How does your organization think about chargebacks?

Do you calculate the percentage of revenue that’s lost to chargebacks? Are you mostly concerned with staying below monitoring thresholds to avoid penalties? Or are you tracking your dispute win rate and trying to win as many disputes as possible?

None of these approaches are wrong, but they can miss the big-picture impact of chargebacks on a business.

Chargebacks are expensive. They come not only with lost transactions, but processing fees, lost customer acquisition spend, and operational costs.

Add it all up, and they can have a significant impact on your bottom line.

In fact, for merchants in low-margin industries, chargebacks can eat up to 25% of net income.

While it’s tempting to focus on increasing win rates, especially when it’s a challenge to dispute 100% of chargebacks, a better metric is net dollar revenue recovery. It takes into account the holistic cost of chargebacks and their associated expenses.

Focus on:

- Maximizing disputes and win rates while…

- Minimizing chargeback-related labor costs, fees and fines.

Only by calculating all that’s involved in revenue recovery and understanding how much revenue was recovered minus expenses, you can truly optimize returns.

In this guide, we’ll break down:

- The factors that make chargebacks so costly to merchants

- How chargeback dispute strategies have evolved over time

- The 10 must-have features in a modern chargeback management solution

Choosing the right chargeback management strategy will help you maximize your profit, not just your chargeback win rate. Let’s start by analyzing the problems merchants face with chargebacks.

Key Takeaways for Merchants

- Chargebacks cost merchants far more than lost transactions; they also add fees, labor, and lost customer acquisition spend.

- Measuring success by net revenue recovery (recovered revenue minus costs) is more effective than focusing only on win rates.

- Manual and template-based chargeback management cannot keep up with evolving fraud tactics, issuer preferences, and network rules.

- A modern chargeback management solution should include automation, AI-powered dynamic arguments, data enrichment, and optimization capabilities.

- Unified reporting across PSPs, predictive forecasting, and real-time alerts help merchants stay ahead of disputes.

- Enterprise-ready security and compliance standards are critical for regulated or high-risk industries.

- Automated chargeback management helps merchants recover more revenue, reduce costs, and protect their bottom line.

Chargeback Challenges for Merchants

Let’s begin by looking at what makes dealing with chargebacks so complex:

- Heavy operational costs: Handling chargeback disputes is costly and labor-intensive. For merchants with low-value transactions, paying an employee to respond to chargebacks is hard to justify. For merchants who can justify hiring to respond to chargebacks, seasonal surges often overwhelm teams, leaving winnable chargebacks uncontested.

- Frequent rule and policy changes: Rules and policies are always evolving, making it difficult for merchants to stay compliant and adapt.

- The complexity of tracking down evidence: Winning disputes requires evidence, but in many cases that means 20 minutes to an hour of work for each chargeback. It isn’t easy to compile, and present proof effectively.

- Difficulty in identifying winnable disputes: If you can’t fight every chargeback, you have to pick your battles. However, without specific expertise, it isn’t easy to identify the right chargebacks to fight.

- High processing fees and hidden costs: Chargeback fees can consume nearly 40% of chargeback costs—hitting merchants at multiple stages. If a dispute is lost, merchants lose both the revenue and the fees.

- Inability to test what works best: Merchants struggle to improve their win rates over time due to a lack of visibility into what works and what doesn’t.

- Time-consuming cross-payment service provider analysis: With chargeback data distributed across multiple PSPs, merchants waste time switching between systems and processes. Viewing the overall picture requires manually compiling data from various sources.

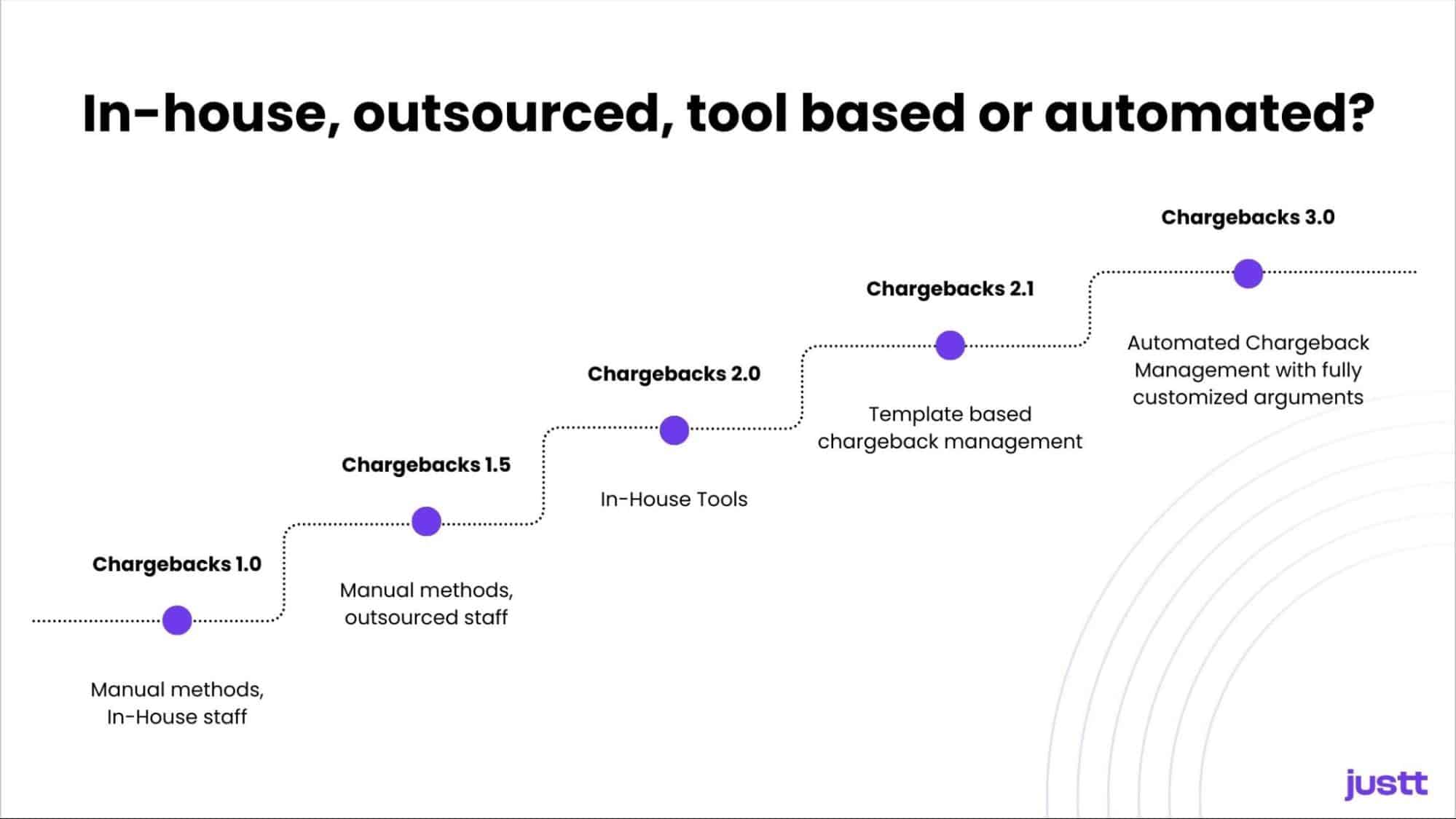

Chargeback tool evolution: from manual to automated

Chargebacks were introduced in the 1970s to protect consumers from fraud. But in the 2010s, a new challenge emerged: friendly fraud—when customers dispute legitimate charges. This rise coincided with the growth of card-not-present (CNP) transactions.

Merchants have always pushed back against invalid chargebacks by submitting evidence to prove transactions were legitimate. However, both the methods and the people handling chargebacks have evolved significantly.

Chargebacks 1.0: Manual Methods, In-House Teams

For years, merchants managed chargebacks internally, manually compiling evidence and submitting representments to issuers. As volumes grew, this labor-intensive approach became expensive and inefficient—paving the way for a new generation of tools.

Chargebacks 1.1: Manual Methods, Outsourced Teams

Eventually, merchants began outsourcing chargeback management to third-party providers with their own processes and templates. While this addressed challenges like hiring and expertise, the core problems remained: manual processes were error-prone, hard to scale, and limited merchants’ ability to improve win rates through data analysis.

Chargebacks 2.0: In-House Tools

Next came software tools that helped merchants (and outsourcers) speed up evidence collection and submission using template-based representments. While this improved efficiency, it didn’t solve deeper issues: merchants still relied on costly, high-turnover teams, struggled with scale, and couldn’t adapt quickly to evolving rules.

Chargebacks 2.1: Template-Based Management

In response, some providers added tools and automation, offering them as both platforms and services. But templates have serious limitations.

Templates are just that: and rely on static formats and fixed language. Real-life disputes are more complex—affected by factors like the issuing bank, reason code, payment method, card brand, and region. A one-size-fits-all template can’t adjust to each unique scenario.

To account for every variable, you’d need hundreds of templates, constantly updated to reflect card network changes and issuer preferences. But the more templates you manage, the more fragile and complex your system becomes—raising overhead and the risk of outdated, underperforming responses.

Chargebacks 3.0: Automated Management with Fully Customized Arguments

Enter the next generation: automated chargeback management.

These solutions move beyond templates. They generate tailored, dynamic arguments in real-time using data from multiple sources. The result? Consistently higher win rates, as the system learns what evidence is most persuasive and adapts accordingly—something templates can’t do.

While templates allow for basic A/B testing of one template vs another, dynamic arguments can build, test and optimize every element of a representment. It builds the best possible case for each dispute—fully customized and fine-tuned for maximum effectiveness.

With this approach, automated solutions clearly lead the pack. But how do you choose the right one? Let’s explore the key considerations.

Here’s a quick snapshot of how chargeback management tools have evolved over time, and why automation is now the clear leader:

| Stage | Approach | How It Works | Challenges |

|---|---|---|---|

| 1.0 | Manual, In-House Teams | Merchants manually compile evidence and submit disputes | Labor-intensive, costly, unscalable |

| 1.1 | Manual, Outsourced Teams | Third-party providers handle disputes using templates | Still manual, error-prone, limited optimization |

| 2.0 | In-House Tools | Software helps with templates and submissions | Relies on costly staff, can’t adapt fast enough |

| 2.1 | Template-Based Providers | Outsourcers/platforms use standardized templates | Rigid, outdated responses, poor win rates |

| 3.0 | Automated, AI-Powered | Dynamic, data-driven arguments crafted in real time | Adaptive, scalable, highest revenue recovery |

The 10 Must-Have Features in a Chargeback Management Solution

Here are the must-have features for your automated chargeback solution.

1. Automated Responses: Scale With Volume & Ensure 100% Coverage

Merchants can receive hundreds or thousands of chargebacks per month—far too many to handle manually. Without automation, disputes fall through the cracks, resulting in avoidable revenue loss.

A best-in-class solution should:

- Ensure 100% of winnable chargebacks are disputed—no more missed revenue opportunities.

- Automatically scale and downsize with business growth—handling both seasonal spikes and slow periods without fixed costs.

- Avoid the human errors and inflexible template-based approaches usually seen with manual work.

- Free up internal resources, so merchants don’t have to hire or train an in-house team and can keep focus on primary business drivers.

- Quickly adapt to rule changes.

Example: A large eCommerce retailer sees a 30% increase in chargebacks during the holiday season. A fully automated chargeback system allows them to handle every case efficiently, without hiring extra staff.

2. Dynamic Arguments: Custom, AI-Powered Responses That Win

No two chargebacks are the same. Top chargeback solutions like Justt utilize dynamic arguments, tailoring the evidence and documentation to each unique case, creating a new representment that’s based on the actual evidence and any other factors (such as issuer, transaction type, etc). A solution should also take into account the person making the decision on the issuer side: how much time do they have to review the evidence, what they are looking for and what needs to be stated where? If they only have several minutes per representment, what should be shown first?

Most chargeback management solutions rely on static templates, but they can quickly become outdated and aren’t adaptable to individual transactions, often omitting evidence, or burying key arguments at the end.

A modern chargeback solution should:

- Use AI and machine learning to create unique, case-specific arguments, based on the evidence at hand.

- Ensure every dispute argument is optimized with the strongest, most relevant evidence, and adapt the representment to the specific evidence, transaction, vertical and issuer.

- Adapt to new chargeback trends and issuer preferences for better dispute outcomes.

Example: A merchant receives a “Transaction Not Authorized” chargeback. Instead of using a generic response, a dynamic system pulls transaction metadata (IP address, device ID, past order history, etc.), and based on these data points puts together the right arguments and orders them for a case-specific rebuttal that proves the purchase was legitimate.

3. Merchant Data Enrichment: Build Your Case With Internal and PSP Data

A robust chargeback solution should automatically pull basic merchant and PSP data for evidence. It should also allow merchants to provide additional evidence to maximize their chances of success. Data can be anything from customer service interactions, to tracking numbers, subscription renewals and product descriptions. Your chargeback solution should leverage those and dynamically craft arguments based on data, your business and vertical.

Example: A customer disputes a high-ticket electronics purchase, claiming it was “not as described.” The merchant’s chargeback solution automatically pulls internal data, including: customer service logs confirming the customer was satisfied after delivery. With this merchant-specific evidence, the dispute response directly refutes the cardholder’s claim—boosting the chances of a successful reversal.

4. Third-Party Data Enrichment: Strengthen Your Case With Outside Evidence

Winning a chargeback requires more than just a transaction receipt—you need strong, multi-source evidence to combat friendly fraud.

A top-tier chargeback solution should add 3rd party data to representments to improve your win rates. Datapoints gathered from third-party systems like geolocation verification and shipping provider records can strengthen your case and should be automatically leveraged.

Example: A merchant gets a chargeback claiming a package was “never received.” A third-party data-enhanced solution pulls the delivery confirmation, producing evidence that wins the case. Or, third-party data shows that the IP address matches the delivery address.

5. Optimization Abilities: A/B Testing to Improve Win Rates Over Time

Winning chargebacks is not a static process. What works today may not be effective tomorrow. A truly data-driven chargeback solution should continuously evolve—refining its approach based on real-world outcomes.

Template-level testing isn’t enough. Templates are too rigid, and chargebacks involve too many variables for one-size-fits-all strategies. The best solutions go deeper.

A best-in-class platform should:

- Run A/B tests at a granular level—experimenting with individual data points, argument styles, evidence types, and formatting—not just swapping out full templates.

- Continuously optimize win rates by analyzing which combinations yield the highest success in specific contexts.

- Add merchant and third-party data, to grow win rates.

- Leverage network effects by applying learnings across merchants. For example, at Justt, insights from one merchant’s success can be applied to similar cases across the platform—boosting performance for everyone.

- Automate ROI-based dispute decisions (dispute optimization) to ensure resources focus on cases most likely to deliver net positive recovery.

- Auto-accept low-ROI chargebacks to avoid unnecessary fees and wasted effort, while preserving focus on high-value disputes.

Example: A merchant discovers that including customer support transcripts increases win rates for subscription cancellation disputes. Justt’s platform recognizes this trend and begins incorporating that evidence into similar cases for all merchants—resulting in higher overall success rates.

6. Industry Expertise: Stay Ahead of the Curve

Chargeback rules and regulations change frequently—merchants need a solution that adapts automatically and helps them stay abreast of what’s new.

A strong chargeback solution should:

- Help merchants stay up to date with Visa, Mastercard, and other global payment networks and their chargeback rate limits.

- Update dynamically as rules change, so merchants don’t have to track evolving regulations manually.

- Provide expert insights on how to navigate complex dispute policies and prepare for upcoming industry shifts, protecting merchants from costly missteps.

7. Effective Reporting & Unified Visibility Across Payment Processors

Many merchants use multiple payment processors, making it difficult to track chargebacks across platforms, understand ratios or even be able to explain changes in chargebacks, their sources and win rates.

Your solution should:

- Provide a centralized dashboard to monitor chargebacks across all processors.

- Display open chargebacks and opportunities to add merchant data to improve your chances of winning.

- Create monthly reports with full explanations of dispute performance, across fraud and service, highlighting areas for improvement in customer experience and payment practices.

Example: A merchant using Stripe, PayPal, and Adyen can see all chargeback disputes in one place, instead of having to log into different portals. They can also filter chargebacks by reasons and understand why the rates are changing over time.

8. Predictions: Forecast Future Revenue Recovery

Chargebacks aren’t just about winning back revenue. The data from your disputes can help forecast revenue trends and help merchants plan ahead. It often takes months for a dispute to resolve, so estimating revenue recovery accurately will make cash forecasting more effective.

A modern chargeback solution should:

- Provide reasons for changes in win rate and help merchants understand how factors like PSP, payment method or reason code impact performance.

- Estimate future chargeback rates based on past trends.

- Predict revenue recovery potential, helping businesses with cash flow planning.

Example: A merchant sees seasonal spikes in chargebacks every Black Friday. Their chargeback solution forecasts how much revenue will be lost vs. recovered, allowing them to budget accordingly.

9. Easy Integration & Quick Setup: Start Recovering Revenue Faster

A chargeback management solution is more valuable if it’s easy to implement and start using right away. Many merchants avoid switching solutions—even when their current approach is ineffective—because they worry about complex onboarding, costly downtime, and potential disruptions to payment processing.

A best-in-class chargeback solution should:

- Seamlessly integrate with your existing payment stack—without requiring major system changes.

- Support multiple payment processors (PSPs) and fraud tools so merchants can track chargebacks across all platforms in one place.

- Minimize onboarding time, allowing merchants to start recovering revenue within days, not weeks or months.

10. Alerts Functionality: Prevent Losing Battles Before They Happen

Many chargebacks are unwinnable from the start due to weak evidence, policy violations, or strict network rules. Instead of fighting a losing battle and paying dispute fees, merchants should have the option to preemptively resolve certain disputes.

A strong chargeback solution should:

- Provide real-time alerts when a chargeback is initiated, so merchants can act fast.

- Help merchants to issue refunds using Rapid Dispute Resolution (RDR) in certain cases before disputes escalate, helping them avoid processor penalties and higher dispute ratios.

- Monitor chargeback and fraud rates, which can lead to increased fees, processing restrictions, or placement in monitoring programs like VAMP (Visa Acquirer Monitoring Program).

- Critically, an alerts system should be tied to a chargeback automation platform. Using separate systems misses opportunities for smart optimization of when to issue a refund or when to challenge chargebacks.

Example: A subscription-based business is close to being listed as a high-risk merchant by card schemes for having a high ratio of chargebacks. Their modern chargeback solution automatically issues refunds to incoming chargebacks for the rest of the month to keep the merchant below the card scheme threshold and avoid fines.

The table below summarizes the 10 must-have features every merchant should look for in a modern chargeback solution, with examples of how each one adds value:

| Feature | Why It Matters | Example Use Case |

|---|---|---|

| Automated Responses | Ensures 100% coverage and scales with volume | Handles holiday surge without extra staff |

| Dynamic Arguments | Tailors evidence to each case for higher win rates | Uses device ID & IP to prove “not authorized” claims are false |

| Merchant Data Enrichment | Leverages internal data to strengthen cases | Adds customer service logs showing satisfaction |

| Third-Party Data Enrichment | Pulls outside data (e.g., shipping, geolocation) | Confirms package delivery to dispute “not received” claims |

| Optimization (A/B Testing) | Continuously improves success rates | Learns that support transcripts boost subscription win rates |

| Industry Expertise | Keeps merchants compliant with evolving rules | Adapts to new Visa/Mastercard regulations automatically |

| Unified Reporting | Centralizes disputes across PSPs | Tracks chargebacks from Stripe, PayPal, Adyen in one dashboard |

| Predictions | Forecasts recovery and trends | Estimates Black Friday chargeback losses/recovery |

| Easy Integration | Reduces onboarding friction | Works with existing PSPs for fast rollout |

| Alerts | Helps avoid unwinnable cases and penalties | Issues RDR refunds to prevent monitoring program placement |

Bonus: Enterprise Ready – Meeting the Highest Security & Compliance Standards

Not every merchant needs enterprise-grade compliance and security—but for those that do, it’s non-negotiable. Companies in regulated industries, high-risk sectors, or high-risk clients need a chargeback management solution that meets the strictest security, data privacy, and compliance standards. If this is relevant to you, begin your search with checking the compliance standards of solutions.

Justt is fully enterprise-ready, offering:

- SOC 2 Compliance – Ensures the highest level of security, availability, processing integrity, confidentiality, and privacy for sensitive financial data.

- ISO 27001, 27017, 27018, 27701 Certifications – Industry-leading standards for information security management, cloud security, and data protection.

- GDPR & CCPA Compliance – Guarantees that customer data is handled responsibly, protecting merchants from regulatory risks.

- A-Rated Vendor Risk Report – Independently verified for best-in-class security, compliance, and risk management.

Conclusion: Why an Automated Chargeback Solution Is the Best Choice

Chargeback disputes are a growing challenge for merchants, but the right solution can turn them from a costly burden into a competitive advantage.

Traditional chargeback management—whether handled manually, through in-house tools, or by external teams—fails to scale, drains resources, and leads to poor win rates. The next evolution of chargeback management is automated and AI-driven—delivering higher recovery rates without the operational headaches.

A modern chargeback solution like Justt:

- Recovers more revenue with intelligent, AI-powered dynamic arguments.

- Reduces operational costs by eliminating manual labor and fixed staffing expenses.

- Leverages data to optimize results, ensuring higher success rates over time.

- Stays ahead of evolving friendly fraud/ first-party misuse tactics and chargeback rules with industry expertise.

- Integrates seamlessly with existing payment processors and business systems.

The Bottom Line: Merchants who use Justt to automate chargeback management recover more revenue, lower costs, and improve their bottom line.

Take Control of Your Chargebacks Today

Every chargeback you don’t fight is lost revenue. Every dispute you don’t win is a hit to your bottom line.

Schedule a free consultation today to see how Justt’s fully automated, tailored chargeback solution can help your business recover more revenue with less effort.

FAQs

What is a chargeback and how does it affect merchants?

A chargeback occurs when a customer disputes a transaction with their card issuer. For merchants, it means lost revenue, fees, and additional operational costs. Managing them effectively is key to protecting your bottom line.

How can merchants reduce chargebacks without alienating customers?

Proactive strategies include clear product descriptions, responsive customer service, fraud prevention tools, and a robust chargeback management solution that resolves disputes efficiently.

What’s the difference between manual, template-based, and automated chargeback management?

Manual methods rely on staff to handle disputes individually. Template-based systems use static responses, which can miss key evidence. Automated solutions use AI to generate dynamic, tailored arguments for higher win rates and less operational effort.

Which features matter most in a chargeback management solution?

Look for automation, AI-powered dynamic arguments, data enrichment (internal and third-party), predictive analytics, unified reporting across PSPs, and real-time alerts. These features maximize recovery and reduce costs.

How much can an automated solution improve revenue recovery?

Top automated platforms can significantly increase win rates and net revenue recovery by focusing resources on winnable disputes and optimizing each case with data-driven arguments.

Is it difficult to integrate an automated chargeback solution with existing systems?

Modern solutions are designed for quick integration with multiple payment processors, fraud tools, and internal systems, allowing merchants to start recovering revenue quickly.

How do I know if my business needs enterprise-level security and compliance?

If your company handles sensitive financial data, operates in regulated industries, or deals with high-risk clients, enterprise-ready solutions with SOC 2, ISO certifications, and GDPR/CCPA compliance are essential.