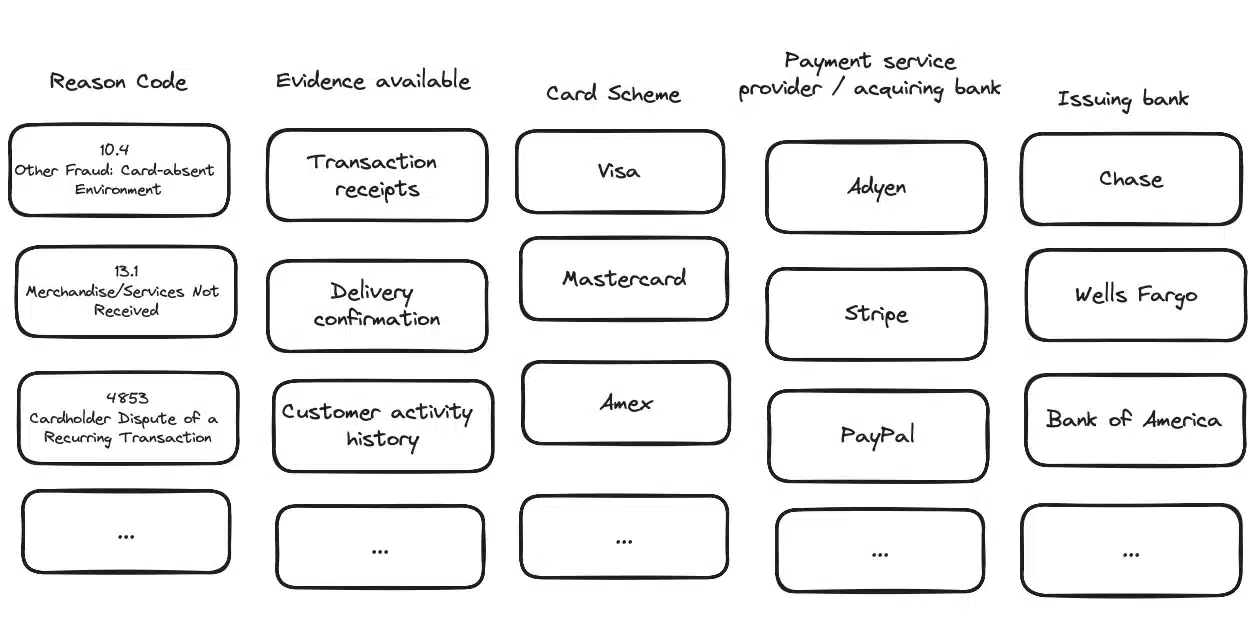

It’s easy to see how the number of combinations can quickly become astronomical. This amounts to a large degree of flux relating to how each chargeback must be handled – and a huge amount of work for payments teams if they are handled manually. If time is not taken to ensure all of these processes are followed according to the whims of each representative part of the payment ecosystem, your chances of winning the cases greatly decreases.

The time constraints faced by issuers further complicate matters – typically, their employees have three minutes to review up to 20 pages of documentation. While rules around evidence requirements are set by card schemes, they are subject to the issuers’ interpretation, and preferences differ drastically across different institutions. This means that evidence must be presented concisely, with the most crucial information prominently displayed – ideally according to the specific preferences of the issuer. Other complicating factors include:

- Business model diversity: Many merchants operate multiple business models (subscription, physical goods, digital goods, services), each requiring different end-user flows and, consequently, different evidence arguments. This creates exponentially more work for administrative staff, who must learn the nuances of several argument types.

- Case-specific narratives: Each chargeback has its own unique story based on the case data, necessitating a tailored response. Generic templates typically fail to address the specific nuances of individual cases.

- Human decision-making: For most chargeback (non-automated) solutions, humans make decisions on how to build the evidence, adding an element of subjectivity and capacity for error that is largely absent in automated solutions. This human factor frequently leads to inconsistencies and omissions in the representment of evidence.

All of these factors create multiple permutations for each evidence document, raising several critical questions. For every chargeback, we need to ask:

- What data points should be used? Different chargebacks require different types of evidence. Certain data points may be compelling in one context, and irrelevant in another. Ensure that your arguments are founded on the most impactful points.

- What arguments should be made? The arguments you choose to present can make or break your case. They need to directly address the reason for the chargeback while effectively utilizing the available evidence to counter the cardholder’s claims.

- How should these arguments be designed? Design choices, such as syntax and font, directly affect comprehension. Given that issuers only have minutes to review each case, well-designed arguments can make your evidence more compelling and easier to understand.

- In what order should these arguments be placed? The order of your arguments can influence their effectiveness. Place your strongest points first to capture the reviewer’s attention and set a persuasive tone for the rest of your evidence.

- How much evidence should be submitted? Too little evidence may not sufficiently support your case, while too much could overwhelm the reviewer.

- How should the evidence be presented? Well-organized, clearly labeled, and easily digestible evidence can make it easier for the reviewer to understand and accept your argument.

The challenge of scale

Due to the difficulty of accounting for these permutations at scale, internal teams and other chargeback solutions typically use generalized templates for common use cases based on industry norms and one-size-fits-all reason codes. This decreases the quality of the evidence and fails to provide tailored responses.

Moreover, when chargeback volumes fluctuate, manual teams—whether internal or through a service provider—struggle to handle all cases or provide top-quality evidence consistently. This challenge is particularly acute during peak seasons or unexpected surges in dispute volume. The result is often a trade-off between quantity and quality, where neither is optimal.