks they receive per transaction. This ratio is usually about 1.5%, but varies according to card scheme, and is often tiered so that higher ratios incur more severe penalties.

The other common form of chargeback threshold is a limit on the overall number of chargebacks that merchants can receive before penalization. These may also be tiered, or may act as an initial limit before chargeback ratios are enforced.

Chargeback thresholds are usually set up so that every chargeback over a given threshold is penalized. For instance, merchants who exceed Amex’s 1% threshold for a period of three months face a fee of $25 for every chargeback that exceeds the threshold.

Like merchants, acquirers are also subject to card schemes’ chargeback thresholds and may be penalized for excessive ratios. Acquirers frequently pass these costs on to merchants in the form of increased processing fees or, in worst-case scenarios, account closure.

Card Scheme Chargeback Thresholds

The most important chargeback thresholds to remain aware of are those imposed by major card schemes, such as Visa, Mastercard, American Express, and Discover. Let’s take a look at how each of these works:

Visa

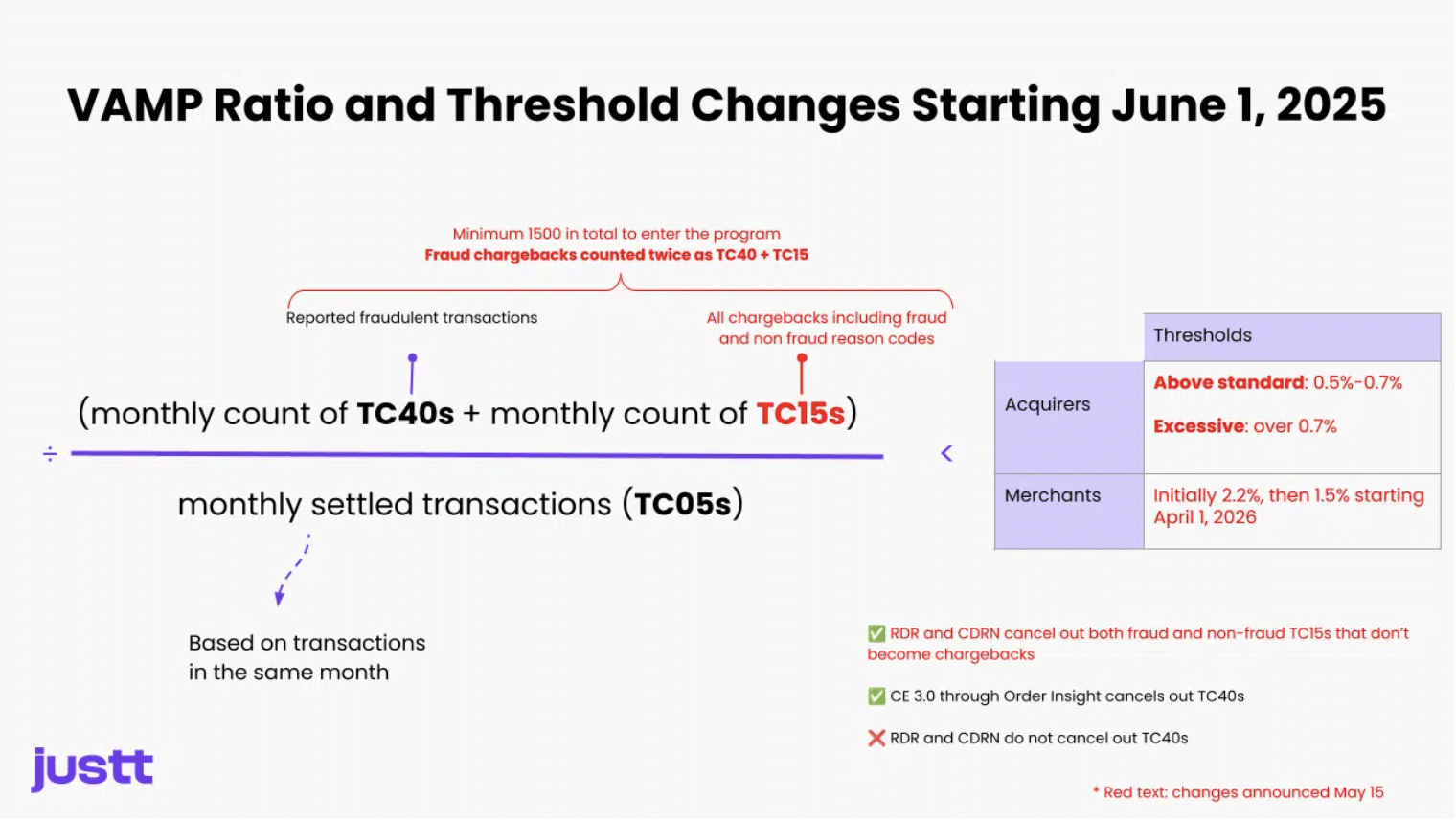

Visa chargeback thresholds are prescribed by the Visa Acquirer Monitoring Program (VAMP), a comprehensive program that dictates acceptable dispute and fraud ratios for all Visa merchants and acquirers. While currently in the “advisory period”, during which thresholds will not be penalized, from September 1st, 2025, merchants with a 2.2% ratio on combined monthly chargebacks and TC40s will be enrolled in VAMP. Those who exceed these thresholds will face a fine of $8 for every chargeback and TC40 received.

The minimum number of monthly disputes and TC40s required for VAMP enrollment is 1,500. However, it is important to note that fraudulent chargebacks are counted twice, as both disputes and TC40s.

Mastercard

Mastercard enforces chargeback thresholds through the Mastercard Excessive Chargeback Program. The program states that merchants who receive more than 100 chargebacks a month and maintain a monthly dispute ratio of more than 1.5% will face enrollment. Higher penalties are reserved for merchants receiving 300 chargebacks a month at a 3% dispute ratio.

For the first six, non-consecutive months of enrollment, merchants are enrolled in the first tier of the program, while months seven to twelve constitute the second tier. Enrolled merchants have one month to develop a plan to reduce their chargeback ratio. Financial penalties begin at $1000 for the second and third month, before increasing to $5000 for months four to six, after which higher fines may be incurred.

Acquirers begin to face penalties for any tier two merchants in their portfolios, and are considered non-compliant if they retain tier two merchants for longer than twelve non-consecutive months of ECM enrollment. They will almost always close merchant accounts before this point.

American Express & Discover

Amex imposes a chargeback ratio of 1% for all merchants, after which they face enrollment in an excessive chargeback program, resulting in fines of $25 per dispute. Discover’s chargeback threshold is similarly 1% for merchants who receive more than 100 chargebacks per month. Exceeding Discover’s thresholds can lead to increased fees, fines and penalties, and potentially account termination.

How Can Merchants Remain Below Chargeback Thresholds?

While fighting and winning chargebacks is a great way to retain revenue that would otherwise be forfeit, these actions generally cannot help you to avoid chargeback thresholds, which measure dispute volumes, rather than wins and losses. The only way to avoid chargeback thresholds is by reducing the number of chargebacks you face on a monthly basis.

Fortunately, there are numerous ways to do this. Key strategies include maintaining easily accessible customer service channels, partnering with reliable shipping and product partners, and providing transparent product descriptions, billing descriptors, and return policies. Robust fraud prevention measures are another key part of the chargeback reduction process; be sure to avail of AVS, CVV, 3D Secure, and other antifraud tools on the market.

How Justt Helps Merchants Avoid Chargeback Thresholds

Perhaps the most effective – and certainly the most informed – way to reduce chargeback volumes, thresholds, fines, and other penalties, is through chargeback data. The information in merchants’ own systems, if robustly consolidated and analyzed, can be used to detect chargeback root causes with incredible accuracy, informing targeted actions that lead to instant volume reductions.

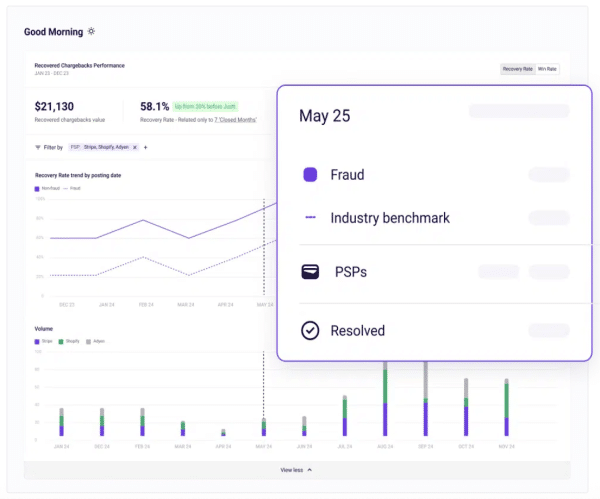

While this work tends to be painstaking for manual teams, and represents a blind spot for the vast majority of chargeback solutions, Justt has developed specialized AI models to automate the entire process of data collection, consolidation, and analysis. The system continuously pulls data from +500 sources, including internal merchant systems, PSPs, and third-party providers. This data both informs each of the platform’s automated responses, and is instantly transformed into actionable chargeback insights.

Justt’s Insights and Analytics dashboard provides a unified viewpoint for all of your chargeback data. Not only will you find detailed revenue and dispute forecasting, and analyses of ongoing chargebacks, but the system performs rigorous root cause analysis and detailed suggestions on how to adjust operations to reduce chargeback volumes. This advice might include swapping problem shipping partners out, improving product or billing descriptors, or halting deliveries to high-dispute countries.

Ready to get your business below chargeback thresholds, and keep it there? Schedule a demo with Justt today.