The chargeback rebuttal letter is an essential activity (or artifact) for merchants looking to recover revenue from chargebacks. It is a formal document that a merchant sends to challenge a customer’s credit card chargeback claim and is part of the chargeback representment. Understanding the nuances and best practices for writing these documents will improve your odds of winning disputes significantly. This article looks at what exactly a rebuttal letter does, why it matters, and how to write one that will give your business the greatest possible chance of success.

What Is a Chargeback Rebuttal Letter?

A chargeback rebuttal letter is essentially a cover letter for your dispute reversal request. These letters form one of two major components of the representment – the other being the compelling evidence. The rebuttal letter performs several functions in the representment process. It should:

- Identify your business and the relevant disputed chargeback.

- State your argument for the reversal of funds.

- Explain why specific compelling evidence was included in the representment.

Who reads your rebuttal letter?

Several parties may read your rebuttal letter throughout the representment process. First, your acquirer may read the letter before deciding whether to proceed with your chargeback reversal. If they believe your dispute is valid, they will send the representment to the cardholder’s issuing bank, who will review your letter before inspecting your compelling evidence and deciding whether to reverse the funds. Finally, if the chargeback goes to arbitration, the card scheme will read your letter before making a final decision on the matter.

Watch Roenen Ben-Ami from Justt explain the chargeback review process:

What Exactly Should Your Letter Include?

Introduction

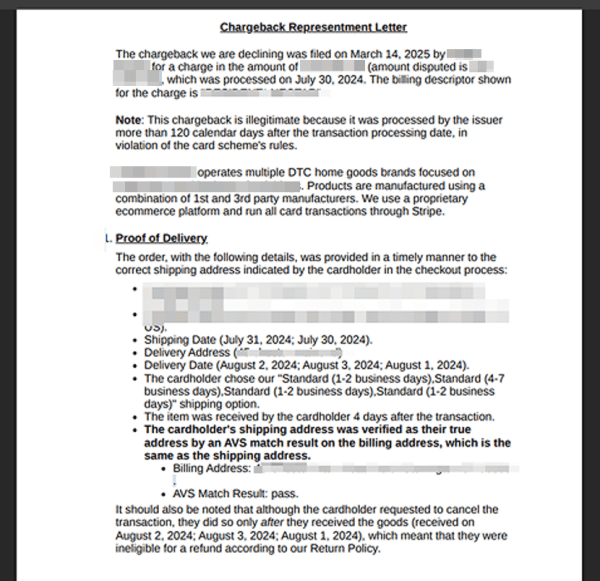

Begin your chargeback rebuttal letter with a concise introduction that outlines who you are, what chargeback you are responding to, and why you wish to reverse it. Vital information here includes your Merchant Identification Number (MID), your business name, the chargeback reference number, the transaction date, and a few words about why the chargeback is illegitimate.

This is a formal letter disputing a chargeback that was filed beyond the 120-day dispute period. It outlines the transaction details, confirms delivery to the verified address, and details policy reasons for rejecting the chargeback.

Arguments

The body of your letter should state your argument in detail, so those reading your letter can see exactly why the funds should be returned. This section might also include details about the exact nature of your business and the product or service rendered, so reviewing issuers can better grasp the nuances of your argument. Key information in this section might include: dates and times of fulfillment, cardholder correspondence, delivery confirmations, and any other compelling reasons that the dispute is invalid.

Compelling Evidence

The next paragraphs of the body of your rebuttal letter should describe what compelling evidence you have included in your representment, and how it proves your case. Don’t take anything for granted here – you might know exactly why you have included a photograph of a package in a doorway, but your issuer won’t unless you tell them.

Conclusion

Your conclusion should briefly restate the main points of your argument, before requesting a chargeback reversal. Include your contact information here so that issuers can get in touch if they have any further questions.

How to Write Your Rebuttal Letter

Now that you know what your letter should include, it’s important to convey these elements as clearly and persuasively as possible for the issuer reviewing your case. Here are some essential rebuttal letter writing tips to ensure nothing is lost in translation:

Make Your Case Easy to Understand Quickly

Use clear, formal language, and keep to the point. This will ensure the issuer, who typically has only three minutes to review each representment – can digest the information swiftly and easily. Aim for skimmability, using bullet points or bold formatting to highlight the most relevant information.

Use the simplest language possible

You’re probably not a lawyer, and neither is the issuer reading your letter, so don’t try to speak legalese! While it may be appropriate to state why the chargeback is harmful to your business, take care not to use overly emotional language. Sob stories will only waste valuable time. Needless to say, keep it polite and respectful.

AAA (Avoid Abstruse Acronyms)

You know your business like the back of your hand, but it might be the issuers’ first time hearing about a virtual reality platform or a cryptocurrency exchange. As such, less common business models should be explained as though the person reading has no knowledge of the industry. Make sure to explain or avoid all but the most commonplace acronyms – you should avoid including anything an issuer will have to look up, as their time is your time. Ensure that the evidence corresponds to the type of business you’re in.

Front-Load Your Strongest Arguments

Not all of the information you include will carry equal weight in the eyes of issuers. Though including multiple types of compelling evidence can have a compounding effect that makes your entire representment more persuasive, you should place your most persuasive evidence and arguments ahead of other examples. This will ensure that issuers read the most important parts, even if they don’t have time to read everything.

Consider Specific Issuer Preferences

Every issuing bank has slightly different ideas about what makes for compelling evidence and effective rebuttal letters. Some have longer than others to examine representments and prefer lengthier, detailed documents, while time-poor branches often appreciate more minimal approaches. Some have a vast knowledge of diverse industries, while others outsource the reviewing process to inexperienced call centre workers who need all the additional information they can get.

Streamlining Your Chargeback Rebuttal Letters: Templates, AI and Automation

If you’re only dealing with a handful of chargebacks, you might write each rebuttal letter from scratch. But as your business grows, you’ll find yourself dealing with more disputes – which means writing and submitting more chargeback rebuttal letters. There are different tools and services that can help with this.

→ Download Justt’s Representment Template

Template-based chargeback response letters have long been the go-to method for most outsourced chargeback solutions – but with more modern technologies increasingly available, they may have outstayed their welcome. While templated letters are marginally faster to create than handtyped letters, they still take considerable time to craft and review, presenting problems for surge prone operations. In general, responding to a chargeback, even in cases where templates are used, can take (when done manually), 20 to 60 minutes each.

Furthermore, the rigid structural format of templated letters can act as an informational straitjacket. Points that need to be prioritized can end up buried deep in the document, where issuers may never read them. Manually filled templates (the vast majority) are also subject to the same typos and factual errors as manual approaches; while even automated templates prevent most kinds of continuous optimization, as their structure is fixed. The template is what you get, and if it doesn’t work as is, then you are putting your revenue at risk.

Using AI to Generate Chargeback Rebuttal Letters

AI-based chargeback mitigation has grown more popular in recent years – however, this is not as simple as asking ChatGPT to write a letter for you! Advanced solutions like Justt have developed state-of-the-art AI and machine learning systems to write industry-leading rebuttal letters that can lift win rates almost overnight.

Justt uses machine learning, AI, and LLMs in order to:

- Identify the best-performing evidence and most persuasive argument, based on continuous A/B testing of different parameters within the dispute representment.

- Pull and normalize data from +500 sources – including third-party providers, PSPs, and internal merchant systems

- Generate bespoke arguments to populate each rebuttal letter using Dynamic Arguments.

- Monitor win rates and continuously improve future rebuttal letters based on past performance, while accounting for rule changes, issuer and acquirer preferences, and industry-specific aspects.

The use of AI allows Justt to transform unstructured data into precision-tailored arguments that address the minutia of every dispute.

Better still, the entire process is automated end-to-end, and happens in seconds, so you’ll never miss a deadline again, and can focus your resources where they’re needed most.

Want to find out more and see an example of Justt’s AI-generated chargeback rebuttal letters, using your actual data? Get in touch today