While chargebacks are a growing pain point for merchants the world over, many still lack a clear understanding of how they work, when you can fight them, and what it takes to improve your win rates. Understanding the dispute management process will help you avoid missed deadlines, errors, and unnecessary revenue loss. This article fills in the blanks, so you can fight your next chargeback with a fully informed strategy.

The Process: Stages and Players

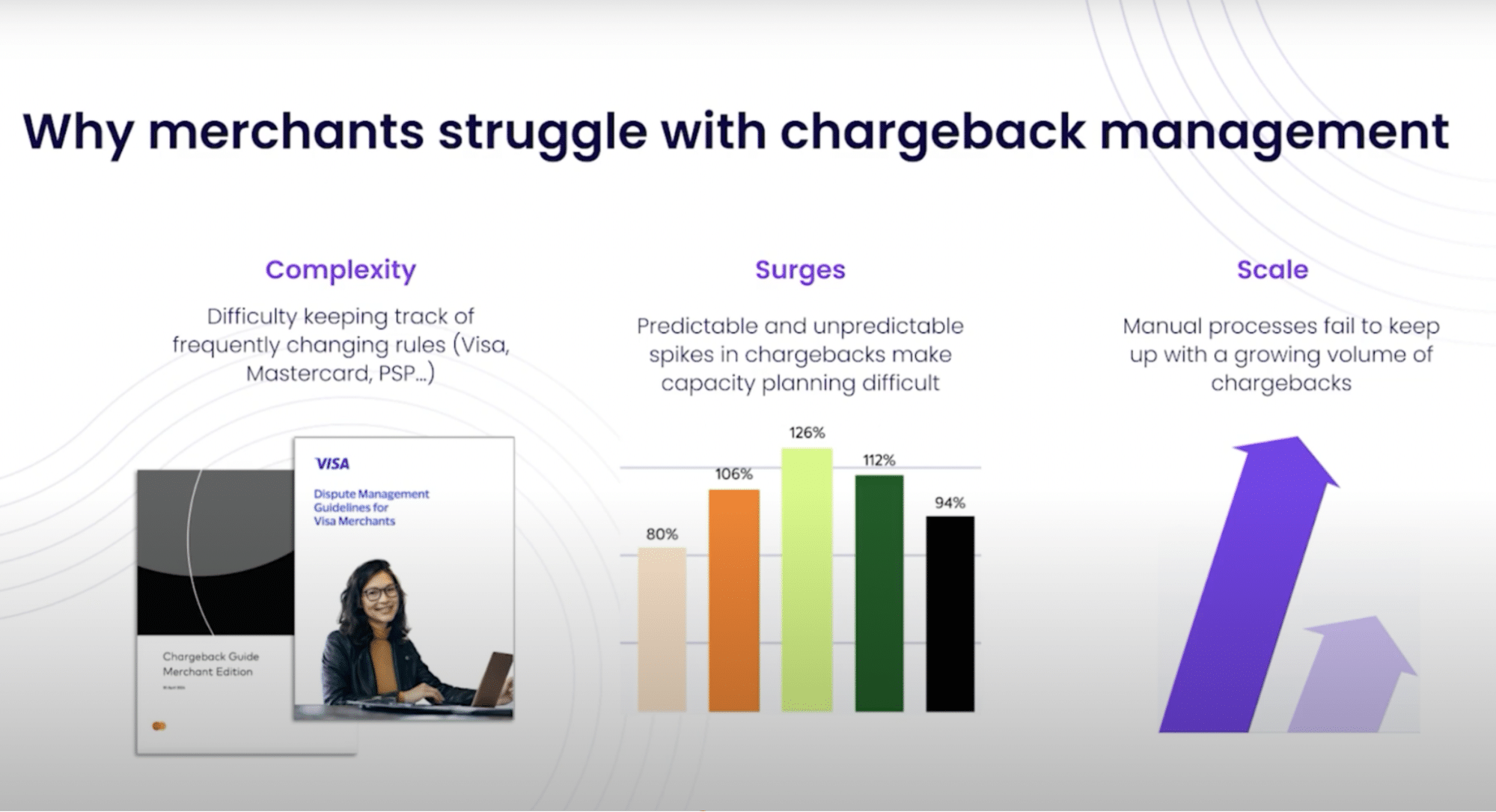

The main reason for the knowledge gap surrounding the dispute management process is its complexity – there are many parts to the equation, several players involved, and specific terminology involved at each stage. This challenge multiplies as businesses scale or face chargeback surges, requiring merchants to additionally keep track of several card scheme rules or issuer deadlines. Understanding of the basic process is vital if you are going to make important decisions about how to manage chargeback escalation and resolution.

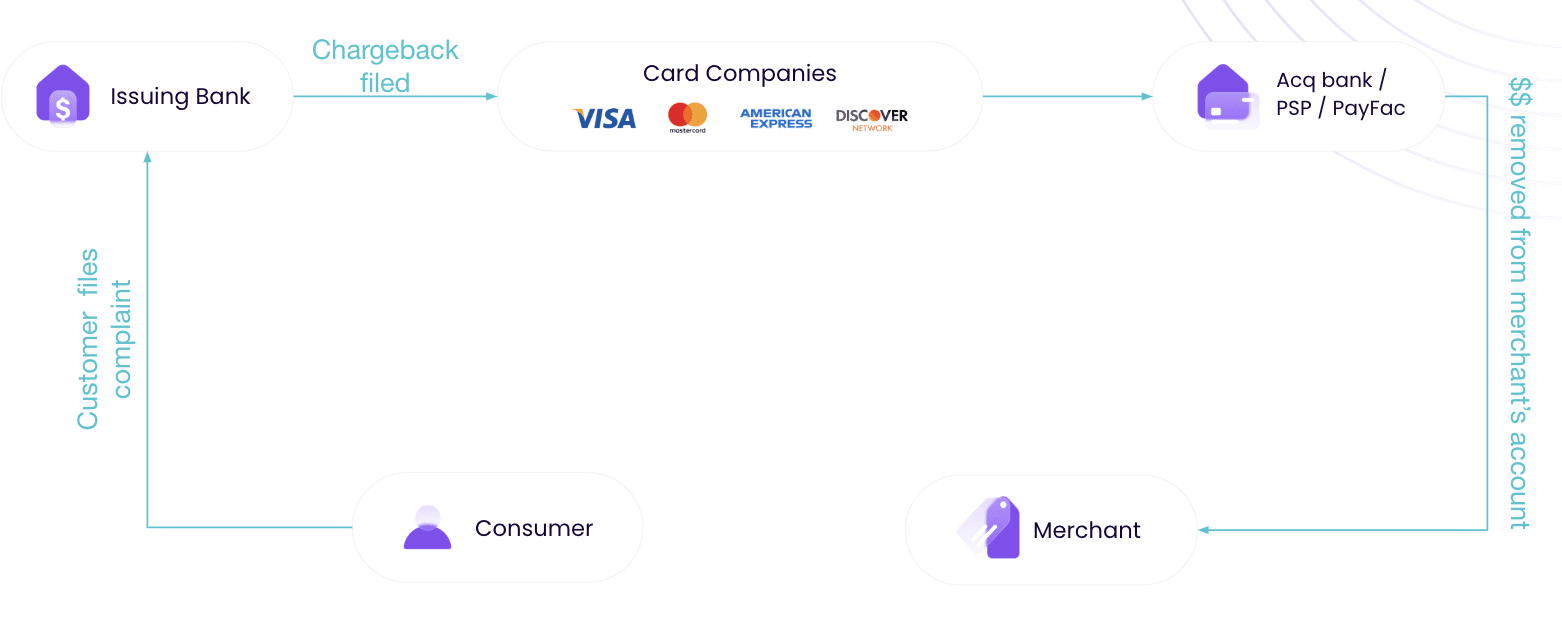

The process typically involves five key players:

- the cardholder who initiates the dispute,

- the issuing bank that represents them,

- the acquiring bank that represents the merchant,

- the card scheme that sets the rules,

- and the merchant themselves.

Each player has specific responsibilities and limitations at different phases within the process, and understanding these will inform your dispute strategy. Let’s take a look at each of the key stages involved.

Transaction

Every chargeback begins with a transaction – this is the subject of the dispute. Collecting as much data as you can at the transaction stage can significantly improve your ability to fight future chargebacks, often determining whether you’ll have sufficient evidence to counter illegitimate claims. This critical information – or “compelling evidence” – includes customer data, device information, shipping records, tracking numbers, service agreements, and detailed product descriptions.

The transaction phase also presents the first opportunity for fraud prevention through tools like 3D Secure, AVS (Address Verification System), and CVV verification. These authentication measures help to prevent true fraud while creating additional evidence trails that strengthen your position in future disputes. Smart merchants also implement clear terms and conditions, cancellation policies, and return procedures during the transaction process, ensuring customers cannot later claim they were unaware of these policies.

Chargeback Initiation

A cardholder typically initiates a dispute by contacting their issuing bank via phone, online banking, or mobile apps. The issuer then reviews the initial claim against standardized criteria before assigning a reason code to categorize the dispute, such as “goods not received,” or “product not as described.” This code is crucial as it determines the evidence types required to counter the dispute. If the issuing bank deems the claim valid, they create a formal chargeback that flows through the card scheme network to the acquiring bank.

The acquiring bank then alerts the merchant about the dispute, providing essential details including the reason code, transaction information, and response deadline. This notification includes a unique case number for tracking purposes and the cardholder’s dispute explanation. However, the timing of this notification varies depending on the acquirer’s systems and the merchant’s integration method, creating potential delays that can narrow an already limited response window. Merchants using advanced chargeback management systems receive these notifications faster, sometimes within hours rather than days.

Merchant Response

The merchant response phase is the critical window where merchants must gather and submit compelling evidence to counter the chargeback claim. This response, compiled in a document called a representment, is subject to strict timeframes that vary by card scheme – typically 30 days from notification. The evidence required varies based on the assigned reason code, with different documentation needed for fraud claims versus merchandise complaints.

The representment is sent via the acquirer and card scheme to the issuer, who reviews it before making a decision. Many issuers only devote 2-3 minutes to reviewing evidence, so merchants must ensure that their responses highlight the most compelling evidence immediately. This requires understanding each issuer’s specific preferences and review processes – knowledge that most merchants lack but specialized chargeback solutions like Justt have developed through analyzing millions of cases using advanced A/B testing.

Merchants who fail to respond within the deadline or submit incomplete evidence automatically forfeit the dispute, making this phase particularly vulnerable to operational challenges during high-volume periods.

Pre-arbitration

If the merchant refuses to accept the result of a chargeback, or the issuer becomes aware of additional evidence in support of the cardholder, the case may enter a pre-arbitration phase, during which merchants and issuers exchange additional evidence in attempts to reach a settlement.

This intermediate stage exists to resolve disputes without escalating to a costly formal arbitration. Merchants must address the specific reasons their initial evidence was rejected rather than simply resubmitting the same documentation. This requires detailed analysis of the rejection reason and a strategic approach to evidence supplementation that many merchants struggle to execute effectively without specialized expertise.

Navigating pre-arbitration demands that merchants carefully weigh up both sides of the dispute. The evidence they provide should aim to convince the issuer that the merchant is more likely to win in an arbitration scenario, and a settlement is therefore preferable. Alternatively, if the merchant sees that the issuer has the stronger evidence, they should aim to resolve, rather than lose at the arbitration stage. They must also act fast – the response window for pre-arbitration is typically shorter than the initial response period, creating additional pressure when gathering and submitting supplementary evidence.

Decision and Arbitration

Following any pre-arbitration activity, the issuer reviews all submitted evidence before deciding to either resolve in the merchant’s favor or uphold the chargeback. If the evidence clearly refutes the cardholder’s claim, the transaction amount is returned to the merchant, and the dispute is closed. However, if the issuer maintains that the chargeback is valid despite the merchant’s evidence, the merchant must decide whether to escalate further or accept the loss.

When merchants strongly believe they have a valid case despite issuer rejection, they can escalate to formal arbitration. This is not a decision to take lightly – losing at this stage incurs a fine of over $500, and complex evidence documentation is required.

During this phase, the card scheme serves as the final decision-maker, evaluating all evidence against their detailed rules and regulations – their decision is binding and non-negotiable. Due to the costs and complexity involved, merchants typically reserve arbitration for high-value transactions or cases that establish important precedents for future disputes.

Time Limits and Deadlines

Each stage of the dispute process comes with strict deadlines that vary by card scheme. Understanding these timeframes is crucial for merchants seeking to defend against chargebacks effectively:

Window for initiating chargeback: Cardholders typically have 120 days from the transaction date to file a dispute, though this varies by card network and reason code. This extended period means merchants often face disputes for transactions that occurred months prior, creating significant challenges for evidence retrieval.

Initial response windows: Merchants usually have 15-30 days to respond to a chargeback notification with compelling evidence. This window begins when the issuing bank files the chargeback, not when the merchant receives notification, effectively shortening the actual working time available.

Pre-arbitration response periods: If a merchant’s initial evidence is rejected, the case may enter pre-arbitration, with response deadlines ranging from 10-45 days depending on the card scheme. This secondary response period allows merchants to provide additional evidence or address specific reasons for the initial rejection.

Evidence submission deadlines: Throughout the process, specific evidence types may have their own submission requirements and deadlines. Documentation must adhere to formatting guidelines and be submitted through proper channels, with many card schemes imposing limits on evidence volume (often 20 pages or less).

Arbitration filing windows: The final escalation stage, arbitration, typically has the shortest deadlines – often just 10 days from the pre-arbitration decision. This compressed timeline requires merchants to quickly decide whether a case merits the additional fees associated with arbitration.

Know the Process to Protect Your Profits

Understanding the chargeback dispute process is crucial for protecting revenue in today’s digital commerce landscape. While the process is complex, merchants who grasp its intricacies can significantly improve their outcomes by making wise decisions regarding evidence collection and dispute escalation. But sometimes there just isn’t enough time in the day. When this happens to you, invest in a smart solution like Justt to navigate your dispute processes with world-beating expertise and end-to-end automation.

Contact Justt today to learn how automated dispute management can transform your chargeback response strategy.