Chargeback automation can save enterprises thousands of hours and millions of dollars annually, but only if your chosen solution enables you to efficiently dispute chargebacks, lower your labor costs, and deliver higher win rates – without compromising on the scope or complexity of the chargebacks you choose to dispute.

This article explores what enterprises really need in a chargeback management solution, before weighing up the most popular platforms against these key criteria.

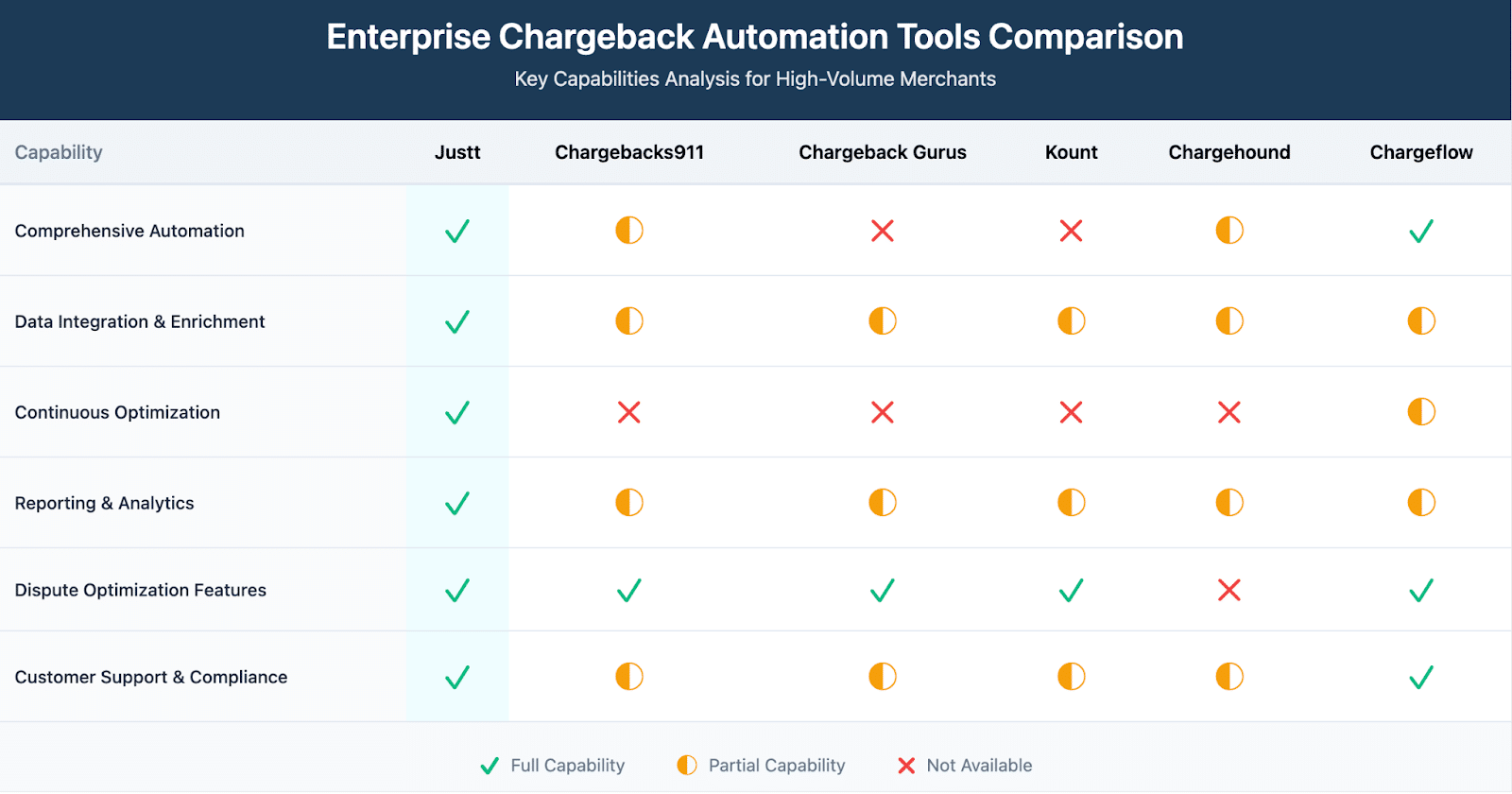

Key Capabilities for Enterprise Chargeback Automation

While we usually compare chargeback solutions against ten critical capabilities, we’ve analyzed these tools across six dispute management parameters most essential for enterprise revenue recovery. Only solutions that excel in each of these areas will be truly capable of maximizing revenue recovery at high-growth or enterprise scale.

To learn about our criteria for comparing chargeback solutions, read 10 Things You Need for Chargeback Automation.

Comprehensive Automation

End-to-end automation lets chargeback solutions handle every dispute the moment it arrives, regardless of volume fluctuations, while maintaining or improving quality. This capability sets truly scalable solutions aside from the time-consuming template-based approaches that comprise most of the chargeback management market. While these basic tools may suit smaller companies, enterprises facing hundreds of chargebacks a day require decision making, evidence collection, and response building at superhuman speed.

An additional layer of automation is dynamic arguments. Ideally, your solution should automatically tailor responses to each dispute’s unique circumstances – analyzing reason codes, transaction details, and available evidence to craft and order compelling arguments that maximize win probability. These capabilities are becoming increasingly vital – record friendly fraud rates, the rise of agentic commerce, and the continued ecommerce boom mean that chargeback numbers will continue to rise for years to come, likely rendering manual responses obsolete for all but the smallest companies.

Data Integration and Enrichment

Data is your most powerful weapon in the fight against chargebacks. But while some solutions enrich your representments with third-party and PSP data, others preclude even internal sources (merchant data), if they are difficult to ingest into the system or are unique to an industry or a merchant.

Your chosen solution should seamlessly integrate with your internal merchant systems so that even disparately stored and unusually formatted data can be continuously pulled and consolidated for chargeback responses. Meanwhile, access to third-party and PSP data is the basic requirement to successfully fight chargebacks and its retrieval should not waste your team’s time with repetitive work.. Ideally, the data that is enriched should then be used to customize the representment using dynamic arguments.

Continuous Optimization

The best chargeback solutions combine machine learning and A/B testing to continuously optimize representment strategies and even individual arguments on a granular level, based on evolving industry patterns, issuer preferences and rule changes. This approach means that every chargeback is informed by those that preceded it, lifting win rates over time. For merchants, this means that their chargeback disputes are improved by learnings across the entire industry, through shared insights from these A/B tests.

In many cases where templates are used, optimization can only happen on a template level, which means that many of the insights achieved through the argument level A|B tests are missed.

Reporting and Analytics

Analytics and reporting capabilities allow merchants to understand dispute patterns and causes, and make informed decisions about prevention strategies. Conversely, predictive capabilities allow finance departments to make informed long-term spending decisions based on forecasted dispute volumes, outcomes, and revenue retention.

Dispute Optimization Features

While most businesses should fight almost every chargeback, this is not always the case. With rising chargeback fees levied by ecosystem players such as Stripe, there are situations where you should choose to avoid fighting categories of chargebacks, or individual cases. Chargeback tools should help you make or automate these decisions based on relevant ROI data.

Comparison of Chargeback Automation Tools

Now that we’ve established which capabilities enterprises should be searching for in automated chargeback tools, let’s take a look at how the market’s most popular solutions stack up.

Justt

Justt is the market’s only end-to-end automated chargeback management solution to specialize in enterprise revenue retention. Our state-of-the-art AI handles evidence collection, representment writing, submission, and predictive analytics – attracting over $100M in funding, and multiple Fortune 500 clients.

- Comprehensive Automation: Justt’s platform has pioneered end-to-end automation in chargeback management. Every aspect of dispute handling – from initial assessment through evidence compilation and submission – operates automatically. This approach ensures that quality never drops during high volume periods, whether processing ten disputes or ten thousand.

Justt’s AI-driven Dynamic Arguments feature creates precision-tailored responses for each dispute. Every detail – from structure to style, and format to informational hierarchy – is determined by both the dispute’s unique characteristics and the strategies that proved successful in millions of similar cases. This formula enables the system to place the most persuasive evidence available in a logical flow designed to convince the individual issuer reviewing the case.

- Data Integration and Enrichment: Justt automatically pulls data from +500 sources, including internal merchant systems, +50 PSPs, and hundreds of third-party data providers. Integrations are automated via APIs or other programmatic methods, with scheduled batch transfers and CSV uploads available when necessary. The platform’s AI algorithm automatically determines which evidence sources are most relevant to each dispute and seamlessly integrates this data into responses.

Justt’s platform is designed for rapid implementation with minimal IT requirements, and no merchant intervention required after initial setup. The solution supports +50 PSPs out of the box, with ready-made APIs that streamline integration. For merchants with unique requirements, Justt’s dedicated integration team creates custom connections where needed, ensuring quick deployment regardless of technical complexity.

- Continuous Optimization: Justt’s machine learning system learns from running and monitoring rigorous A/B tests across every stage and aspect of the dispute process. Data point selection, language style, informational hierarchy, and formatting are each continuously adjusted based on the outcomes of millions of prior cases, with winning patterns applied to future cases. Adjustments occur at the structural and granular level, allowing the representment process to evolve and adapt to ongoing payments ecosystem trends and the preferences of individual issuers.

- Reporting and Analytics: Justt’s Insights and Analytics dashboard is a unified and user-friendly viewpoint for all chargeback data, eliminating the need to access multiple portals for this key information. Disputes are carefully categorized according to timeframe, reason code, and payment method, allowing merchants to see at a glance where problems may lie.This dashboard is also equipped with advanced forecasting and revenue prediction capabilities. The system analyzes historical data to determine future chargeback volumes, revenue retention, and win rates with pinpoint accuracy. Meanwhile, the platform’s root cause analysis feature instantly identifies operational weak points, and suggests customized strategies to reduce chargeback volumes.

- Dispute Optimization Features: Justt has recently launched its AI-driven Dispute Optimization feature, which analyzes success likelihood, cost of loss, chargeback value, and data enrichment possibilities to determine whether fighting any given chargeback is likely to generate positive ROI. Merchants can use this tool to make ad-hoc decisions on specific chargebacks, or allow Justt’s algorithm to automate the decision making process.

Chargebacks911

Chargebacks911 is an established player in the chargeback space, and has been around since 2011. They use a combination of templates and outsourcing to eliminate some of the busywork around chargeback dispute management, but reliance on these semi-manual approaches might raise concerns over the ability to automate chargebacks and/or provide quality at scale.

- Comprehensive Automation: Chargebacks911 employs a human-centric, template-based approach that requires manual involvement to complete each representment. They do not offer Dynamic arguments or an equivalent solution. Despite introducing basic automation to certain workflows, this hybrid approach creates inherent scalability challenges such as bottlenecks and delays during surges – just when consistent coverage is most critical.

- Data Integration and Enrichment: Chargebacks911 maintains integrations with some major PSPs, and can pull standard transaction data from merchant systems. However, their third party enrichment capabilities are limited to basic tools for chargeback source analysis. The platform offers a relatively quick setup through PSP integrations. However, their hybrid manual-automated approach may result in important evidence being left out, or result in significant overhead on the merchant’s side when it comes to collecting and collating evidence.

- Continuous Optimization: Template-based structures – like Chargeback911’s – limit the potential for optimization to gradual the template level, rather than on an argument-by-argument basis. Their manual focus also means that optimization relies on changes to team performance, rather than systematic machine learning, which limits the ability to update strategies based on lessons learned from work with other merchants.

- Reporting and Analytics: Chargebacks911 provides single-platform reporting about disputes and alerts, which includes customizable notifications and basic analytics. However, they do not appear to offer predictive forecasting capabilities.

- Dispute Optimization Features: To the best of our knowledge, Chargebacks911 allows merchants to accept certain categories of chargebacks, but does not provide automated data-driven decisioning based on potential ROI.

Compare Justt vs Chargebacks911 and see why enterprises prefer full automation

Chargeback Gurus

Chargeback Gurus combines AI, basic automation, manual review, and static templates to offer a plug-and-play chargeback solution to small and medium sized businesses. However, this hands-off approach may be insufficient for complex enterprise environments.

- Comprehensive Automation: Despite claiming some automation capabilities, Chargeback Gurus primarily relies on human teams to review and process chargebacks. The company uses static templates to build representments, potentially precluding optimization attempts, as well as more diverse evidence that can help build stronger arguments.

- Data Integration and Enrichment: While Chargeback Gurus collects basic merchant and PSP data for chargeback responses, their template-driven approach suggests that they focus on reason code-based data types, rather than comprehensive evidence gathering. The platform does not appear to offer automated third-party data enrichment capabilities. Chargeback Gurus offers a “no-IT lift” performance-based trial, suggesting relatively straightforward implementation.

- Continuous Optimization: While Chargeback Gurus likely make gradual improvements to their template-based approach, their system lacks the automated optimization capabilities seen in more modern solutions.

- Reporting and Analytics: Chargeback Gurus’ FPRONE platform provides standard chargeback and analytics reporting capabilities. Despite its branding as an AI-powered feature, the platform does not appear to support the advanced predictive insights available on more modern systems.

- Dispute Optimization Features: To the best of our knowledge, Chargeback Gurus does not offer data-driven dispute optimization.

See how Justt outperforms Chargeback Gurus for large-scale, automated dispute management

Kount

Kount – formerly Midigator – provides customizable DIY templates that allow merchants to respond to chargebacks faster than if they did so independently. While this DIY approach may suit small businesses with low chargeback volumes, chargeback surges or business growth may quickly overwhelm even the best prepared in-house teams.

- Comprehensive Automation: Kount does not automate – or write – chargeback responses. Instead, they provide merchants with templates with which to create their own. While Kount’s templates allow for some degree of structural customization, they may still struggle to accommodate diverse evidence types and maintain response quality when dealing with larger volumes of transactions.

- Data Integration and Enrichment: Kount offers an API for merchants to upload predefined types of evidence that can later be used in the templatized responses. The platform also collects chargeback data from 14 affiliated PSPs, and offers integrations with third party data providers. Kount’s simple API-based set up supports 14 PSPs out of the box. Merchants using unaffiliated payment processors, or those with more complex data storage facilities, may face a longer implementation period.

- Continuous Optimization: To the best of our knowledge, Kount does not offer any automated continuous optimization. Merchants craft their own representments based on customizable templates, reducing the degree of structural variance required for case-by-case optimization.

- Reporting and Analytics: Kount offers basic reporting and analytics capabilities through a consolidated dashboard that displays ongoing chargebacks, win-rates, and historical chargeback volumes. However, according to our information, the platform has yet to implement forecasting capabilities or root cause analysis.

- Dispute Optimization Features: To the best of our knowledge, Kount does not offer data-driven dispute optimization.

Learn why Justt’s AI-driven automation beats Kount’s template-based approach

Chargehound

Chargehound is a semi-automated dispute management platform that relies on manual representment writing for more complex cases. While merchants with simple business models may benefit from their basic dispute automation, more complex enterprise environments typically require more nuanced chargeback responses, and will ultimately bear the cost of Chargehound’s time-intensive manual processes.

- Comprehensive Automation: Chargehound’s responses are semi-automated; the solution uses AI to fill in the details in static templates for basic cases, while more nuanced representments are handled by humans. This can create problems around scale and quality of responses – manual intervention and reliance on templates could make it difficult to accommodate less obvious evidence types, while volume spikes are likely to impact response quality, leading to win-rate decline.

- Data Integration and Enrichment: Chargehound’s system automatically retrieves dispute data from merchant systems. However, they only partner with select PSPs – meaning that merchants are largely reliant on internal evidence. Chargehound does not appear to offer any third-party data enrichment, based on publicly available information. The platform offers a relatively speedy API-based integration process. However, their limited number of PSP partnerships may delay implementation for merchants using unaffiliated payment providers.

- Continuous Optimization: While Chargehound’s static templates are likely regularly updated, their system lacks advanced optimization abilities due to the rigid structures of their templated response formats. Chargehound’s reliance on manual teams for nuanced cases acts as a further barrier to optimization, as human response quality tends to fluctuate unpredictably.

- Reporting and Analytics: While Chargehound’s top-line reporting informs merchants about overall chargeback volumes and win-rates, the solution does not appear to provide in-depth breakdowns of dispute factors, predictive analytics, or root cause analysis.

- Dispute Optimization Features: We could not find any public information indicating that Chargehound offers integrated dispute optimization services.

Compare Justt’s AI automation with Chargehound’s templates and see the difference

Chargeflow

Founded in 2021, Chargeflow is a relatively recent market entrant, and one of just a handful to claim full automation capabilities. While these claims are promising, they rely primarily on a Shopify-based plugin, and may struggle to accommodate the demands of larger and more complex enterprises.

- Comprehensive Automation: While Chargeflow claims full automation and AI-powered capabilities, the company’s website suggests its customer base is mostly made up of small and medium-sized businesses – meaning that these capabilities may not be proven at scale. Furthermore, it is unclear how far this automation goes and what level of customization actually occurs, as the product does not use Dynamic Arguments. The system’s automated responses may not fully adapt to the nuances of different industries or complex dispute scenarios.

- Data Integration and Enrichment: Chargeflow can pull basic transaction data from merchant systems, and boasts some third party enrichment capabilities. However, its integrations are primarily focused on common e-commerce platforms like Shopify, potentially limiting data collection for merchants with more complex setups.Chargeflow’s primary strength lies in its quick setup for standard e-commerce platforms like Shopify. However, this ease comes with limitations – more complex merchant environments, some types of PSPs, or custom setups may not be as well supported.

- Continuous Optimization: While Chargeflow likely makes gradual improvements to its system, there’s limited evidence of systematic, data-driven optimization through comprehensive A/B testing – it seems like optimization is happening on the dispute template level farther than on an argument-by-argument basis. Furthermore, as a relatively new startup with fewer total disputes processed, Chargeflow has a smaller dataset from which to draw optimization insights.

- Reporting and Analytics: Chargeflow provides basic reporting functionality, showing dispute status and outcomes. However, merchants operating across multiple payment processors may find Chargeflow’s visibility limited, due to its relatively limited scope of PSP integrations (see above). The platform also supports some forecasting capabilities.

- Dispute Optimization Features: To the best of our knowledge, Chargeflow does not offer data-driven dispute optimization.

Compare Justt’s AI chargeback automation with Chargeflow for enterprise merchants

See the Difference on Your Own Chargebacks, with Zero Risk

Still not sure which solution will work for your business? No reason to take our word for it. Talk to our team today to set up a head-to-head trial of Justt versus any competitor of your choice. Unlike many other solutions, Justt also offers success based pricing, in which you only pay a percentage of the direct revenue Justt has recovered for your business. That means you can see how Justt performs in real-world conditions with zero risk to your revenue.