Recent fee changes may be a sign it’s time to re-think your chargeback dispute strategy. If you’re still managing chargebacks the same way you were six months ago, it might be time to reassess. Recent changes from Visa and Stripe – in case they apply to your business – may have reshaped the economics of chargeback disputes.

In this webinar, Justt’s Ronen Ben-Ami and Tsuf Israeli break down what’s changed, what hasn’t, and how to figure out your chargeback dispute strategy in this new landscape.

Chargeback automation tools, such as Justt’s, make it feasible to dispute every chargeback. Before chargeback automation, the constraining factor was the time it took to complete a dispute – a manual process that took labor. Automation eliminated that cost and improved recovery rates. With no penalties for failing to win a dispute, disputing 100% was often the smartest move. That guidance still holds true, but fee changes result in some modifications.

In practice, most merchants don’t dispute all of their chargebacks. Operational constraints, perceived low win rates, and the assumption that some disputes aren’t worth the effort lead many to apply broad filters or rely on manual review. That often leaves money on the table, since even chargebacks that are deemed “unwinnable” can be won using chargeback automation and systems based on machine learning and constant optimization.

The goal wasn’t to win every case. It was to recover more overall.

Suppose you have a $100 chargeback. You pay a $15 fee for the chargeback, and your win rate is 40%. That nets you an expected value of $40 in recovered funds, minus the $15 fee = $25 ROI. Even if you lose some disputes, the math still works out. That’s why some merchants automated full-dispute flows: dispute everything, submit solid evidence, and let volume and win rate do the work.

What’s Changed: New Fees That (May) Flip the Economics

Visa’s $7 “Do Nothing” Fee

Visa now charges a $7 “acceptance fee” if you don’t dispute a chargeback within 10 days. Previously, you had the full dispute window to decide. Now, if you wait too long, even if you decide to accept the chargeback, your acquirer gets hit with the fee. And most will pass it along to you.

Even worse, it’s not enough to submit evidence to your processor in time. It must reach Visa Resolve Online (VROL) within 10 days. If your processor is slow, you still get penalized.

Solution: automation, automation, automation.

With fees for doing nothing, the power of chargeback automation means you can set a policy and rest assured you’ll meet deadlines.

Stripe’s New $15 Representment Fee

Stripe now charges a second $15 fee when you submit evidence to fight a chargeback. If you win, it’s refunded. If you lose, it’s not. Combined with the original $15 chargeback fee, that’s $30 in fees for a failed dispute.

Take the same $100 chargeback from before. Dispute and lose, and you’re out $130—the chargeback + both fees. That changes the ROI calculus significantly, especially for low-dollar or low-probability disputes. Read more about the recommended way to address it in our Net Dollar Recovery guide.

Solution: rather than re-categorize a bigger group of chargebacks (by reason code, for instance) as not worth disputing, try using dispute optimization (read more below).

VAMP Ratios: Fraud Now Counts Twice

Visa has also updated how it calculates fraud ratios under the Visa Acquirer Monitoring Program (VAMP):

- Fraud disputes now count twice: once as a TC40 (fraud alert) and again as a TC15 (dispute)

- The threshold for penalties drops to 1.5% in April 2026 (down from 2.2%)

- Merchants under 1,500 TC40+TC15 cases per month are exempt from ratio tracking

A surprising twist: even if you win a fraud dispute, it still counts toward your ratio. So fighting fraud after the fact doesn’t improve your standing. Prevention becomes the priority.

Solution: understand what VAMP means to you and act accordingly.

From dispute-all to dispute optimization

With the “dispute everything” strategy changing, a more selective, data-driven approach is needed. That’s why Justt built Dispute Optimization, a feature that helps merchants evaluate each chargeback on its own merits and decide which ones are worth fighting.

Importantly, this doesn’t mean giving up the benefits of automation. The model calculates the expected ROI of disputing an individual chargeback based on factors like the chargeback amount, estimated win probability, associated fees, issuer behavior, reason code, and merchant-specific data.

If the expected ROI is negative, Justt can automatically accept the case, helping you avoid unnecessary costs. If the ROI is positive, the system prepares and submits the evidence for you, fully automated end-to-end.

You can override recommendations, treat them as suggestions, or apply custom auto-accept rules. The goal is to save money on low-value or low-probability disputes without adding manual overhead for you or your team.

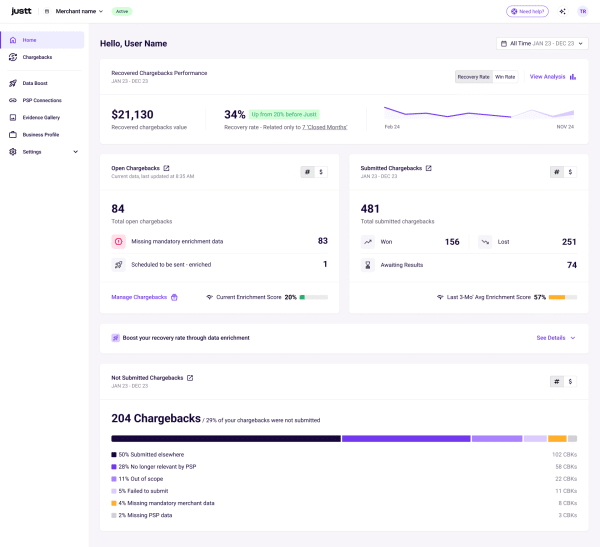

Dispute Optimization is built into Justt’s customer dashboard. When a chargeback is expected to have a negative ROI, it’s marked with an orange icon.

You can then auto-accept those cases, review them manually, export the data for reporting, or treat the model as an assistant helping you prioritize, not taking over. It’s especially useful for merchants impacted by Stripe’s new fees or approaching VAMP thresholds.

The bottom line

Chargebacks are getting more complex, more expensive, and harder to manage with blanket strategies. But that doesn’t mean you have to guess your way through them, or leave revenue behind.

If you’re rethinking your dispute approach, start with the numbers. This guide can help you calculate the true ROI of fighting chargebacks.

And if you want to see Justt’s Dispute Optimization in action, let’s talk.

From the Q&A

If I win a fraud chargeback, does it still count toward my VAMP ratio?

Yes. Winning doesn’t remove it from the count.

What if I don’t have access to TC40/TC15 data from my PSP?

Approximate: count fraud chargebacks twice and non-fraud once. But ideally, ask your PSP for official data.

How long can I stay in the VAMP excessive program?

You get a 3-month grace period with one clean month to exit. But only if you haven’t been in the program within the last 12 months.

Can I override Justt’s dispute optimization recommendations?

Yes. You’re always in control.

Does this work for BNPL disputes?

Yes. Justt already handles chargebacks for several BNPL providers.