For enterprises dealing with high chargeback volumes, it’s vital to know your chosen solution is minimizing your workload and maximizing revenue retention. Some offerings may seem superficially similar, but they aren’t. Offerings differ widely in power, scope, and automation capabilities, and merchants need to take a closer look under the hood before they sign the dotted line.

In this article, we take a look at how Justt and Chargehound compare across ten critical capabilities, so you can better understand what to look for in your chosen solution. Although we obviously have a horse in this race, we have done our best to present a correct factual picture based on publicly available information as well as conversations with former Chargehound customers and prospects..

The TL;DR:

- Justt’s fully-automated representments are granularly customized according to the industry, issuer, reason code, and other nuances of every dispute. While Chargehound’s responses are semi-automated, response flexibility is hampered by static templates that apply the same logic across all cases.

- Justt’s rigorous A/B testing means that win-rates improve with each dispute – Chargehound’s templates are a barrier to this kind of structural optimization.

- Justt delivers comprehensive analytics, revenue forecasting, and root cause assessments. While Chargehound provides basic top-line metrics, they have yet to launch in-depth reporting capabilities.

- Justt acts as a strategic partner with hands-on onboarding, on-demand consultations, and ongoing customer support; Chargehound functions more like a self-service tool with limited merchant engagement.

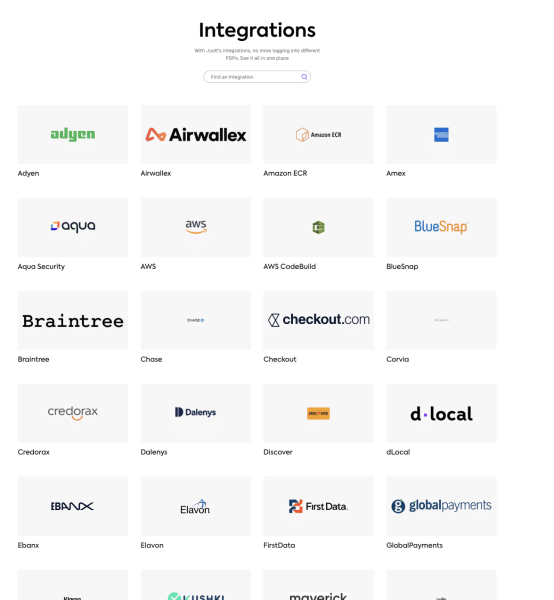

- Justt supports 50+ PSPs and complex integrations out of the box, while Chargehound has fewer integrations and may take longer to set up for complex environments.

Comparison of Critical Capabilities

To illustrate how Justt and Chargehound compare, we’ve analyzed each offering across ten essential dispute management parameters. Only solutions that excel in each of these areas will be truly capable of maximizing revenue recovery at enterprise scale.

To learn about our criteria for comparing chargeback solutions, read 10 Things You Need for Chargeback Automation.

1. Automated Responses: Scale With Volume and Deliver High-Quality Disputes

Chargeback volumes are unpredictable – spikes during peak seasons and product launches can leave manual teams scrambling to meet deadlines. Effective solutions use comprehensive automation to handle these fluctuations without sacrificing quality, speed, or coverage.

Chargehound

Chargehound’s responses are semi-automated; the solution uses AI to fill in the details in static templates for basic cases, while more nuanced representments are handled by humans. This can create problems around the ability to scale chargeback operations and the quality of responses – manual intervention and reliance on templates could make it difficult to accommodate less obvious evidence types, while volume spikes are likely to impact response quality, leading to win-rate decline.

Justt

Justt is the industry’s only end-to-end automated chargeback management solution. The system combines industry expertise with machine learning and data orchestration so that every response is fully automated and generated within seconds, and is at a better quality than an expert human would generate. This means that quality never suffers and deadlines are never missed, regardless of volume.

2. Use of Dynamic Arguments

The best representments are uniquely tailored to reflect industry nuances, reason codes, evidence types, transaction details, and more. If you are generating your chargebacks automatically, you need to be sure that your automation tool is helping put your best foot forward by first presenting the strongest arguments based on the specific facts of the dispute.

Chargehound

Chargehound’s reliance on static templates means they may struggle to accommodate diverse evidence types, regional regulatory variations, PSP rules or preferences, or industry niches. Furthermore, rigid template structures can bury the most important information deep within the evidence document, where issuers – with only three minutes to review, may never read it.

Justt

Justt’s AI-driven Dynamic Arguments feature is designed to solve the problems posed by templates. Every detail from the structural to the superficial is granularly adjusted to meet the demands of each case. The system analyzes each dispute’s unique characteristics – including reason codes, transaction history, and customer behavior patterns – to craft data-informed representments that prioritize the most compelling details within a persuasive argumentative flow.

3. Dispute Optimization: Maximize Net Dollar Recovery, Not Just Win Rates

The most effective chargeback strategies look beyond win rates to ensure that every dispute delivers positive ROI, factoring in potential fees, ticket value, and the likelihood of success.

Chargehound

We could not find any public information indicating that Chargehound offers an ROI-based dispute optimization feature. Without this capability, merchants may end up fighting low-value or low-probability disputes, potentially incurring unnecessary fees and eroding net revenue.

Justt

Justt’s Dispute Optimization is a first-in-market capability that uses AI-driven ROI prediction to decide whether to fight or accept each chargeback. The system automatically considers historical win rates, industry-specific knowledge, ticket size, chargeback fees, and enriched data sources to forecast net recovery.

If the projected ROI is positive, the system generates fully enriched evidence and submits it within issuer deadlines.

If the ROI is negative, it accepts the chargeback immediately to avoid fees and protect the merchant’s chargeback ratio.

Merchants can run this in fully automated mode or set tailored rules for human review. The result: a smarter, more profitable dispute strategy that prevents wasteful effort and maximizes returns at scale.

4. Access to Merchant and PSP Data for Chargeback Disputes

The best solutions automatically pull data from merchant systems and numerous PSPs, so that it’s ready to use when chargebacks arrive.

Chargehound

Chargehound’s system automatically retrieves dispute data from merchant systems. But good representments also require data coming from PSPs. However, Chargehound only partners with select PSPs – meaning that merchants are largely reliant on their own evidence when defending against chargebacks.

Justt

Justt automatically pulls data from internal merchant systems and +50 PSPs out of the box. Integrations are automated via APIs or other programmatic methods, with scheduled batch transfers and CSV uploads available when necessary. This continuous evidence collection process means that all representments have rich data to support the argument, from both PSPs and merchants (as well as third party data sources). This means that each response is provides the strongest possible defense against each chargeback.

5. Third-Party Data Enrichment Capabilities

Third-party data providers can furnish representments with independent verification and compelling evidence types, such as delivery confirmation, IP location, and identity verification – each of which can prove critical to winning a chargeback.

Chargehound

Chargehound does not appear to offer any third-party data enrichment, based on publicly available information. This means that merchants must either do without highly valuable evidence that could have won their case – such as usage logs, geographical details, and fraud histories – or invest significant effort into collecting this data from third party providers on an ad-hoc basis.

Justt

Every Justt response is informed by partnerships with hundreds of third-party data providers. The system seamlessly incorporates the most compelling evidence from shipping carriers, device fingerprinting services, IP intelligence providers, email verification platforms, and fraud detection services into each response.

6. Optimization Abilities and A/B Testing to Improve Win Rates Over Time

The best systems combine machine learning and A/B testing to continuously optimize chargeback responses based on evolving industry patterns, issuer preferences, and rule changes.

Chargehound

While Chargehound’s static templates are likely regularly updated, their system lacks advanced optimization abilities. As we’ve mentioned above, the templated formats used by most legacy companies prohibit granular optimization due to their rigid structures. Chargehound’s reliance on manual teams for nuanced cases acts as a further barrier to optimization, as human response quality tends to fluctuate unpredictably.

Justt

Justt’s machine learning system learns from running and monitoring rigorous A/B tests across every stage and aspect of the dispute process. Data point selection, language style, informational hierarchy, and formatting are each continuously adjusted based on the outcomes of millions of prior cases, with winning patterns applied to future cases. Adjustments occur at the structural and granular level, allowing the representment process to evolve and adapt to ongoing payments ecosystem trends and the preferences of individual issuers.

7. Industry Expertise

Card schemes and regulatory bodies constantly update the rules that govern chargebacks and chargeback data. It’s essential that your chosen solution possesses the industry expertise to remain compliant with these changes – otherwise, disputes may be forfeit.

Chargehound

While Chargehound has acquired considerable industry expertise, their manual approach to more complex cases presents a risk of human error and limits the time experts can spend on regulatory issues.

Justt

Justt’s experts have over a century of combined experience in chargeback management – reflected in the company’s A-Rated Vendor Risk Report and partnerships with +50 PSPs. The platform’s end-to-end automation means that these experts can spend their time finetuning the system to meet regulatory changes and providing consultative support to clientele. Just’s experts tune the system in accordance with industry changes, PSP preferences, industry changes, and the improvements are immediately available to all Justt customers.

8. Effective Reporting & Unified Visibility Across Payment Processors

Chargeback analytics and reporting capabilities enable merchants to understand and make informed decisions surrounding chargeback volumes, causes, and revenue retention.

Chargehound

While Chargehound’s top-line reporting informs merchants about overall chargeback volumes and win-rates, to the best of our knowledge the solution does not provide in-depth breakdowns of dispute factors.

Justt

Justt’s Insights and Analytics dashboard is a unified and user-friendly viewpoint for all chargeback data, eliminating the need to access multiple portals for this key information. Disputes are carefully categorized according to timeframe, reason code, and payment method, allowing merchants to see at a glance where problems may lie.

9. Forecasting and Revenue Prediction

Some chargeback solutions provide powerful predictive tools that forecast revenue and win-rates, and identify chargeback root causes. These capabilities allow finance departments to make informed spending decisions months in advance, and enable operations teams to reduce disputes by recalibrating their processes.

Chargehound

To the best of our knowledge, chargehound does not provide predictive analytics or root cause analysis. Merchants wishing to access these insights may need to perform their own analytics or seek out complementary tools.

Justt

Justt’s Insights and Analytics dashboard is equipped with advanced forecasting and prediction capabilities. The system analyzes historical data to determine future chargeback volumes, revenue retention, and win rates with pinpoint accuracy. Furthermore, the platform’s root cause analysis feature instantly identifies operational weak points, and suggests customized strategies to reduce chargeback volumes.

10. Easy Integration and Quick Setup

Complex or prolonged setups delay chargeback reversal and leave your revenue defenseless. Look for a solution that offers a simple and rapid implementation.

Chargehound

Chargehound offers a relatively speedy API-based integration process. However, their limited number of PSP partnerships may delay implementation for merchants using unaffiliated payment providers.

Justt

Justt’s platform is incredibly low maintenance for merchants, with a rapid implementation, minimal IT requirements, and +50 PSPs supported out of the box. Justt offers ready-made APIs to accelerate integration, and staffs a dedicated integration team to provide custom connections to merchants with unique requirements.

11. Integrated Chargeback Alerts

While it is usually worth fighting every chargeback, some low value disputes and instances of merchant error can be better served with a simple refund. Pre-dispute alert tools allow merchants to prevent these cases from escalating into chargebacks.

Chargehound

We could not find any public information which would indicate that Chargehound offers integrated chargeback alerts.

Justt

Justt comes fully equipped with Ethoca alerts and Verifi CDRN. Furthermore, the solution has recently launched its AI-driven Dispute Optimization feature, which analyses success likelihood, cost of loss, chargeback value, and any data enrichment possibilities to determine whether fighting any given chargeback is likely to generate positive ROI. Merchants can use this tool like an alerts system, or allow Justt’s algorithm to automate the decision making process.

See the Difference on Your Own Chargebacks, with Zero Risk

Still not sure which solution will work for your business? No reason to take our word for it. Talk to our team today for a free ROI estimate, and to set up a head-to-head trial of Justt versus any competitor of your choice. Unlike many other solutions, Justt also offers success based pricing, in which you only pay a percentage of the direct revenue Justt has recovered for your business. That means you can see how Justt performs in real-world condition with zero risk to your revenue.

Next steps:

- Learn more about our unique approach to chargeback management.

- Read our previous article to find out what you should look for in a chargeback management solution.

- Create a free account to start recovering more revenue with Justt.