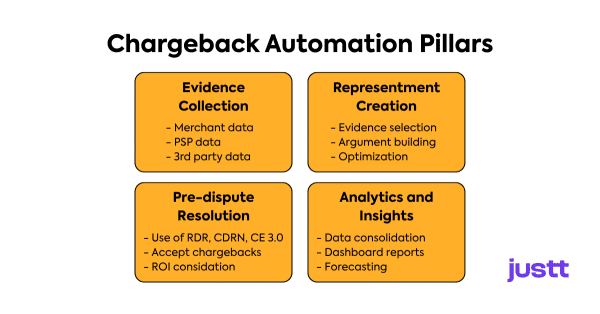

Automation can vastly improve the quality and cost-efficiency of an otherwise expensive and error-prone chargeback management process. However, chargebacks are a complex process with many moving parts, and it’s easy to get confused about what automation actually means. This article takes an in-depth look at what the best solutions are actually automating, so you can ensure your chosen chargeback automation solution truly delivers.

The Problem with Manual Chargeback Handling: Why Chargeback Automation Is Essential for Your Bottom Line

Manually handling chargebacks involves huge time investments in writing representments, collecting evidence, and researching regulations, each of which incur costs in time, money, or both. At Justt, we estimate that preparing a chargeback representment takes anything between 20 to 50 minutes of a chargeback analyst’s time.

Losing winnable chargeback cases is of course very expensive as well, and for some merchants these costs can amount to up to 25% of net revenue. Fortunately, modern automation technology means these processes can now take seconds rather than weeks, vastly reducing merchant expenses and labor.

Furthermore, manual handling is error-prone, and subject to quality fluctuations and missed deadlines during seasonal chargeback surges. Comprehensive automation guarantees a consistent output that eliminates missed deadlines and errors, while solutions like Justt harness machine learning so that output continues to improve and win rates rise over time.

Now that we’ve established why automation is important, let’s take a look at what parts of the process need to be automated to achieve the best results.

Evidence Collection and Enrichment

Winning chargebacks is impossible without the compelling evidence that forms the basis of your representments. Manually collecting this evidence requires hours spent sifting through databases, logging into multiple PSP portals, managing ad hoc requests, normalizing the various data sources, and collecting additional documentation from third party providers (such as fulfilment partners). Not only is this incredibly time consuming and costly, but one slip in concentration can mean that a key piece of the puzzle is overlooked, potentially losing the chargeback.

Furthermore, while this approach may be adequate at low volumes, higher volumes or seasonal spikes can lead to win rate collapse, as reason codes diversify, workloads increase, and employees struggle to find the specialized evidence types required.

Enriching Your Evidence = Enriching Your Business

Effective chargeback automation uses a combination of APIs, manual uploads, and custom data ingestion architecture to continuously collect potential evidence from hundreds of sources, so that it is automatically available when needed.

How Justt automates this: Our platform continuously pulls data from +500 sources, including third-party providers, +50 PSPs, and internal merchant systems. This means that any merchant proof can be enriched by external data such as usage logs, geographical markers, and prior transaction history. These multiple layers of evidence produce a compounding effect, resulting in far more persuasive representments.

Representment Creation

As with evidence collection, delegating representment writing to manual teams – whether in-house or outsourced – means accepting human error, quality fluctuations, and costly timeframes, all of which frequently lead to lost chargebacks and missed deadlines. Manually producing representments also prevents any kind of granular optimization from happening, which means that win rates stagnate at best, and (more commonly) see-saw unpredictably.

The Dynamic Argument for Automating Representments

The best chargeback solutions comprehensively automate representment writing to produce custom documents for every case. Justt’s Dynamic Arguments feature automatically assembles the most compelling evidence available into representments that address the minutia of each chargeback. Every detail from language style to formatting, and evidence structure to informational density is granularly adjusted to meet the preferences of the individual issuer reviewing the case.

It’s as Simple as A/B…

Meanwhile, Justt’s machine learning algorithm conducts A/B testing on every chargeback, so that each representment is informed by strategies that proved effective in millions of prior disputes. This means that win rates continue to rise as the system continues to learn, and that responses effortlessly evolve with the changing payments ecosystem.

Pre-Dispute Resolution

Although the vast majority of chargebacks are worth fighting, some disputes arise purely from the fault of the merchant, are tied to very low cost transactions, or are very unlikely to produce a win. In these cases it might be worth avoiding the dispute completely to avoid chargeback fees and potential enrollment in programs such as VAMP.

Multiple tools are available for automating early dispute resolution:

-

- Verifi’s Rapid Dispute Resolution (RDR) allows merchants to define rules that can automatically issue refunds if a dispute meets certain criteria. For instance, merchants can configure RDR to auto-refund all disputes under $25, disputes from certain high-risk regions, or transactions matching other criteria.

- CDRN (Visa / Vefiri) and Ethoca are tools that provide alerts when a customer has reported a transaction that is about to become a chargeback. The merchants then have a time window of 24-72 to resolve the issue and avoid the chargeback

- Order Insight / Compelling Evidence 3.0 is an automated system for real-time data sharing between merchant systems and issuing banks. This allows the bank’s representatives to present data such as the exact time and place of the transaction to the cardholder, which could dissuade them from proceeding with the dispute.

Automating Dispute Optimization

A manual approach to selecting disputes to fight (versus accepting the chargeback or using one of the above mentioned tools) requires careful analysis of chargeback trends and the potential to recover revenue against considerations such as the cost of the alert and the risk of being enrolled in monitoring programs.

How Justt automates this: Justt’s new Dispute Optimization tool weighs up the likelihood of winning each chargeback, the costs associated with a loss, the value of the chargeback, and any data enrichment possibilities to determine whether or not fighting is likely to generate a positive ROI. Merchants can review and accept these suggestions manually, or automate the process by accepting Justt’s recommendations – saving significant amounts of labor and revenue.

Predictive Analytics and Insights

While winning lots of chargebacks is great, the best case scenario is receiving fewer disputes in the first place. The best way to achieve this is by detecting weak points – or root causes – in your business processes, and intervening appropriately.

How do you find them? The answer used to be manually sorting through chargeback data and trying to understand where problems lay. Like most kinds of manual chargeback labor, this took a long time, and was prone to cognitive bias, lapses in concentration, and other human errors. Matters were made worse by siloed and often incomprehensibly formatted data, further frustrating and confusing manual teams.

Fortunately, some modern solutions combine automated data pulling systems with advanced predictive analytics to produce detailed insights into your chargeback data.

How Justt automates this: Our Insights and Analytics dashboard helps to forecast chargeback volumes and revenue retained based on historical data, industry trends, and current chargebacks – allowing finance departments to make informed spending decisions many months in advance.

Justt’s predictive algorithm doesn’t just conduct root cause analysis on every chargeback, but also generates detailed advice on how to intervene for a long term reduction in dispute volumes. This might include swapping out an unreliable shipping partner, dropping a poorly designed product, or implementing additional fraud protection measures for a particular customer segment or region.

Justt Automate It

As the long-established industry leader in smart chargeback management, Justt is well ahead of the curve when it comes to automating disputes. While you may find another solution that can handle some parts of the above, Justt is unparalleled in its capability to offer end-to-end automation that maximizes revenue recovery and minimizes overhead..

Want to see for yourself? Schedule a demo with Justt today.