In an era defined by record levels of friendly fraud and increasingly sophisticated scams, few businesses find dealing with chargebacks to be plain sailing. For digital marketplaces, the stakes are often higher: dispute volumes are not only unusually high, but each chargeback can cost much more than the value of the disputed transaction. Let’s look at exactly what makes digital marketplaces so vulnerable, and what these businesses can do to strengthen their chargeback defenses.

Editor’s note: this article is broadly based on an on-stage conversation between Roenen Ben Ami, Justt Cofounder and Chief Risk Officer, and Parveen Kaur – Senior Payment and Risk Specialist at Back Market, which happened at the recent Marketplace Risk Conference.

The Challenge of Digital Marketplace Chargebacks: Merchants of Record in Name Only

Unlike traditional e-commerce businesses that sell their own products directly, marketplaces operate as intermediaries between buyers and sellers, while also serving as the merchant of record. This means that, despite only securing a small proportion of the profits for any sale, these merchants are liable for all dispute losses, and responsible for gathering evidence to recoup revenue.

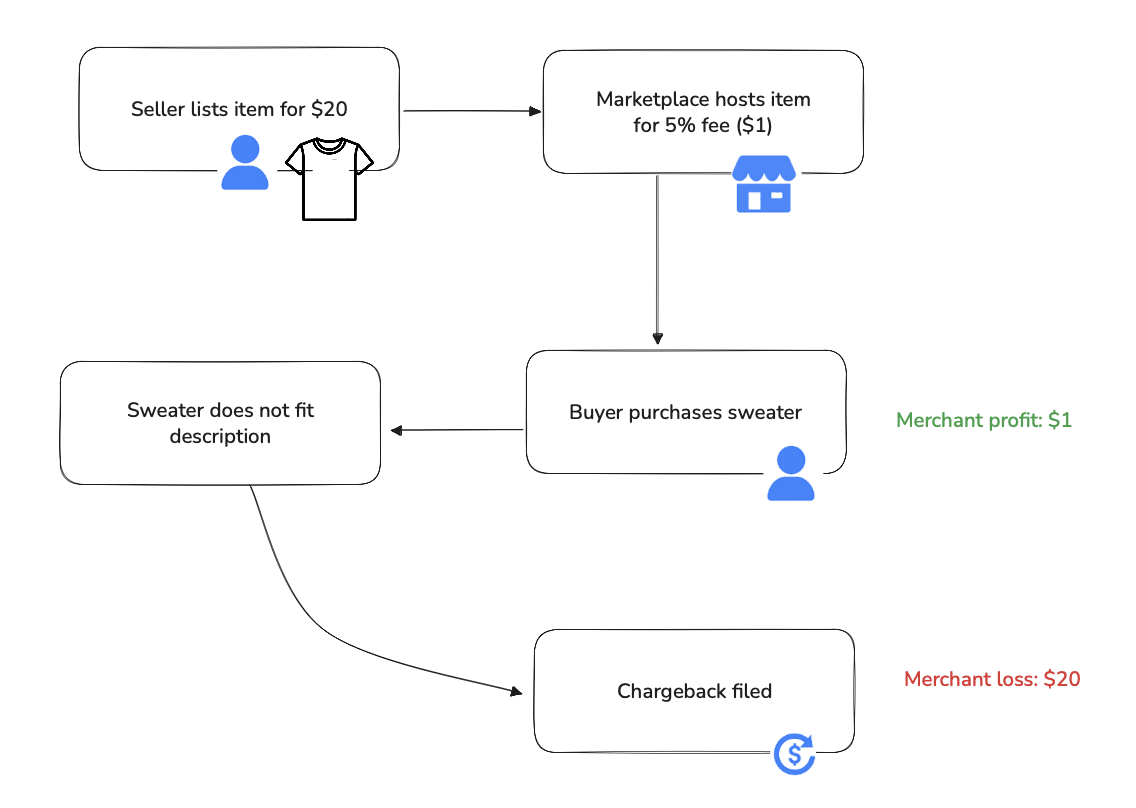

For example, let’s think of a website that allows users to sell second-hand clothes. A chargeback case might look something like this:

- The seller lists a sweater for a sell price of $20.

- The marketplace hosts the listing for the sweater for a fee of 5% of the listed value, or $1.

- A buyer purchases the sweater. The payment is made to the marketplace, which immediately transfers this sum to the seller.

- On the buyer’s credit card statement, the merchant of record is now the marketplace.

- Upon delivery, they find that the sweater does not fit the description on the site.

- They phone their card company and complain about the charge, leading to a chargeback being filed.

- The merchant is now ‘on the hook’ for the full $20, even though their entire revenue from the transaction was actually just $1.

- Fighting the chargeback and collecting all the relevant evidence is the merchant’s responsibility.

Let’s take a closer look at a few of the challenges this creates:

P2P Transaction Complexity

When a dispute arises, marketplaces must defend transactions they didn’t directly fulfill, despite limited visibility into the buyer-seller interaction that led to the problem. This creates a mediation nightmare where marketplaces are dealing with two wildcards – a buyer who may be disputing fraudulently and the seller who may have caused the issue.

Marketplaces must maintain relationships with both parties while navigating disputes they have had little involvement in creating. This makes it tricky to reach mutually agreeable resolutions in order to prevent disputes from becoming chargebacks; and once a chargeback is filed, it can be difficult for the merchant to gather all the relevant compelling evidence (e.g. in cases where fulfilment is the seller’s responsibility and the buyer is claiming they did not receive the goods or service).

Financial and Reputational Impact: Doing the Time Without Doing the Crime

For marketplaces operating on razor thin margins, chargebacks create an outsized financial impact. Because these merchants only recoup a fractional percentage of each transaction, a single lost chargeback can wipe out the commission from 20 or more successful sales. For example, a typical marketplace might earn 3-5% commission on transactions, meaning a single $500 chargeback requires $10,000-$17,000 in successful transactions just to break even. (However, in some cases, marketplaces have the systems in place to ensure that the merchant pays for the chargeback).

While traditional ecommerce merchants only need to worry about their reputation with consumers, high chargeback rates can erode confidence from both sides of a digital marketplace. Buyers lose trust in the platform’s ability to facilitate safe transactions, while sellers become reluctant to invest time and resources in a marketplace that can’t protect them from payment disputes. This creates a negative feedback loop that can undermine the entire business model.

Non-Traditional Goods and Services

Many marketplaces specialize in non-traditional offerings that don’t neatly fit into established e-commerce categories. Whether it’s refurbished electronics, peer-to-peer accommodations, second-hand luxury goods, or unique services, these transactions often involve nuances that issuing banks don’t fully understand – which can lead to chargeback losses.

Customers also approach these marketplaces with traditional expectations – they want new-product quality from refurbished goods or hotel-level service from peer-to-peer accommodations. When reality doesn’t match these expectations, disputes soon follow. This challenge is compounded by the fact that the issuers reviewing these disputes may not appreciate these distinctions either – and that friendly fraudsters are increasingly aware of this issuer blind spot.

How Marketplaces Can Reduce Chargeback Risk

Overcoming digital marketplaces’ unique chargeback challenges requires a unique array of tools and strategies. Here are a few of the most effective ways to start building your revenue protection strategy:

Evidence Collection and Data Consolidation

Where many merchants struggle to come up with compelling evidence to reverse chargebacks, digital marketplaces find this problem compounded by a reliance on second-hand information from sellers. Worse still, if a seller is not sufficiently invested in the marketplace, they can cut their losses and refuse to engage.

To counteract potential blind spots, digital marketplaces should demand as much upfront information as possible about the sellers, buyers, and products they deal with. This should include detailed product descriptions, photographs, and delivery practices, as well as ID checks and proofs of address. Communications between buyers and sellers should be kept on-platform wherever possible.

However, the evidence needed for successful representment often exists across disconnected systems – customer service platforms, shipping providers, payment gateways, and marketplace-specific tools that don’t communicate with each other. Some of Justt’s clients describe scenarios where critical evidence is exclusively available through third-party providers or non-affiliated PSPs, requiring specialized integrations that only well-connected chargeback management solutions can access effectively. When this is in place, evidence collection from merchants can be as easy as sending them a typeform that integrates into the automated chargeback management platform.

Abandon All Templates: Non-Traditional Goods and Services Require Non-Traditional Representments

Static templates are commonly used for representment creation, yet they often fail in marketplace environments where non-traditional goods and services don’t fit standard e-commerce categories. Secondhand goods, peer-to-peer accommodations, and freelance services require flexible and nuanced defense approaches that address the inherent variability of these transactions. Using a chargeback solution that’s based on dynamic arguments, creating a unique representment for each case, solves this.

Winning marketplace representments requires custom narratives that educate reviewers about the transaction context while providing diverse sources of compelling evidence to counter fraudulent claims. Unlike templates, which risk burying important information deep within the document, custom representments can adjust informational hierarchy and accommodate complex data to meet the unique demands of each case.

Make Chargeback Management a Cross-Departmental Concern

With the chargeback odds stacked against them, marketplaces must do everything in their power to place the chargeback management function in the right place in the organization. Many of Justt’s clients have experimented with different models, in finance or operations teams, each with its advantages and disadvantages. However, the most effective strategies are cross-departmental, between operations and finance, harnessing several areas of expertise for a better solution to the chargeback issue.

For instance, operations teams typically emphasize scalability and efficiency, investing in solutions and data science approaches that can automate chargeback handling. This approach works well for marketplaces processing hundreds or thousands of transactions daily, for whom manual handling would prove hugely expensive. However, operations teams are unlikely to understand the nuances of payment dynamics and customer psychology that drives dispute behavior.

Conversely, while finance teams may lack the expertise required to implement automation technology, they excel at using chargeback data to inform long term spending and ensuring proper integration with settlement systems. Meanwhile, customer care teams might not detect friendly fraud, but can identify signs of dissatisfaction before they become disputes. Customer care teams can also care about the NPS (net promoter score) of the merchant/seller, which relies on the marketplace to support them when chargebacks occur. This can also be a strong driver when designing the way the marketplace deals with chargebacks. By educating each department on the various roles within the dispute process, marketplaces can encourage cross-departmental communication that helps stem the tide of friendly fraud.

Beyond Dispute Management: Learning from Chargeback Data

While sellers may not have much chargeback data they can learn from, digital marketplaces can harness their historical chargeback data for valuable insights that extend far beyond individual dispute resolution. Sophisticated analysis can reveal patterns of abuse, operational issues, and fraud trends that preserve revenue and inform broader business strategy.

For instance, identity linking across multiple accounts is crucial for detecting serial abusers. Friendly fraudsters sometimes create multiple accounts and file chargebacks on each to avoid detection – in extreme cases, a single individual might file dozens of disputes using different identities and payment methods. Fortunately, chargeback data analysis can quickly put a stop to these bad actors.

Chargeback patterns can also reveal operational issues. For instance, a cluster of “item not received” disputes might indicate problems with a specific fulfillment partner or shipping route. In some cases, the analysis reveals infrastructure fraud, such as delivery points that are systematically involved in fraudulent claims.

Justt’s Automation Addresses Scale, Surges, and Data Silos

Digital marketplaces’ slim margins require huge transaction volumes to reach profitability, which can be easily offset by even a moderate number of chargebacks. Unfortunately, with many transactions come many disputes. Seasonal spending and product launches can create chargeback surges that overwhelm manual teams and cause dramatic drops in representment quality and win rates. When these surges arrive, data silos, absentee sellers, and unusual evidence requirements present further hurdles to revenue retention.

Justt’s end-to-end solution is custom built to handle these perfect storms. The platform’s world-leading AI automates everything from initial notification to evidence collection, and representment building to submission, so merchants can save their energies for more pressing matters, confident in the knowledge that they’ll never miss a dispute deadline.

To learn more, schedule a chat with a Justt chargebacks expert.