You could be forgiven for thinking that reported chargeback win rates are the only metric that matters when evaluating your approach to disputing chargebacks.

After all, win rates record dispute reversals, which reflect revenue that was recovered – a no brainer, right?

Unfortunately, it’s not so simple. While win rates are an important metric, they only tell half the story. They are important to track and measure but there’s more.

This article puts chargeback win rates under the microscope to show what they truly reveal, and what they leave out. Armed with this knowledge, you’ll be able to make dispute decisions that maximize revenue retention, rather than chasing imaginary numbers.

For a deeper dive on the metrics that count, check out How to Calculate Your Net Dollar Recovery From Chargebacks.

How Chargeback Win Rates Can Distort Reality

Chargeback win rates are a simple ratio that measures a merchant’s percentage of chargebacks won, calculated as the number of successfully disputed chargebacks divided by the total number of chargebacks fought.

While the simplicity of this calculation makes it attractive for merchants and vendors alike, it also makes it easy to abuse. Here’s what to look out for:

Playing the Numbers

Conventional wisdom is that you want your win rate to be as high as possible. This is true in one sense (obviously it is better to win a dispute than to lose one), but with critical caveats. A very common fallacy is to only measure the win rates for those disputes you decided to fight, ignoring the fact that you may have chosen to NOT dispute large amounts of chargebacks, due to overcomplexity, certain reason codes, business lines, or low value. As you might expect, this strategy doesn’t shed much light on revenue retention at all, but simply obscures the true scale of your losses, because it only focuses on chargebacks you’ve decided to dispute.

Chargeback teams (or external solutions) that rely on templates are often ill-equipped to deal with the nuanced disputes that arise from diverse business models, or those requiring highly specific evidence types to secure reversal. As a result, they might choose to sidestep certain types of chargebacks altogether by not putting up a fight. We’ve seen merchants doing this for 50-20% of their overall chargebacks. This can result in an inflated win rate that looks good on a slide deck, but doesn’t actually translate into optimal revenue recovery – as many of these disputes are actually winnable with more sophisticated chargeback solutions.

Opportunity Cost

Another cost often obscured by win rates is the cost of the chargeback management operation that’s needed to maintain them, which often requires significant human labor, which diverts employees from where they could be more useful.

When automation is limited to templates, merchants will often still need to invest time and effort that could have been spent elsewhere. Even if the system automates most ‘business as usual’ cases, chargebacks are unpredictable and surge prone – so when volumes soar, in-house teams become overwhelmed and miss deadlines, leaving chargebacks unrepresented.

Outsourced chargeback mitigation can be almost as expensive as in-house teams. Many solutions charge monthly retainers that claim a large proportion of money saved – even if they only represent a fraction of winnable chargebacks. Others charge fees for every dispute represented, win or loss. If this amounts to a high percentage of your recovered revenue, then you aren’t really winning at all.

Industry Variance

Merchants also need to consider that chargeback win rates vary between industries and business models. For instance, while luxury jewellers need to prioritize fighting every chargeback and must retain high win rates to succeed, SaaS vendors can operate under a different model. The same applies to BNPL merchants and more.

Playing for Keeps: Fighting Every Chargeback

Conversely, if you fight every chargeback, your win rate is likely to be lower, but your revenue retention might be much higher – a 40% win rate on 99% of transactions is more valuable than a 99% win rate on 35% of transactions!

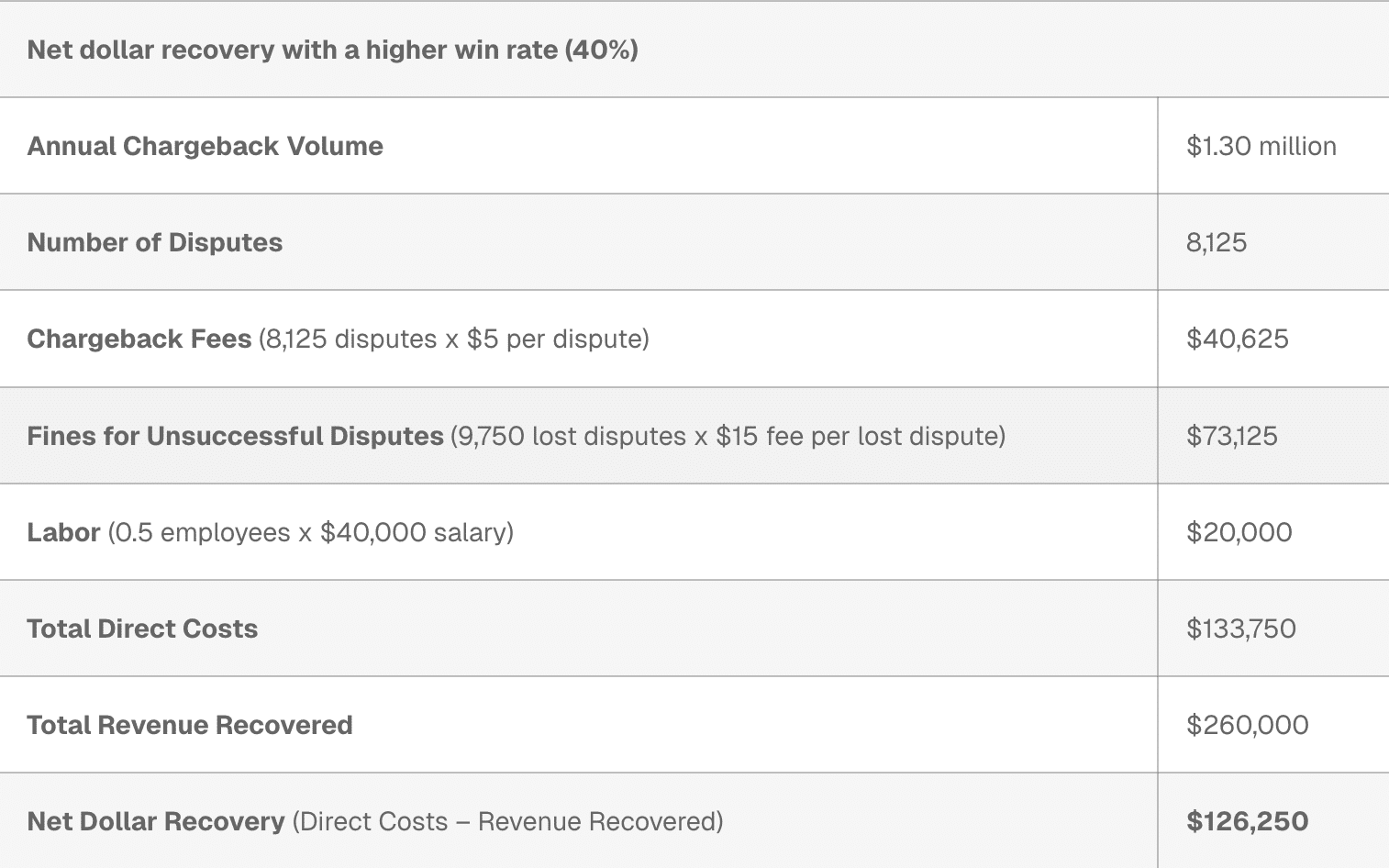

A better way to calculate revenue retention from chargeback mitigation is by considering the value of your chargebacks won against the total cost of chargebacks lost and accepted, and that of your chargeback mitigation efforts. You can learn more here.

Consider this example: a SaaS merchant sells subscriptions at $30 per month. They receive 300 chargebacks per month, of which they fight 99%, using a mitigation solution that costs $1,500 per month. They successfully reverse 60% of chargebacks fought. This means that the company faces $9,000 in disputed chargeback each month, of which they recover $5,346, which leaves $3,846 after the solution is paid for. That amounts to 42.7% of contested revenue recovered.

Conversely, if the chargeback solution only fought 45% of the company’s more straightforward chargebacks, that might lead to a win rate of 75% – a great claim on paper! However, this would only translate into $3037, or 33% of revenue recovered. The moral of the story? You pay for dinner with revenue, not win rates, so you need to ensure that you’re fighting almost every chargeback!

Of course, that’s only a rough example. Fortunately, a formula exists that allows you to work out exactly how much revenue you’re reclaiming on your chargebacks. This is it:

Net Dollar Recovery: The Informed Alternative to Win Rates

Net Dollar Recovery (NDR) is a formula for calculating the true value of your chargeback mitigation attempts. Instead of focusing on the partial picture that we get from win rates, this focuses on the total economic value that chargeback mitigation produces for your business.

To find your NDR, you’ll need the following pieces of information:

Chargeback Volumes (Represented, Unrepresented, and Won)

- Total dollar value of your chargebacks over a given period

- Number of chargebacks received

- Percentage of chargebacks submitted

- Dispute win rate

Internal Costs

- Staff hours dedicated to chargebacks

- Average salary of in-house chargeback team member

Additional Chargeback Fees

- The cost of additional fees, fines, and penalties for disputes

- Fees for late submissions

Outsourced Solution Costs

- External solution fees

Read more about net dollar recovery

Use Automation to Boost NDR, Win Rates, and More

Optimized chargeback management requires skilfully representing all of your disputes at as low a cost as possible. Of course, this begs the question: how do you balance the benefits of representing more chargebacks, with the high costs of in-house teams or manual outsourcing?

The answer? Automation.

Justt’s end-to-end automation removes manual work from the chargeback equation, so that evidence collection, representment writing, and submission happen instantly, cost-effectively, and with superhuman precision, using Justt’s dynamic arguments. This puts the solution in a unique position – Justt offers success-based pricing where you only pay for chargebacks won, so you can represent every dispute, knowing you’ll only pay when it pays off.

Know When to Hold ‘Em

One caveat to all of the above is that with recent fee changes and other industry developments, there are situations where it becomes disadvantageous to fight a chargeback, and instead you should simply accept the chargeback and refund the transaction. This would typically be the case for low value transactions where the odds of winning are also low.

This is the reasoning behind Justt’s Dispute Optimization. This recently-introduced feature carefully analyzes win-likelihood, transaction value, applicable fees, and available evidence to determine which chargebacks you should fight and which to refund for maximum NDR. You can choose to allow the feature to fully automate the decisioning process, or to simply make suggestions.

The main point here is that you are not forfeiting a chargeback simply because they are too complex for your team or your system to handle – these costs are virtually nil since Justt is fully automated. Rather, you are making an informed decision to avoid certain cases based on the costs and odds of winning them, in order to avoid potential fees from bodies such as Visa and Stripe.

Want to see what Justt can do for your NDR? Schedule a demo today.